Promissory Note Loan Agreement Form

What is the Promissory Note Loan Agreement

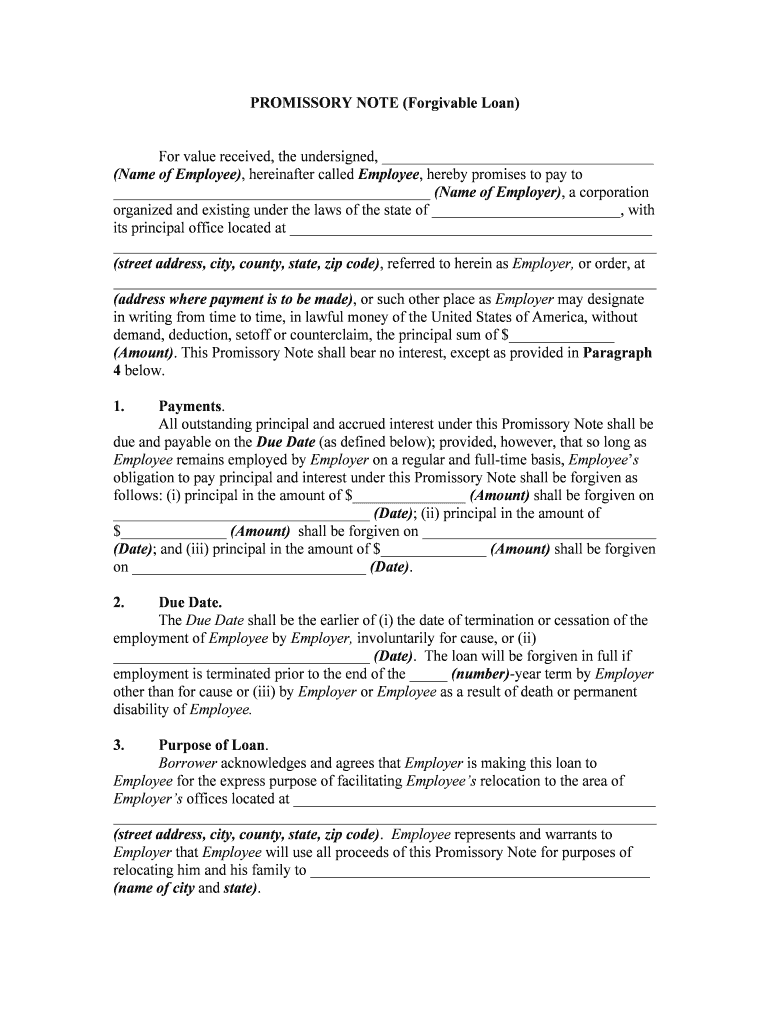

A promissory note loan agreement is a legal document that outlines the terms under which one party promises to pay a specified sum of money to another party. This agreement typically includes details such as the principal amount, interest rate, repayment schedule, and any collateral involved. It serves as a binding contract that protects both the lender and the borrower by clearly defining their rights and obligations. In the context of personal or business loans, a promissory note can be essential for ensuring that the terms of the loan are understood and agreed upon by both parties.

Key elements of the Promissory Note Loan Agreement

To create a comprehensive promissory note, several key elements must be included:

- Principal Amount: The total amount borrowed that must be repaid.

- Interest Rate: The percentage charged on the principal amount, which can be fixed or variable.

- Repayment Schedule: The timeline for repayments, including due dates and payment amounts.

- Signatures: The signatures of both the borrower and lender, which validate the agreement.

- Default Terms: Conditions under which the borrower may default on the loan and the potential consequences.

- Governing Law: The state laws that will govern the agreement in case of disputes.

Steps to complete the Promissory Note Loan Agreement

Completing a promissory note loan agreement involves several important steps:

- Identify the Parties: Clearly state the names and addresses of the borrower and lender.

- Define Loan Terms: Specify the principal amount, interest rate, and repayment schedule.

- Include Additional Clauses: Add any necessary clauses regarding defaults, prepayment, or collateral.

- Review the Document: Both parties should carefully review the agreement to ensure accuracy and clarity.

- Sign the Agreement: Both parties must sign and date the document to make it legally binding.

- Distribute Copies: Provide copies of the signed agreement to both parties for their records.

Legal use of the Promissory Note Loan Agreement

The legal use of a promissory note loan agreement is crucial for ensuring that the document is enforceable in court. To be legally binding, the note must meet specific requirements, such as being in writing, signed by the borrower, and containing clear terms regarding repayment. Additionally, it is important to comply with state laws regarding interest rates and lending practices. In the event of a dispute, a properly executed promissory note can serve as evidence of the loan agreement, making it easier for lenders to recover owed amounts.

How to obtain the Promissory Note Loan Agreement

Obtaining a promissory note loan agreement can be done through various means:

- Online Templates: Many websites offer free or paid templates that can be customized to fit specific needs.

- Legal Professionals: Consulting with an attorney can ensure that the agreement is tailored to comply with local laws and regulations.

- Financial Institutions: Banks and credit unions often provide standardized promissory note forms for their loan products.

Examples of using the Promissory Note Loan Agreement

Promissory notes can be utilized in various scenarios, including:

- Personal Loans: Friends or family members lending money to each other.

- Business Loans: Companies borrowing funds for operational expenses or expansion.

- Real Estate Transactions: Buyers financing a property purchase through seller financing.

Quick guide on how to complete promissory note loan agreement

Complete Promissory Note Loan Agreement seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Promissory Note Loan Agreement on any device using airSlate SignNow's Android or iOS applications and optimize any document-based workflow today.

The simplest way to modify and eSign Promissory Note Loan Agreement effortlessly

- Obtain Promissory Note Loan Agreement and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to share your form—via email, SMS, or invitation link—or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Promissory Note Loan Agreement to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a promissory note paper?

Promissory note paper is a legal document that contains a written promise from one party to pay a specified amount of money to another party at a defined time. It serves as a formal agreement and can be used for various financial transactions. Utilizing airSlate SignNow, you can easily create, send, and eSign your promissory note paper.

-

How do I create a promissory note paper using airSlate SignNow?

To create a promissory note paper with airSlate SignNow, simply choose a template or start from scratch within our user-friendly platform. You can customize your document with specific terms, amounts, and parties involved. Once your promissory note paper is ready, you can send it out for eSignatures quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for promissory note paper?

Yes, airSlate SignNow offers various subscription plans, which include options for creating and managing promissory note paper. Pricing varies based on the features and number of users. We recommend checking our pricing page for the most accurate and up-to-date information.

-

What are the benefits of using eSignatures on promissory note paper?

Using eSignatures on your promissory note paper provides several benefits, including increased security, faster transaction times, and enhanced legal validity. eSignatures are compliant with legal standards, which means your promissory note paper is officially recognized. Furthermore, it eliminates the need for physical paperwork, streamlining your business operations.

-

Can I integrate airSlate SignNow with other software for managing promissory note paper?

Yes, airSlate SignNow offers integrations with numerous applications, allowing you to manage your promissory note paper alongside other software solutions seamlessly. Popular integrations include CRM systems and project management tools. This ensures a smooth workflow and better organization of your documentation.

-

What features does airSlate SignNow offer for managing promissory note paper?

airSlate SignNow provides a host of features for managing promissory note paper, including customizable templates, automated reminders, secure cloud storage, and real-time tracking of document status. These features ensure efficiency and security throughout the signing process. Moreover, our intuitive interface makes it easy for all users to navigate and utilize the platform effectively.

-

How secure is my promissory note paper when using airSlate SignNow?

airSlate SignNow employs high-level encryption and security measures to protect your promissory note paper and all other documents. User data and signatures are safeguarded against unauthorized access. Our commitment to security ensures that your sensitive financial agreements remain confidential and secure.

Get more for Promissory Note Loan Agreement

- Subcontractors notice individual form

- Space above this line for recording data mortgage form

- Notice to all bidders brunswick county government form

- Writing a assignment of lien form sample ampampamp example format

- The grantors husband and wife of the form

- Oklahoma mechanics lien law in construction faqs forms

- Required notices in car repossessionsnolo form

- Ac supply company inc texas commercial lien form

Find out other Promissory Note Loan Agreement

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate