Irc Code Section Form

What is the IRC Code Section?

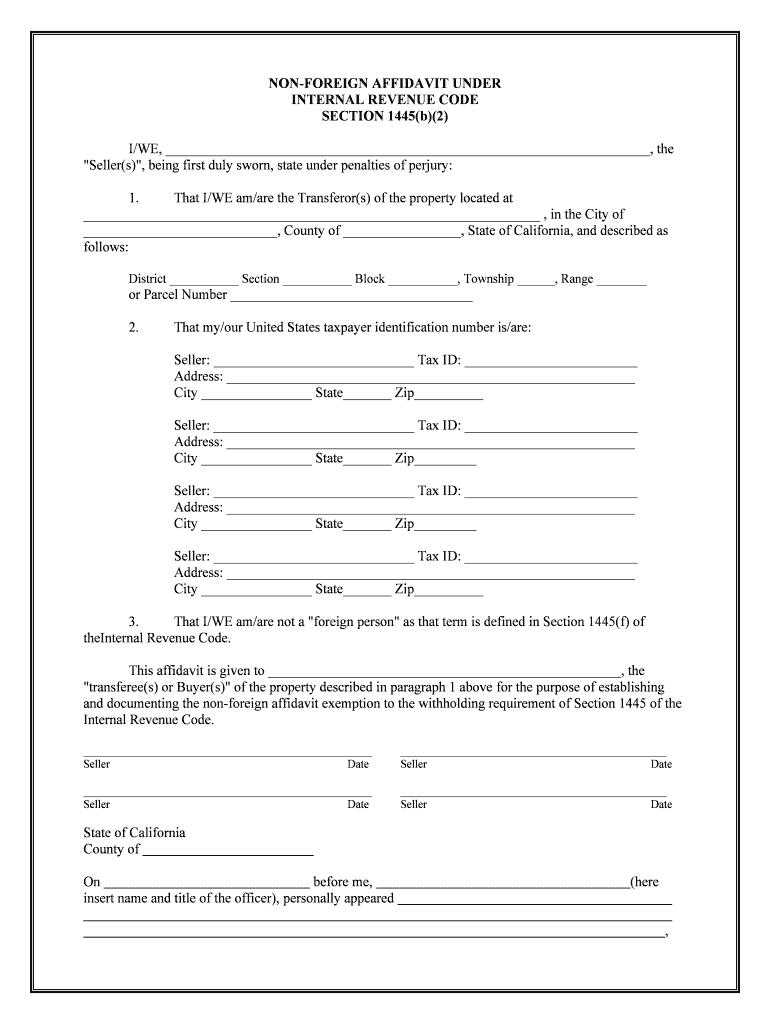

The Internal Revenue Code (IRC) Code Section refers to specific provisions within the federal tax law that govern various tax-related matters. These sections provide the legal framework for taxation in the United States, detailing the rules and regulations that taxpayers must follow. Understanding the IRC Code Section is essential for compliance and ensuring that all tax obligations are met. For example, the IRC Section 1445 pertains to withholding tax on dispositions of U.S. real property interests by foreign persons, which is crucial for both buyers and sellers in real estate transactions.

How to Use the IRC Code Section

Using the IRC Code Section effectively involves understanding its stipulations and applying them to your specific tax situation. Taxpayers should first identify which section is relevant to their circumstances, such as IRC Section 1445 for real estate transactions. Once identified, it is important to review the requirements and ensure compliance with the regulations outlined in that section. This may include filing necessary forms, such as the non-foreign affidavit, to confirm the status of the seller in a real estate transaction. Utilizing digital tools can streamline this process, making it easier to fill out and submit required documentation.

Steps to Complete the IRC Code Section

Completing the IRC Code Section involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your tax situation, such as property sale agreements or income statements. Next, determine the specific IRC section that applies to your case. For instance, if you are dealing with real estate transactions, you would focus on IRC Section 1445. After identifying the correct section, fill out the appropriate forms, ensuring all information is accurate and complete. Finally, submit your forms electronically or via mail, depending on the requirements outlined in the IRC.

Legal Use of the IRC Code Section

The legal use of the IRC Code Section is paramount for ensuring compliance with U.S. tax laws. Each section is designed to provide clarity on tax obligations and rights. For example, IRC Section 1445 establishes guidelines for withholding taxes on foreign sellers of U.S. property, which helps the IRS collect taxes owed by non-resident aliens. It is critical to adhere to these legal stipulations to avoid penalties and ensure that transactions are recognized as valid by the IRS. Utilizing reliable eSignature solutions can also enhance the legal standing of documents by ensuring that all signatures are compliant with federal regulations.

Required Documents for the IRC Code Section

When dealing with the IRC Code Section, specific documents are often required to ensure compliance. For instance, if you are completing forms related to IRC Section 1445, you may need to provide a non-foreign affidavit to certify the seller's status. Other common documents include property sale agreements, tax identification numbers, and any relevant financial statements. It is essential to have these documents ready and accurately completed to facilitate a smooth filing process and to meet the legal requirements set forth in the IRC.

Filing Deadlines and Important Dates

Filing deadlines and important dates associated with the IRC Code Section can vary depending on the specific section and the nature of the tax obligation. For example, if you are involved in a real estate transaction under IRC Section 1445, the withholding tax must typically be submitted to the IRS within a specified timeframe following the sale. It is crucial to be aware of these deadlines to avoid penalties and ensure compliance. Keeping a calendar of important tax dates can help taxpayers stay organized and on track with their obligations.

Quick guide on how to complete irc code section

Complete Irc Code Section effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Irc Code Section on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and eSign Irc Code Section effortlessly

- Locate Irc Code Section and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your preference. Edit and eSign Irc Code Section and ensure exceptional communication at any point during the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ca code section regarding electronic signatures?

The ca code section refers to the laws governing electronic signatures in California, ensuring they are legally binding. This means that contracts signed electronically via platforms like airSlate SignNow comply with these regulations, providing assurance to businesses and individuals using electronic documents. Understanding this code section is crucial for businesses to ensure compliance.

-

How does airSlate SignNow comply with the ca code section?

airSlate SignNow fully complies with the ca code section by using secure technology that ensures the integrity and authenticity of electronic signatures. Our platform is designed to meet legal standards set forth in California, giving users confidence that their electronically signed documents are valid. This commitment to compliance sets airSlate SignNow apart as a reliable e-signature solution.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans designed to meet the needs of businesses of all sizes. Our plans are competitive and transparent, ensuring you pay only for what you need while remaining compliant with the ca code section. Visit our website to find the plan that best suits your requirements.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a robust set of features, including customizable templates, real-time notifications, and secure cloud storage that comply with the ca code section. These features streamline the document signing process, making it easier for businesses to manage their contracts. With airSlate SignNow, you can create, send, and sign documents efficiently.

-

What benefits does airSlate SignNow provide for businesses?

By using airSlate SignNow, businesses can enhance their operational efficiency and reduce costs associated with traditional paper signing methods. The platform's ease of use and adherence to the ca code section mean that you can sign documents quickly while ensuring legal compliance. This leads to faster agreements and improved business relationships.

-

How can airSlate SignNow integrate with my existing tools?

airSlate SignNow features seamless integrations with various business tools and software, such as CRMs and project management systems. This ensures that you can enhance workflows while remaining compliant with the ca code section. Integration allows for a smoother process, saving time and improving productivity for your team.

-

Is airSlate SignNow suitable for small businesses?

Yes, airSlate SignNow is specifically designed to cater to businesses of all sizes, including small businesses. The cost-effective plans and features help small businesses comply with the ca code section without breaking the bank. Our user-friendly interface also makes it easy for teams to adopt and integrate e-signatures quickly.

Get more for Irc Code Section

- Free limited power of attorney florida formadobe pdf

- Special durable power of attorney for bank account matters form

- Control number oh p093 pkg form

- Respective and collective rights titles and interests in the separate and joint property of the form

- Form ok 988lt

- State of oregon including any uniform premarital agreement act or other applicable laws

- State of rhode island including any uniform premarital agreement act or other applicable laws

- State of south carolina declaration of a desire for a form

Find out other Irc Code Section

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now