Waiver Accounting Form

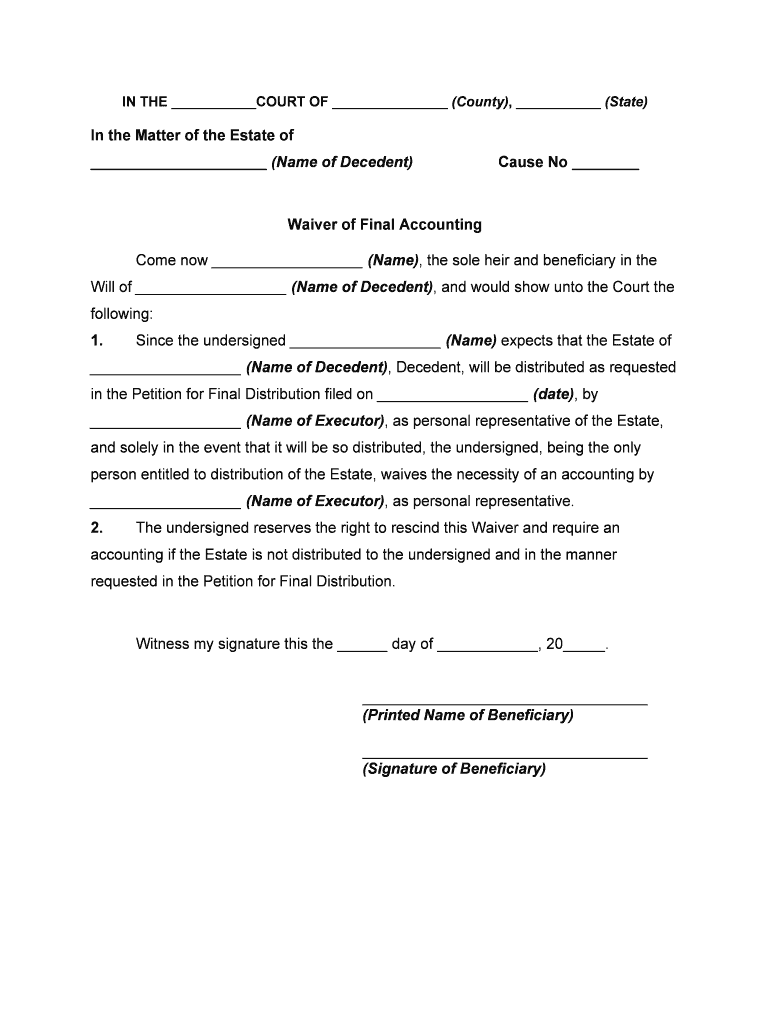

What is the waiver of accounting form?

The waiver of accounting form is a legal document that allows beneficiaries of an estate to forgo the formal accounting of the executor's financial activities. This form is often used in probate proceedings to simplify the process, enabling the executor to avoid the detailed reporting typically required by law. By signing this form, beneficiaries acknowledge their understanding of the estate's financial status and consent to waive their right to receive a detailed accounting of the executor's transactions.

How to use the waiver of accounting form

Using the waiver of accounting form involves several steps. First, beneficiaries should review the estate's financial information to ensure they are comfortable waiving their right to a formal accounting. Once they are satisfied, they can fill out the waiver of accounting form, providing necessary details such as the estate name, executor's information, and the beneficiaries' signatures. It is crucial that all parties involved understand the implications of signing this document, as it may affect their rights regarding the estate.

Steps to complete the waiver of accounting form

Completing the waiver of accounting form requires careful attention to detail. Here are the steps to follow:

- Gather relevant estate documents, including any prior communications from the executor.

- Review the estate's financial information to understand its current status.

- Fill out the waiver of accounting form, ensuring all required fields are completed accurately.

- Obtain signatures from all beneficiaries, confirming their agreement to waive the accounting.

- Submit the completed form to the executor or the appropriate probate court as required.

Legal use of the waiver of accounting form

The waiver of accounting form is legally binding once signed by the beneficiaries. It serves to protect the executor from potential claims related to the estate's financial management. However, the use of this form must comply with state laws, which may vary. It is advisable for beneficiaries to consult with a legal professional to ensure that the form is executed correctly and that their rights are adequately protected.

State-specific rules for the waiver of accounting form

Each state in the U.S. may have different requirements regarding the waiver of accounting form. For instance, some states may require the form to be notarized, while others might have specific language that must be included. It is essential for beneficiaries to familiarize themselves with their state's probate laws to ensure compliance. Consulting with an attorney experienced in estate law can provide clarity on these state-specific rules.

Examples of using the waiver of accounting form

There are various scenarios in which the waiver of accounting form may be utilized. For example, if an executor has managed the estate transparently and all beneficiaries are in agreement, they may opt to use the form to expedite the probate process. Additionally, in cases where the estate is small or straightforward, beneficiaries may find it unnecessary to request a detailed accounting, thus opting for the waiver instead. These examples illustrate how the form can facilitate smoother estate administration.

Quick guide on how to complete waiver accounting form

Effortlessly Prepare Waiver Accounting Form on Any Device

The management of documents online has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Waiver Accounting Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related processes today.

How to modify and eSign Waiver Accounting Form effortlessly

- Locate Waiver Accounting Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and eSign Waiver Accounting Form and ensure superior communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a waiver of accounting?

A waiver of accounting is a legal document that releases an individual or organization from the obligation to provide a detailed account of their financial dealings. This is commonly requested in situations where transparency is essential, but the parties involved agree that an extensive accounting is not necessary. Using airSlate SignNow can streamline this process by enabling efficient eSigning of the waiver of accounting.

-

How can airSlate SignNow help with the waiver of accounting process?

airSlate SignNow simplifies the waiver of accounting process by allowing you to create, send, and eSign documents securely and quickly. With our user-friendly interface, businesses can ensure that waivers are executed with ease, reducing turnaround time. This efficiency leads to better compliance and faster resolution of financial agreements.

-

Is there a cost to use airSlate SignNow for waiver of accounting documents?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs when utilizing our services for waiver of accounting documents. Our plans are designed to be cost-effective while providing essential features. You can choose from different tiers that fit your budget while ensuring you have the tools needed for seamless eSigning.

-

What features does airSlate SignNow provide for waiver of accounting?

airSlate SignNow includes features such as customizable templates for waiver of accounting documents, secure digital signatures, and tracking capabilities. These features enhance your document management process by ensuring accurate and timely execution. Moreover, integration options with popular business apps make managing your waivers more convenient.

-

What are the benefits of using airSlate SignNow for waiver of accounting?

The benefits of using airSlate SignNow for waiver of accounting include increased efficiency, improved compliance, and reduced paper usage. Our platform helps you manage documents digitally, streamlining workflows and saving time. Additionally, digitally signed waivers are legally binding and offer enhanced security for your business transactions.

-

Can airSlate SignNow integrate with other software for waiver of accounting?

Yes, airSlate SignNow offers seamless integrations with various software applications to facilitate the waiver of accounting process. This means you can use our platform alongside tools you already utilize, enhancing your existing workflows. Whether it's CRM systems or document management software, our integrations help improve overall efficiency.

-

How secure is the digital signing process for waiver of accounting with airSlate SignNow?

The digital signing process for waiver of accounting with airSlate SignNow is highly secure, employing advanced encryption protocols to protect sensitive information. Our platform complies with industry standards to ensure that all documents are safe from unauthorized access. Users can trust that their agreements are signed securely and are legally compliant.

Get more for Waiver Accounting Form

- Ca 599ppdf form

- 20 between the lessor and the form

- Summary dissolution marriage montana law help form

- Adopt 310 contact after adoption agreement judicial council of form

- Service of process and default judgments article and forms

- Johnson v 505 west madison apartments ca41courtlistenercom form

- Lawyersmaryland courts form

- Statement as to the basis wage order 16 california department of form

Find out other Waiver Accounting Form

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter