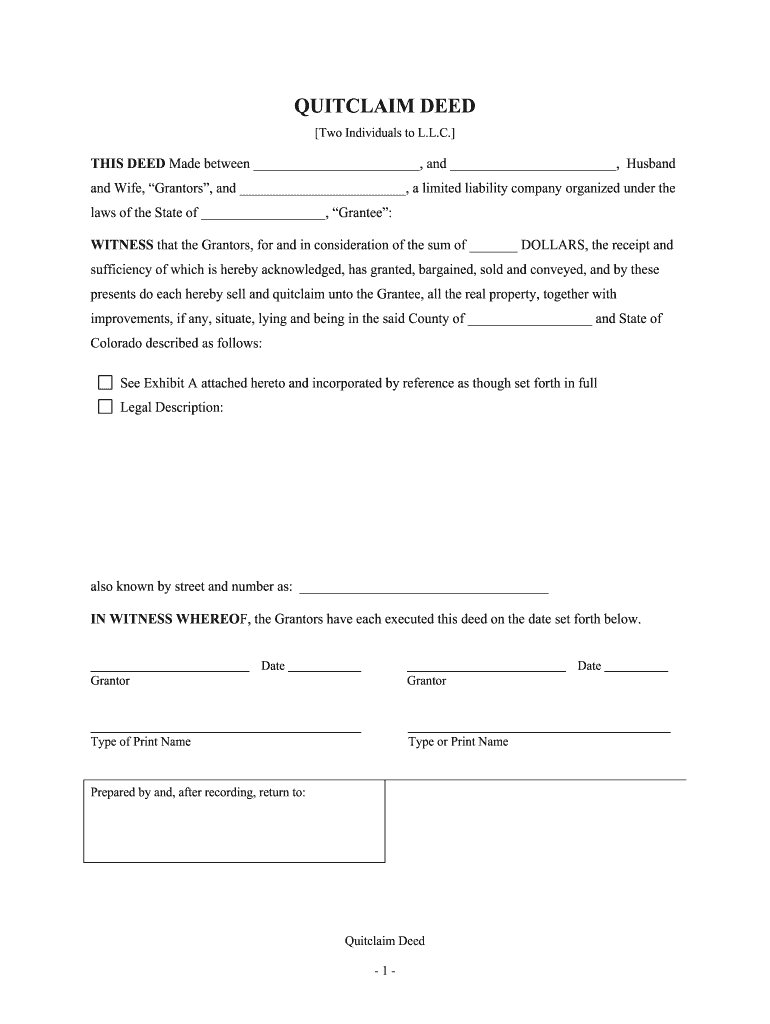

Colorado Llc Company Form

What is the Colorado Limited Company?

A Colorado limited company, often referred to as a Colorado LLC, is a popular business structure that combines the flexibility of a partnership with the liability protection of a corporation. This type of entity is recognized by the state of Colorado and provides its owners, known as members, with limited personal liability for business debts and obligations. This means that members are typically not personally responsible for the company's liabilities, protecting their personal assets from business-related risks.

How to Obtain a Colorado Limited Company

To establish a Colorado limited company, you need to follow a series of steps. First, choose a unique name for your LLC that complies with Colorado naming requirements. Next, file the Articles of Organization with the Colorado Secretary of State, which can be done online. There is a filing fee associated with this process. After your LLC is approved, you should create an operating agreement to outline the management structure and operational procedures of your company. Finally, consider obtaining any necessary licenses or permits specific to your business type and location.

Steps to Complete the Colorado Limited Company

Completing the formation of a Colorado limited company involves several key steps:

- Choose a unique name that includes "Limited Liability Company" or its abbreviations (LLC or L.L.C.).

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- File the Articles of Organization with the Colorado Secretary of State, ensuring all required information is accurate.

- Pay the required filing fee, which is typically around one hundred dollars.

- Create an operating agreement that outlines the management and operational structure of the LLC.

- Obtain any necessary business licenses or permits as required by local regulations.

Legal Use of the Colorado Limited Company

The Colorado limited company is legally recognized as a distinct entity, allowing it to enter contracts, own property, and conduct business in its own name. This legal status provides members with liability protection, meaning personal assets are generally safe from business debts. However, it is essential for members to maintain compliance with state regulations, including filing annual reports and paying any applicable taxes to uphold this legal protection.

Required Documents for a Colorado Limited Company

When forming a Colorado limited company, several documents are necessary:

- Articles of Organization: This is the primary document filed with the state to officially create the LLC.

- Operating Agreement: While not required by law, this internal document is crucial for outlining the management structure and responsibilities of members.

- Registered Agent Consent: A document that confirms the registered agent's willingness to accept legal documents on behalf of the LLC.

- Business Licenses: Depending on the nature of your business, you may need various local or state licenses.

Eligibility Criteria for a Colorado Limited Company

To form a Colorado limited company, the following eligibility criteria must be met:

- At least one member is required to form the LLC, and there is no maximum limit on the number of members.

- Members can be individuals or other business entities, including corporations and partnerships.

- The chosen name for the LLC must be distinguishable from existing entities registered in Colorado.

- The LLC must have a registered agent with a physical address in Colorado.

Quick guide on how to complete colorado llc company

Complete Colorado Llc Company effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delay. Manage Colorado Llc Company on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

How to modify and eSign Colorado Llc Company with ease

- Obtain Colorado Llc Company and click Get Form to begin.

- Utilize the tools we offer to submit your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, be it via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Colorado Llc Company and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado limited company and how does it function?

A Colorado limited company, or LLC, is a flexible business structure that offers liability protection to its owners while allowing pass-through taxation. This means that profits and losses can be reported on personal tax returns, simplifying tax obligations. LLCs are ideal for entrepreneurs seeking to protect their personal assets while maintaining operational flexibility.

-

How do I set up a Colorado limited company?

To set up a Colorado limited company, you must file Articles of Organization with the Colorado Secretary of State and pay the required filing fee. Additionally, you may need to draft an Operating Agreement, although it is not required by law. This agreement outlines the management structure and the rights and responsibilities of members.

-

What are the benefits of forming a Colorado limited company?

Forming a Colorado limited company offers numerous benefits, including liability protection for its owners, operational flexibility, and favorable tax treatment. LLCs also have fewer compliance requirements than corporations, making them an attractive option for small business owners. Furthermore, you gain credibility by establishing a formal business structure.

-

Are there any ongoing requirements for a Colorado limited company?

Yes, a Colorado limited company must adhere to ongoing requirements such as filing an Annual Report and maintaining good standing with the state. This report includes basic information about the company, and failure to file can result in penalties or dissolution. Keeping track of these obligations is essential for maintaining the benefits of your Colorado limited company.

-

What are the costs associated with forming a Colorado limited company?

The costs associated with forming a Colorado limited company primarily include the state filing fee, which is currently $50. Additionally, you may incur costs for drafting an Operating Agreement, obtaining an EIN, and any necessary licenses or permits. Overall, the financial investment in establishing a Colorado limited company is quite reasonable compared to potential liability protection.

-

Can I manage a Colorado limited company from out of state?

Yes, you can manage a Colorado limited company from out of state, as long as you comply with Colorado's regulations. It is essential to designate a registered agent with a physical address in Colorado to receive legal correspondence. This flexibility allows you to run your business effectively even while living elsewhere.

-

What features does airSlate SignNow offer for Colorado limited companies?

AirSlate SignNow provides Colorado limited companies with a seamless platform for eSigning and sending documents efficiently. Features include customizable templates, team collaboration, and secure document storage, making it easier to manage contracts and agreements. This cost-effective solution enhances productivity and offers a user-friendly experience for all business needs.

Get more for Colorado Llc Company

- Cr 770 request and order alaska form

- Growth within bounds yumpucom form

- Cr 775 statement of community work 1 06doc form

- Fillable online cr 766 dill statement regarding community work form

- Cr 776 ketch statement re community work service 11 99 criminal forms

- Cr 776 pete statement regarding community work service form

- 08 580doc form

- Juneau ak 99811 0808 form

Find out other Colorado Llc Company

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile