Kansas Fixed Rate Note, Installment Payments Unsecured Form

What is the Kansas Fixed Rate Note, Installment Payments Unsecured

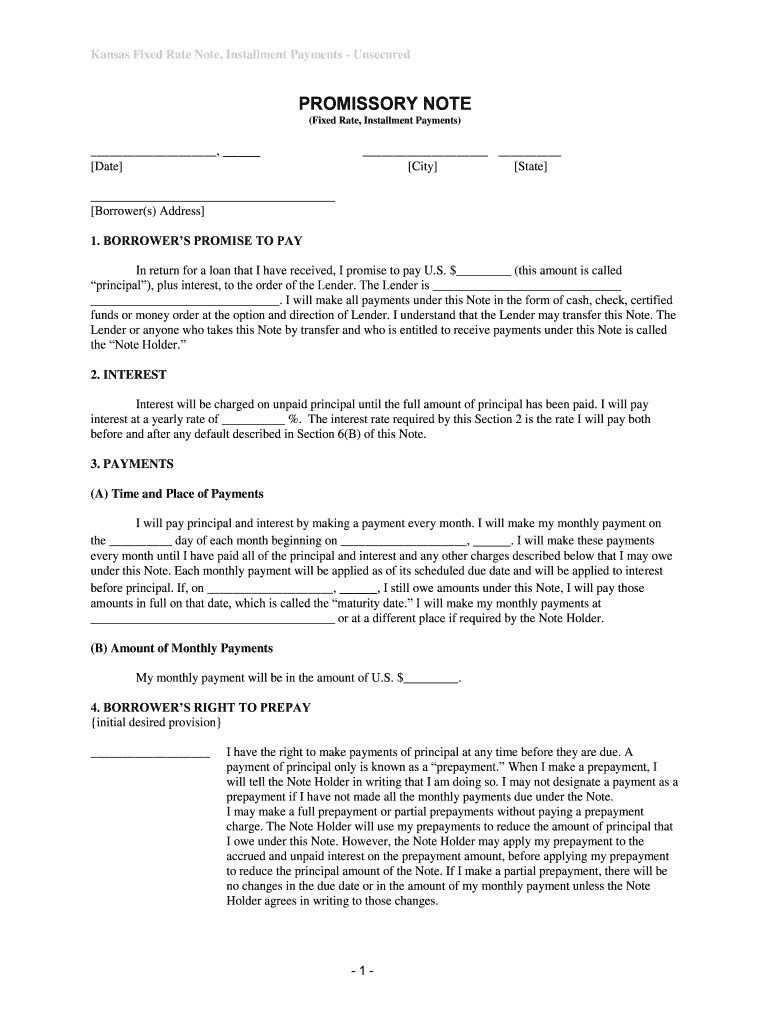

The Kansas Fixed Rate Note, Installment Payments Unsecured is a legal document that outlines the terms of a loan agreement where the borrower agrees to repay the lender in fixed installments over a specified period. This note is considered unsecured, meaning it is not backed by collateral. It is commonly used in personal loans, where the lender relies on the borrower's promise to repay rather than any physical asset. Understanding the structure and implications of this note is essential for both lenders and borrowers to ensure clear expectations and legal compliance.

How to use the Kansas Fixed Rate Note, Installment Payments Unsecured

Using the Kansas Fixed Rate Note involves several steps that ensure the document serves its intended purpose effectively. First, both parties should review the terms of the note, including the interest rate, payment schedule, and any penalties for late payments. Once both parties agree to the terms, they should complete the document accurately, ensuring all necessary information is included, such as names, addresses, and loan amounts. After filling out the form, both parties must sign it to make it legally binding. Utilizing a digital signature solution can streamline this process and enhance security.

Key elements of the Kansas Fixed Rate Note, Installment Payments Unsecured

Several key elements must be included in the Kansas Fixed Rate Note to ensure its validity and enforceability. These elements typically include:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the outstanding balance.

- Payment Schedule: Specific dates and amounts for each installment payment.

- Default Terms: Conditions under which the borrower may be considered in default and the lender's rights in such an event.

- Signatures: The signatures of both the borrower and lender to validate the agreement.

Steps to complete the Kansas Fixed Rate Note, Installment Payments Unsecured

Completing the Kansas Fixed Rate Note involves a series of clear steps to ensure accuracy and compliance:

- Gather necessary information, including personal details of both parties and loan specifics.

- Fill out the loan amount, interest rate, and payment schedule in the document.

- Review the terms carefully to ensure mutual understanding and agreement.

- Sign the document using a secure digital signature method to enhance legal validity.

- Keep a copy of the signed note for both parties' records.

Legal use of the Kansas Fixed Rate Note, Installment Payments Unsecured

The Kansas Fixed Rate Note is legally binding when executed according to state laws and regulations. It must comply with the Uniform Commercial Code (UCC) provisions applicable in Kansas, which govern promissory notes and secured transactions. Both parties should ensure that they understand their rights and obligations under the note. In case of disputes, the note can serve as evidence in court, making it crucial to maintain its integrity and accuracy throughout the loan period.

State-specific rules for the Kansas Fixed Rate Note, Installment Payments Unsecured

In Kansas, specific rules apply to the execution and enforcement of the Fixed Rate Note. These include requirements for clear terms, proper signatures, and adherence to state interest rate limits. Borrowers and lenders should also be aware of any additional local regulations that may impact the enforceability of the note. It is advisable to consult with a legal professional familiar with Kansas law to ensure compliance and avoid potential pitfalls.

Quick guide on how to complete kansas fixed rate note installment payments unsecured

Complete Kansas Fixed Rate Note, Installment Payments Unsecured effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Kansas Fixed Rate Note, Installment Payments Unsecured on any platform with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to edit and eSign Kansas Fixed Rate Note, Installment Payments Unsecured seamlessly

- Locate Kansas Fixed Rate Note, Installment Payments Unsecured and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow makes available specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management with just a few clicks from any device you prefer. Modify and eSign Kansas Fixed Rate Note, Installment Payments Unsecured and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Kansas Fixed Rate Note, Installment Payments Unsecured?

A Kansas Fixed Rate Note, Installment Payments Unsecured is a financial document that allows borrowers to repay a loan with fixed installment payments over a specified period. This type of note is unsecured, meaning it does not require collateral, providing borrowers a simplified access to funds without risking personal or business assets.

-

How do I obtain a Kansas Fixed Rate Note, Installment Payments Unsecured?

To obtain a Kansas Fixed Rate Note, Installment Payments Unsecured, you can start by applying online through financial institutions or lenders specializing in unsecured notes. Once your application is approved, you will receive the documentation needed to formalize the agreement.

-

What are the benefits of using a Kansas Fixed Rate Note, Installment Payments Unsecured?

Using a Kansas Fixed Rate Note, Installment Payments Unsecured offers several advantages, such as predictable payments, which help in budgeting. Additionally, as it is unsecured, borrowers can access funds without the need to pledge assets, allowing greater financial freedom.

-

Are there specific eligibility requirements for a Kansas Fixed Rate Note, Installment Payments Unsecured?

Eligibility for a Kansas Fixed Rate Note, Installment Payments Unsecured typically involves a review of your credit history, income stability, and overall financial profile. Lenders may have varying criteria, so it's essential to check with specific institutions for their requirements.

-

What is the typical interest rate for a Kansas Fixed Rate Note, Installment Payments Unsecured?

Interest rates for a Kansas Fixed Rate Note, Installment Payments Unsecured can vary based on factors like credit score, loan amount, and lender policies. Generally, these rates can range from moderate to competitive, reflecting current market trends and individual qualifications.

-

How do I manage payments on a Kansas Fixed Rate Note, Installment Payments Unsecured?

Payments on a Kansas Fixed Rate Note, Installment Payments Unsecured can typically be managed through automatic bank drafts or online payments, which many lenders offer. Setting reminders or utilizing budgeting tools can also help ensure that payments are made on time.

-

Can I refinance my Kansas Fixed Rate Note, Installment Payments Unsecured?

Yes, refinancing a Kansas Fixed Rate Note, Installment Payments Unsecured is often possible. This process can help you secure a lower interest rate or modify payment terms, but it's essential to consider any fees or conditions involved with refinancing.

Get more for Kansas Fixed Rate Note, Installment Payments Unsecured

Find out other Kansas Fixed Rate Note, Installment Payments Unsecured

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document