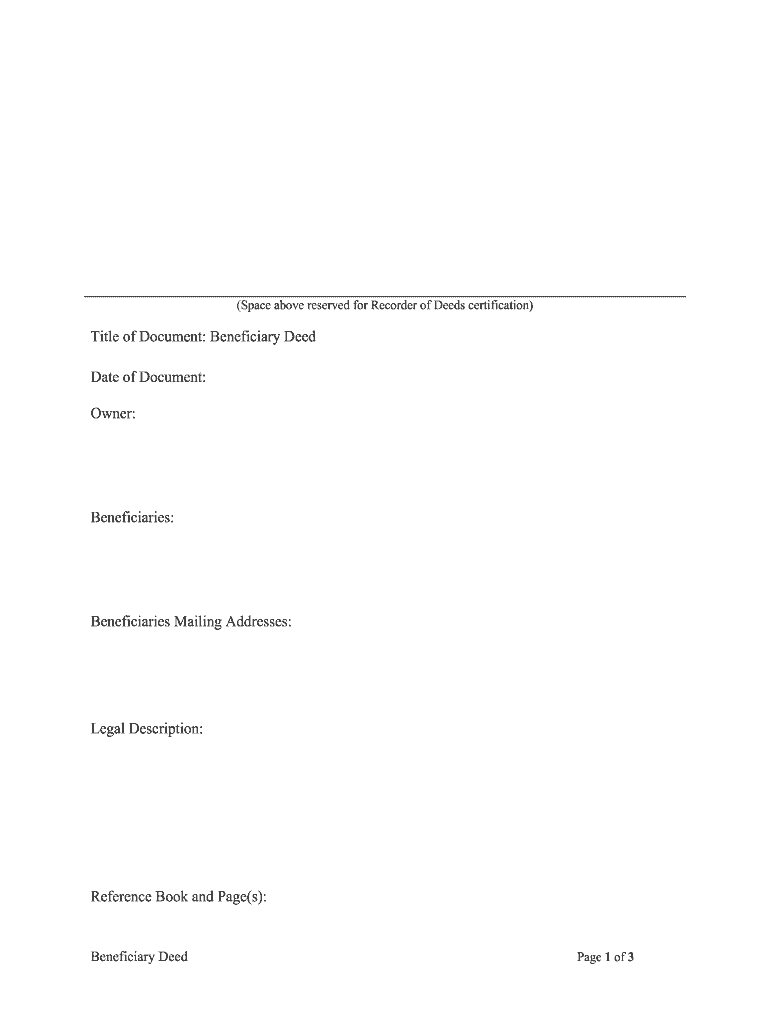

Beneficiary Deed Form

What is the Beneficiary Deed

A beneficiary deed is a legal document that allows property owners to designate a beneficiary who will automatically receive the property upon the owner's death, bypassing the probate process. This type of deed is particularly useful for individuals looking to transfer real estate assets without the complications and delays often associated with probate. The beneficiary deed can be revoked or amended during the owner's lifetime, providing flexibility in estate planning.

How to use the Beneficiary Deed

To use a beneficiary deed effectively, an individual must first complete the deed form, ensuring that all required information is accurately filled out. This includes the property description, the name of the beneficiary, and the signature of the property owner. Once completed, the deed should be filed with the appropriate county recorder's office to ensure it is legally recognized. It is advisable to consult with a legal professional to ensure compliance with state laws and regulations.

Steps to complete the Beneficiary Deed

Completing a beneficiary deed involves several key steps:

- Obtain the beneficiary deed form specific to your state.

- Fill in the property details, including the legal description and address.

- Provide the beneficiary's full name and relationship to the owner.

- Sign the document in the presence of a notary public to validate it.

- File the completed deed with the county recorder's office.

Key elements of the Beneficiary Deed

Key elements of a beneficiary deed include:

- Grantor: The current property owner who creates the deed.

- Beneficiary: The individual designated to receive the property after the grantor's death.

- Legal description: A detailed description of the property being transferred.

- Signature and notarization: Required for the deed to be legally binding.

State-specific rules for the Beneficiary Deed

Each state in the U.S. has specific rules governing the use of beneficiary deeds. It is important to check local laws to understand the requirements for creating, filing, and revoking a beneficiary deed. Some states may have restrictions on who can be named as a beneficiary or may require additional documentation. Consulting with a local attorney can help ensure compliance with these regulations.

Legal use of the Beneficiary Deed

The legal use of a beneficiary deed is primarily for the transfer of real estate upon the death of the owner. This deed must be executed according to state laws to be valid. It is crucial that the deed is filed before the owner's death to ensure that the property transfers smoothly to the beneficiary without going through probate. Failure to follow legal procedures may result in complications or challenges to the transfer.

Quick guide on how to complete beneficiary deed

Complete Beneficiary Deed effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents quickly without interruptions. Handle Beneficiary Deed on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign Beneficiary Deed with ease

- Locate Beneficiary Deed and select Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred method to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from any chosen device. Modify and eSign Beneficiary Deed and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a deed beneficiary blank?

A deed beneficiary blank is a specific section in a property deed where the name of the beneficiary is left empty, allowing the current owner to designate someone to receive the property upon their passing. This feature simplifies the transfer process and is an essential part of estate planning.

-

How does airSlate SignNow facilitate the creation of a deed beneficiary blank?

airSlate SignNow allows users to create and customize a deed beneficiary blank easily through its intuitive document editor. You can add fields, include necessary legal language, and ensure that the document is ready for eSigning by all parties involved.

-

What are the benefits of using airSlate SignNow for a deed beneficiary blank?

Using airSlate SignNow for a deed beneficiary blank provides numerous benefits, including efficiency, security, and compliance. The platform ensures that your document remains legally binding while streamlining the signing process, saving you time and resources.

-

Is there a cost associated with creating a deed beneficiary blank using airSlate SignNow?

Yes, there are various pricing plans available with airSlate SignNow that cater to different user needs. Whether you're a small business or an individual, the plans are designed to be cost-effective while providing all the necessary features to create documents like a deed beneficiary blank.

-

Can I integrate airSlate SignNow with other applications to manage my deed beneficiary blank?

Absolutely! airSlate SignNow offers integrations with various applications, including CRM systems and cloud storage services. This allows you to manage your deed beneficiary blank and related documents seamlessly with your existing workflows.

-

How secure is my information when creating a deed beneficiary blank with airSlate SignNow?

airSlate SignNow prioritizes the security of your information, implementing industry-standard encryption and compliance measures. Your deed beneficiary blank and any related documents are stored securely, ensuring that only authorized users have access.

-

Can I edit a deed beneficiary blank after it's been created in airSlate SignNow?

Yes, you can easily edit a deed beneficiary blank in airSlate SignNow after it's been created. The platform allows for quick adjustments, ensuring that you can keep your documents up-to-date as your estate planning needs change.

Get more for Beneficiary Deed

- Guarantor form as attachment to lease i do

- Sample letter letter of complaintapartmentguidecom form

- Solar equipment lease agreement seia form

- Rules and regulations of apartments form

- Terms and conditions of the sample lease agreement included form

- Tenant acknowledges and admits that rent due on tenants lease is owing but unpaid and that as of the form

- Assignment of commercial lease with landlord consent ampamp guide form

- This is a uslf sample preview contents while the form

Find out other Beneficiary Deed

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free