Independent Contractor Form

What is the Independent Contractor?

An independent contractor is a self-employed individual who provides services to clients under a contractual agreement. Unlike employees, independent contractors have the flexibility to choose their work hours, clients, and methods of completing tasks. They are responsible for their own taxes and typically do not receive employee benefits such as health insurance or retirement plans. This arrangement is common in various fields, including consulting, freelancing, and skilled trades.

How to Obtain the Independent Contractor License

To operate as an independent contractor, obtaining the necessary licenses and permits is essential. The specific requirements can vary by state and industry. Generally, the process includes:

- Researching state and local regulations to determine the required licenses.

- Gathering necessary documentation, such as identification and proof of business address.

- Completing any required training or certification programs relevant to your field.

- Submitting an application to the appropriate state or local authority, along with any applicable fees.

Once approved, you will receive your independent contractor license, allowing you to legally operate your business.

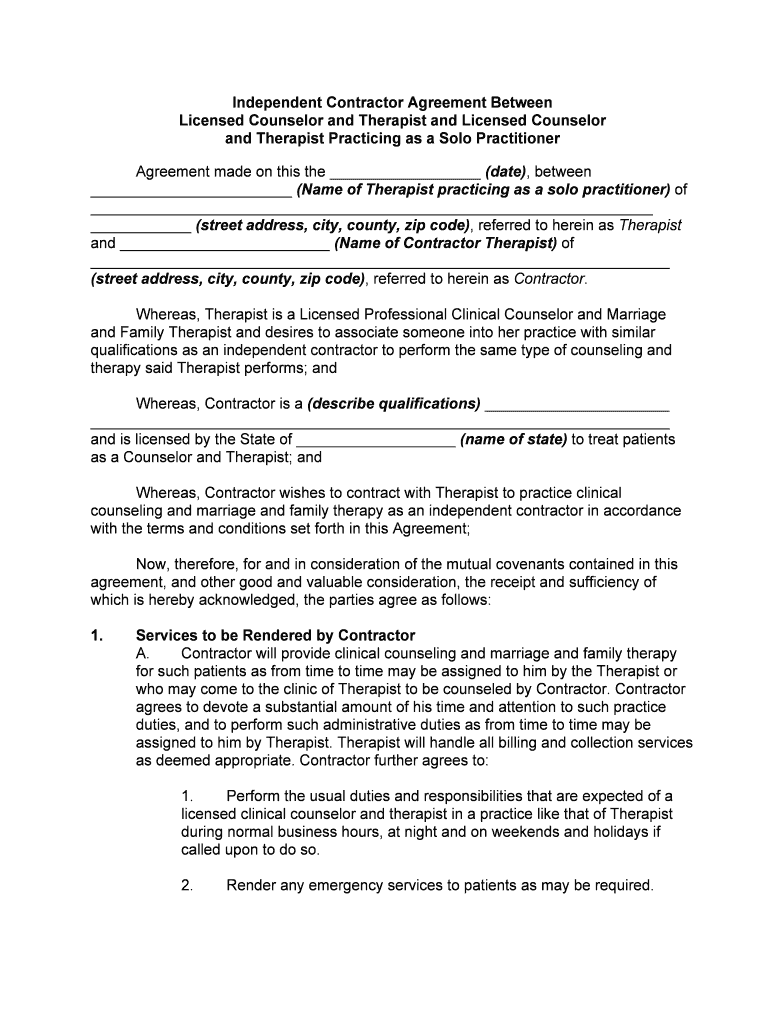

Key Elements of the Independent Contractor Agreement

A well-structured independent contractor agreement is crucial for defining the working relationship between the contractor and the client. Key elements typically include:

- Scope of Work: Detailed description of the services to be provided.

- Payment Terms: Outline of compensation, including rates and payment schedule.

- Duration: The timeline for the completion of services or the length of the contract.

- Confidentiality: Provisions to protect sensitive information shared during the contract.

- Termination Clause: Conditions under which either party can terminate the agreement.

Including these elements helps ensure clarity and protects the rights of both parties involved.

Steps to Complete the Independent Contractor Application

Completing an independent contractor application involves several steps to ensure accuracy and compliance. Here’s a straightforward process:

- Gather all necessary personal and business information, including your Social Security number and business address.

- Fill out the application form accurately, ensuring all details match your official documents.

- Review the application for any errors or omissions before submission.

- Submit the application through the designated method, whether online or via mail.

Following these steps can help streamline the application process and reduce the likelihood of delays.

Legal Use of the Independent Contractor License

Using an independent contractor license legally involves adhering to all relevant laws and regulations. This includes:

- Maintaining compliance with federal, state, and local tax obligations.

- Following industry-specific regulations that govern your services.

- Ensuring that all contracts are clear, fair, and legally binding.

- Keeping accurate records of all business transactions and communications.

By following these guidelines, independent contractors can operate their businesses legally and ethically.

IRS Guidelines for Independent Contractors

The IRS provides specific guidelines for independent contractors, particularly regarding tax obligations. Key points include:

- Independent contractors must report their income using Form 1099-MISC if they earn more than $600 from a single client.

- They are responsible for paying self-employment taxes, which cover Social Security and Medicare contributions.

- Contractors can deduct business expenses on their tax returns, which can help reduce taxable income.

Understanding these guidelines is essential for maintaining compliance and optimizing tax responsibilities.

Quick guide on how to complete independent contractor 481369823

Complete Independent Contractor effortlessly on any gadget

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents quickly without delays. Manage Independent Contractor on any gadget using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Independent Contractor without hassle

- Find Independent Contractor and then click Get Form to commence.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Independent Contractor and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an independent contractor licensed?

An independent contractor licensed is a professional who operates their own business and is authorized to perform specific services in their industry. They hold a valid license that demonstrates their expertise and adherence to regulatory standards. This licensing is crucial for gaining client trust and ensuring compliance with local laws.

-

How does airSlate SignNow benefit independent contractors licensed?

airSlate SignNow provides independent contractors licensed with a streamlined solution for sending and signing documents. This user-friendly eSigning platform helps contractors save time and resources, allowing them to focus more on their projects and client relationships. It also ensures secure, legally binding signatures that enhance credibility.

-

What features does airSlate SignNow offer for independent contractors licensed?

AirSlate SignNow offers a variety of features specifically designed to help independent contractors licensed. These include customizable templates, mobile signing, and advanced security options. These tools allow licensed contractors to manage their documents efficiently and enhance overall productivity.

-

Is airSlate SignNow affordable for independent contractors licensed?

Yes, airSlate SignNow offers competitive pricing plans that are budget-friendly for independent contractors licensed. With flexible subscriptions and no hidden fees, contractors can choose a plan that fits their financial needs. The cost-effectiveness of airSlate SignNow makes it an ideal choice for budget-conscious professionals.

-

Can independent contractors licensed integrate airSlate SignNow with other tools?

Absolutely! Independent contractors licensed can seamlessly integrate airSlate SignNow with various popular business tools and applications. This integration enhances workflow and enables contractors to synchronize their eSigning activities with project management and CRM systems, streamlining their operations.

-

How secure is airSlate SignNow for independent contractors licensed?

AirSlate SignNow prioritizes security for independent contractors licensed, offering features like SSL encryption, two-factor authentication, and compliance with industry regulations. This ensures that all signed documents and personal data are kept secure and confidential. Contractors can confidently use the platform knowing their information is protected.

-

What support options are available for independent contractors licensed using airSlate SignNow?

Independent contractors licensed can access a wide range of support options through airSlate SignNow, including live chat, email support, and a comprehensive knowledge base. This is particularly important for contractors who may need immediate assistance while using the platform. The dedicated support team is readily available to help with any questions or issues.

Get more for Independent Contractor

- Together with the notes and obligations therein described or referred to the money due and to form

- Your investment property yip magazine issue 30 november form

- Is landlord check the appropriate box form

- Ten landlord legal mistakes to avoid findlaw form

- Of percent per annum from the date hereof until paid payable as follows form

- Kansas known as form

- Consumer pamphlet rights and duties of tenants and form

- Commercial lease docracy form

Find out other Independent Contractor

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure