Az Deed Beneficiary Form

What is the Arizona Deed Beneficiary

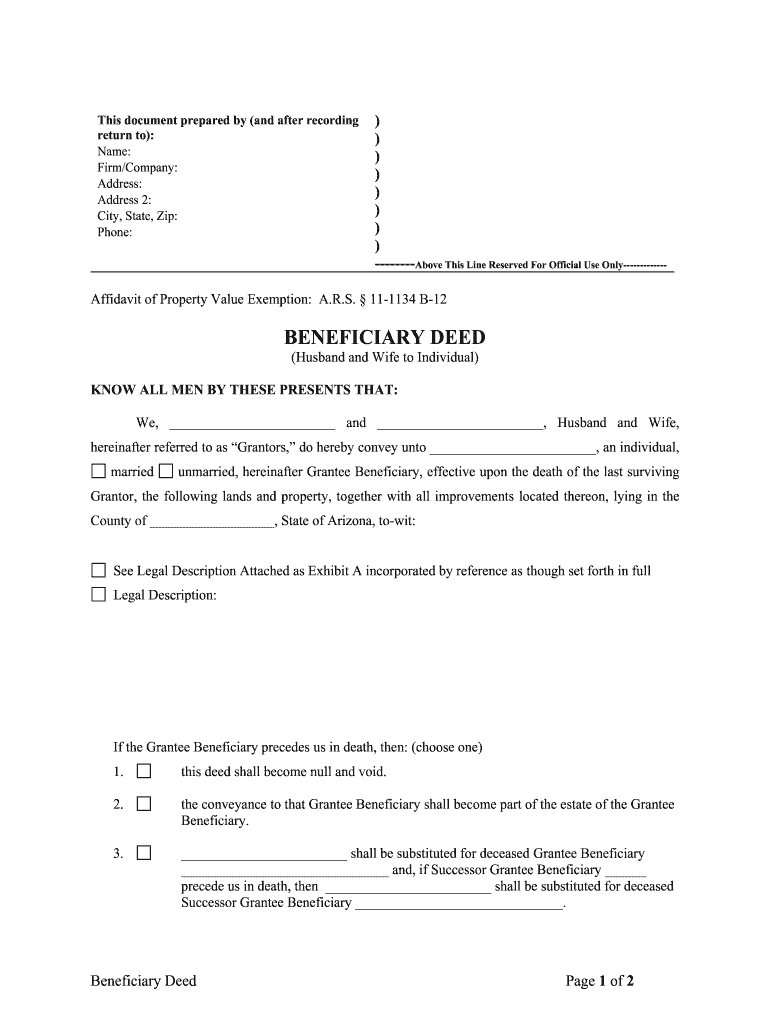

The Arizona deed beneficiary refers to a designation made within a property deed that allows a specific individual or entity to inherit property upon the death of the current owner. This arrangement is often utilized to bypass the lengthy probate process, ensuring that the property transfers directly to the designated beneficiary. The beneficiary can be a spouse, child, or any other individual or organization. This type of deed is commonly known as a Transfer on Death (TOD) deed in Arizona.

How to Use the Arizona Deed Beneficiary

To effectively use the Arizona deed beneficiary, the property owner must complete a Transfer on Death deed form. This form should clearly identify the property being transferred and the designated beneficiary. Once completed, the form must be signed and notarized. It is crucial to record the deed with the county recorder's office where the property is located to ensure its validity. This process allows the beneficiary to claim the property without going through probate, simplifying the transfer process.

Steps to Complete the Arizona Deed Beneficiary

Completing the Arizona deed beneficiary involves several key steps:

- Obtain the Transfer on Death deed form from a reliable source.

- Fill out the form with accurate property details and beneficiary information.

- Sign the form in the presence of a notary public to ensure legal compliance.

- File the notarized deed with the county recorder's office to make it effective.

Following these steps ensures that the deed is legally binding and recognized by the state, facilitating a smooth transfer of property upon the owner's death.

Legal Use of the Arizona Deed Beneficiary

The legal use of the Arizona deed beneficiary is governed by state laws that outline the requirements for creating a valid Transfer on Death deed. This includes the necessity for the deed to be signed, notarized, and recorded. Additionally, the property owner retains full control of the property during their lifetime and can revoke or change the beneficiary at any time before death. It is essential to understand these legal aspects to avoid complications in the future.

Required Documents for the Arizona Deed Beneficiary

When preparing to establish an Arizona deed beneficiary, several documents are necessary:

- The completed Transfer on Death deed form.

- A valid form of identification for the property owner.

- Any existing property deeds that provide proof of ownership.

Having these documents ready will streamline the process and ensure compliance with state regulations.

State-Specific Rules for the Arizona Deed Beneficiary

Arizona has specific rules regarding the use of Transfer on Death deeds. For instance, the deed must be recorded within a specific timeframe after being signed to be effective. Additionally, Arizona law allows for multiple beneficiaries to be named, and the owner can specify how the property will be divided among them. Understanding these state-specific rules is vital to ensure the deed is executed correctly and fulfills the owner's intentions.

Quick guide on how to complete az deed beneficiary

Complete Az Deed Beneficiary effortlessly on any gadget

Online document administration has become increasingly popular with businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Az Deed Beneficiary on any gadget with airSlate SignNow Android or iOS applications and streamline any document-centered procedure today.

How to modify and eSign Az Deed Beneficiary without breaking a sweat

- Find Az Deed Beneficiary and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to the computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Az Deed Beneficiary and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

Arizona filing

How to file a beneficiary deed in Arizona?

You must sign the deed and get your signature signNowd, and then record (file) the deed with the recorder's office before your death. Otherwise, it won't be valid. You can make an Arizona beneficiary deed with WillMaker. Arizona Beneficiary (Transfer on Death) Deeds - WillMaker willmaker.com https://.willmaker.com › legal-manual › transfer-on-... willmaker.com https://.willmaker.com › legal-manual › transfer-on-...

-

Where to get

Where can I get a beneficiary deed form in Arizona?

the Maricopa County Recorder's Office BENEFICIARY DEEDS §33-405 (statute includes a sample form) available from the Arizona Legislature Website. ➢ Beneficiary deeds are filed in the Maricopa County Recorder's Office. ➢ See the Maricopa County Recorder's Website for information on form requirements and filing fees. PROPERTY ISSUES See A.R.S. §33-405 (statute includes a sample ... maricopa.gov http://.superiorcourt.maricopa.gov › PDF › SelfHelp maricopa.gov http://.superiorcourt.maricopa.gov › PDF › SelfHelp

-

How does a beneficiary deed work in Arizona?

A beneficiary deed goes into effect only upon the death of the owner. Until that time, the owner can easily revoke or revise the beneficiary deed at any time, and the owner retains all rights of ownership, including selling, developing and encumbering the property.

-

How do I file a beneficiary deed in Arizona?

You must sign the deed and get your signature signNowd, and then record (file) the deed with the recorder's office before your death. Otherwise, it won't be valid. You can make an Arizona beneficiary deed with WillMaker.

-

How much does a beneficiary deed cost in Arizona?

How much is a beneficiary deed in Arizona? An estate attorney may prepare a Beneficiary Deed for approximately $250 to $750. There will also be a nominal recording fee in the county where the property is located.

-

What are the downsides of a beneficiary deed?

What are the disadvantages of a beneficiary deed? Using a beneficiary deed has its drawbacks, such as estate taxes, lack of asset protection, issues with Medicaid eligibility, no automatic transfer, and incapacity not addressed.

-

How much does it cost to file a beneficiary deed in Arizona?

In Arizona, beneficiary deeds must be recorded with the county recorder's office of the county in which the property is located. Recording Fee: A $30 recording fee applies for each document (§ 11-475(A)(1)).

-

Cost to record

How much does it cost to record a beneficiary deed in Arizona?

In Arizona, beneficiary deeds must be recorded with the county recorder's office of the county in which the property is located. Recording Fee: A $30 recording fee applies for each document (§ 11-475(A)(1)). Arizona Beneficiary (Transfer on Death) Deed - eForms eforms.com https://eforms.com › deeds › az › beneficiary-transfer-on... eforms.com https://eforms.com › deeds › az › beneficiary-transfer-on...

-

Do you have to pay taxes on a beneficiary deed in Arizona?

An Arizona Beneficiary Deed is much simpler than creating and administering a trust. In addition, the owner retains complete control over the property with an Arizona Beneficiary Deed. No gift tax liability. Since an Arizona Beneficiary Deed does not transfer property as a “gift,” it is not subject to gift taxes.

-

What are the downsides of a beneficiary deed?

What are the disadvantages of a beneficiary deed? Using a beneficiary deed has its drawbacks, such as estate taxes, lack of asset protection, issues with Medicaid eligibility, no automatic transfer, and incapacity not addressed.

-

Do you have to pay taxes on a beneficiary deed in Arizona?

An Arizona Beneficiary Deed is much simpler than creating and administering a trust. In addition, the owner retains complete control over the property with an Arizona Beneficiary Deed. No gift tax liability. Since an Arizona Beneficiary Deed does not transfer property as a “gift,” it is not subject to gift taxes.

Get more for Az Deed Beneficiary

- Charge sheet letter sample og international properties form

- Asb client keeper package alabama state bar form

- Adminname a resident of form

- Affidavit of heirship formlegalnature

- Carta poder argentinagobar presidencia de la nacin form

- Para uso en varios estados form

- Legal form packagesus legal forms

- Marriage formspostnuptial agreement and moreus legal forms

Find out other Az Deed Beneficiary

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now