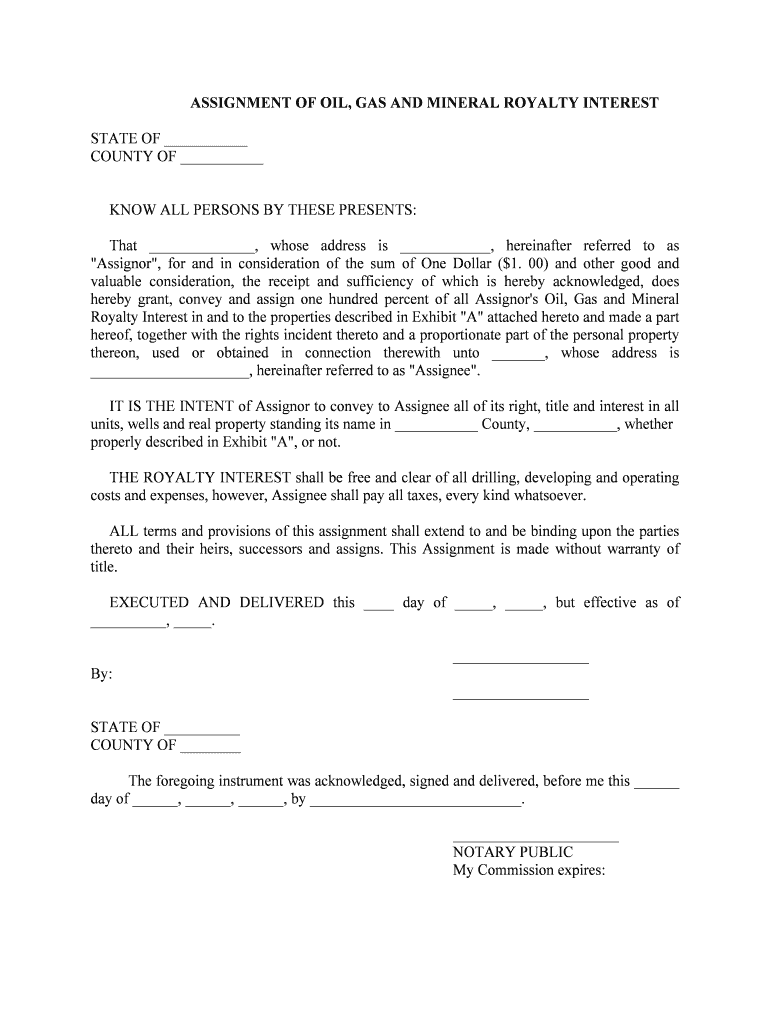

Mineral Royalty Form

What is the Mineral Royalty

The mineral royalty refers to the payment made to the owner of mineral rights for the extraction of resources such as oil, gas, or minerals from their property. This payment is typically a percentage of the revenue generated from the sale of the extracted resources. Understanding the stipulation of interest in a mineral royalty agreement is crucial for both landowners and operators, as it outlines the terms of compensation and the rights associated with mineral extraction.

Steps to complete the Mineral Royalty

Completing a mineral royalty form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the legal description of the property and the parties involved. Next, accurately calculate the royalty percentage based on the agreement terms. After filling out the form, review it for any errors. Finally, submit the completed form to the appropriate authority, whether online or via mail, ensuring that all required signatures are included.

Legal use of the Mineral Royalty

The legal use of a mineral royalty is governed by various state and federal laws. It is essential for all parties involved to understand the legal framework surrounding mineral rights and royalties. This includes compliance with local regulations regarding the extraction of resources. Any stipulation of interest must be clearly defined in the agreement to avoid disputes and ensure that all parties understand their rights and obligations.

Required Documents

To properly complete a mineral royalty form, several documents may be required. These typically include the mineral deed, which establishes ownership of the mineral rights, and any previous agreements related to the royalty payments. Additionally, identification documents for all parties involved may be necessary to validate the agreement. Ensuring that all required documents are gathered beforehand can streamline the completion process.

Form Submission Methods

Submitting a mineral royalty form can be done through various methods, depending on state regulations. Common submission methods include online platforms, where forms can be filled out and submitted electronically, and traditional methods such as mailing the completed form to the relevant authority. In-person submission may also be an option in some jurisdictions, allowing for direct interaction with officials who can provide assistance.

Who Issues the Form

The mineral royalty form is typically issued by state regulatory agencies or local government offices responsible for overseeing mineral rights and resource extraction. These entities ensure that all agreements comply with applicable laws and regulations. It is important for landowners and operators to identify the correct issuing authority to avoid delays in the processing of their royalty agreements.

Quick guide on how to complete mineral royalty

Effortlessly Prepare Mineral Royalty on Any Device

Managing documents online has gained signNow traction among companies and individuals. It serves as an excellent environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Handle Mineral Royalty on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Alter and eSign Mineral Royalty Effortlessly

- Locate Mineral Royalty and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Select important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misfiled documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you select. Modify and eSign Mineral Royalty and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a stipulation of interest?

A stipulation of interest is a legal document that outlines the agreement between parties regarding specific terms related to a transaction or case. Understanding this document is crucial for proper contract management, and airSlate SignNow makes it easy to create and eSign such stipulations efficiently.

-

How does airSlate SignNow help with the stipulation of interest process?

airSlate SignNow simplifies the stipulation of interest process by providing an intuitive interface for creating, sending, and eSigning documents. Its features allow you to streamline workflows, making it easier to manage legal agreements without unnecessary delays.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that accommodate various business sizes and needs. Whether you’re a small business or a larger enterprise, you’ll find a pricing option that suits your budget while ensuring you can effectively manage stipulation of interest documents.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various platforms such as CRM systems, cloud storage solutions, and more. These integrations help streamline your workflows, especially when handling documents like stipulation of interest, ensuring that you can operate efficiently across multiple tools.

-

What benefits does airSlate SignNow provide for managing stipulations of interest?

The benefits of using airSlate SignNow for managing stipulations of interest include enhanced speed and security in document transactions. You can track the status of your documents, ensuring that all parties are kept informed and that your agreements are executed promptly and securely.

-

Is airSlate SignNow suitable for all industries?

Absolutely! AirSlate SignNow is designed to be versatile, catering to multiple industries that require handling of legal documents, including stipulations of interest. Its user-friendly platform supports various business needs, making it a great solution for any sector.

-

Can I customize my stipulation of interest templates in airSlate SignNow?

Yes, airSlate SignNow allows users to customize templates for their stipulations of interest. You can modify fields, add clauses, and design documents that meet your specific legal requirements, ensuring your documents are tailored to your needs.

Get more for Mineral Royalty

Find out other Mineral Royalty

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast