Contract Independent Contractor Form

What is the Contract Independent Contractor

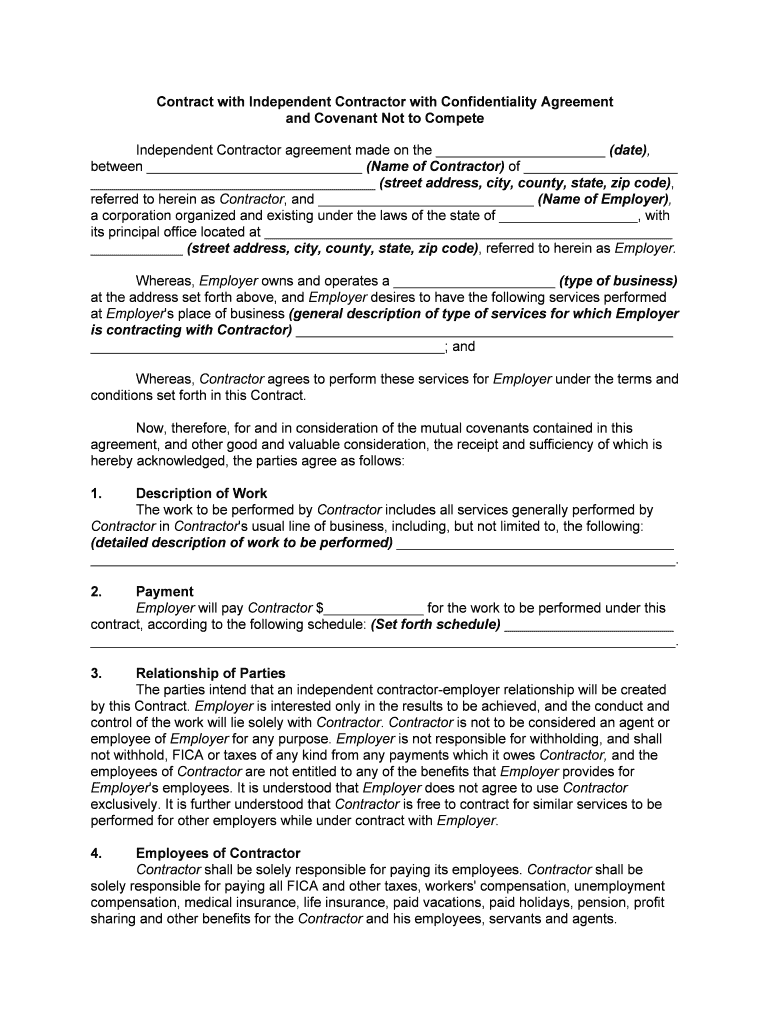

The contract independent contractor is a legal document that outlines the terms of the working relationship between a business and an independent contractor. This form specifies the nature of the work, payment terms, deadlines, and other essential conditions that govern the engagement. Unlike traditional employment contracts, which often include benefits and job security, the contract independent contractor emphasizes the contractor's autonomy and the temporary nature of the work arrangement.

How to use the Contract Independent Contractor

Using the contract independent contractor involves several steps to ensure that all parties are clear on their rights and obligations. First, both the business and the contractor should review the terms to ensure mutual understanding. Next, the document should be filled out with accurate details, including the scope of work, payment structure, and deadlines. Once completed, both parties should sign the contract, either in person or electronically, to formalize the agreement. Utilizing a reliable eSignature solution can streamline this process, ensuring that the document is legally binding and securely stored.

Steps to complete the Contract Independent Contractor

Completing the contract independent contractor requires careful attention to detail. Here are the essential steps:

- Identify the parties involved, including the business name and the contractor's name.

- Clearly define the scope of work, including specific tasks and deliverables.

- Outline payment terms, including rates, payment schedule, and any expenses that will be reimbursed.

- Set deadlines for project milestones and final deliverables.

- Include confidentiality clauses if sensitive information will be shared.

- Specify the terms for termination of the contract, including notice periods.

- Ensure that both parties sign the document, either physically or digitally.

Legal use of the Contract Independent Contractor

To ensure the legal validity of the contract independent contractor, it must comply with relevant laws and regulations. In the United States, this includes adherence to the Fair Labor Standards Act (FLSA) and Internal Revenue Service (IRS) guidelines regarding independent contractors. The contract should clearly state that the contractor is not an employee, which helps to avoid misclassification issues. Additionally, using a digital signature solution that meets the requirements of the ESIGN Act and UETA can further validate the document's legality.

Key elements of the Contract Independent Contractor

Several key elements must be included in a contract independent contractor to make it comprehensive and enforceable. These elements typically include:

- The names and addresses of both the contractor and the hiring entity.

- A detailed description of the services to be provided.

- Payment terms, including rates and payment methods.

- Duration of the contract and any specific milestones.

- Confidentiality and non-disclosure agreements, if applicable.

- Indemnification clauses to protect against potential liabilities.

IRS Guidelines

The IRS has specific guidelines for classifying workers as independent contractors versus employees. Understanding these guidelines is crucial for both businesses and contractors to ensure compliance and avoid penalties. Key factors include the degree of control the business has over the worker, the nature of the relationship, and the financial aspects of the arrangement. The IRS uses a three-part test to determine whether a worker is an independent contractor, focusing on behavioral control, financial control, and the type of relationship. Properly completing the contract independent contractor can help clarify this classification.

Quick guide on how to complete contract independent contractor

Effortlessly Prepare Contract Independent Contractor on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without hindrances. Manage Contract Independent Contractor on any device using the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The Easiest Way to Modify and eSign Contract Independent Contractor with Ease

- Obtain Contract Independent Contractor and click Get Form to initiate the process.

- Utilize the provided tools to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using the specialized tools offered by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether it’s via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of misplaced or lost documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Modify and eSign Contract Independent Contractor and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a contract independent contractor?

A contract independent contractor is a person or entity that provides services to another entity under terms specified in a contract. Unlike traditional employees, independent contractors have the freedom to choose how they perform their work. Understanding this distinction is essential for businesses to comply with legal and tax obligations.

-

How can airSlate SignNow help manage contract independent contractor agreements?

airSlate SignNow streamlines the process of sending and eSigning contract independent contractor agreements. The platform allows businesses to create, send, and manage contracts efficiently, ensuring that both parties can review and sign the document securely. This eliminates the hassle of paper and in-person meetings.

-

What features does airSlate SignNow offer for contract independent contractor management?

AirSlate SignNow offers features like customizable templates for contract independent contractor agreements, advanced tracking, and easy sharing options. Users can automate workflows to expedite the eSigning process and maintain documentation in one centralized location. These features signNowly reduce the turnaround time for contracts.

-

Is airSlate SignNow priced competitively for businesses hiring contract independent contractors?

Yes, airSlate SignNow provides cost-effective pricing plans tailored to businesses that engage contract independent contractors. With various tiers to choose from, you can select a plan that fits your organization's specific needs, enabling you to manage contracts without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for better contract independent contractor management?

Absolutely! AirSlate SignNow integrates seamlessly with various business tools like CRM systems, project management software, and cloud storage services. This ensures that you can manage your contract independent contractor agreements alongside your other business processes, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for contract independent contractor agreements?

Using airSlate SignNow for contract independent contractor agreements offers numerous benefits, including quicker turnaround times and reduced paperwork. The electronic signature feature boosts efficiency while ensuring legal compliance. Moreover, the platform enhances collaboration between contractors and businesses.

-

How secure is airSlate SignNow for handling contract independent contractor documents?

AirSlate SignNow prioritizes security by implementing robust encryption and adhering to industry standards. Your contract independent contractor documents are stored securely, ensuring that sensitive data is protected from unauthorized access. You'll have peace of mind knowing your contracts are safe.

Get more for Contract Independent Contractor

- Corporation party of the second part hereinafter called the quotbuyers whether one or more form

- This space is reserved for the register of deeds form

- May hold two or more offices form

- Date bynames of persons form

- This instrument was acknowledged to me on date form

- Enclosed please find the original and one copy of articles of organization form

- Form 811 download fillable pdf certificate of

- Kansas fixed rate note installment payments unsecured form

Find out other Contract Independent Contractor

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template