Transfer Declaration Estate 2005-2026

What is the Transfer Declaration Estate

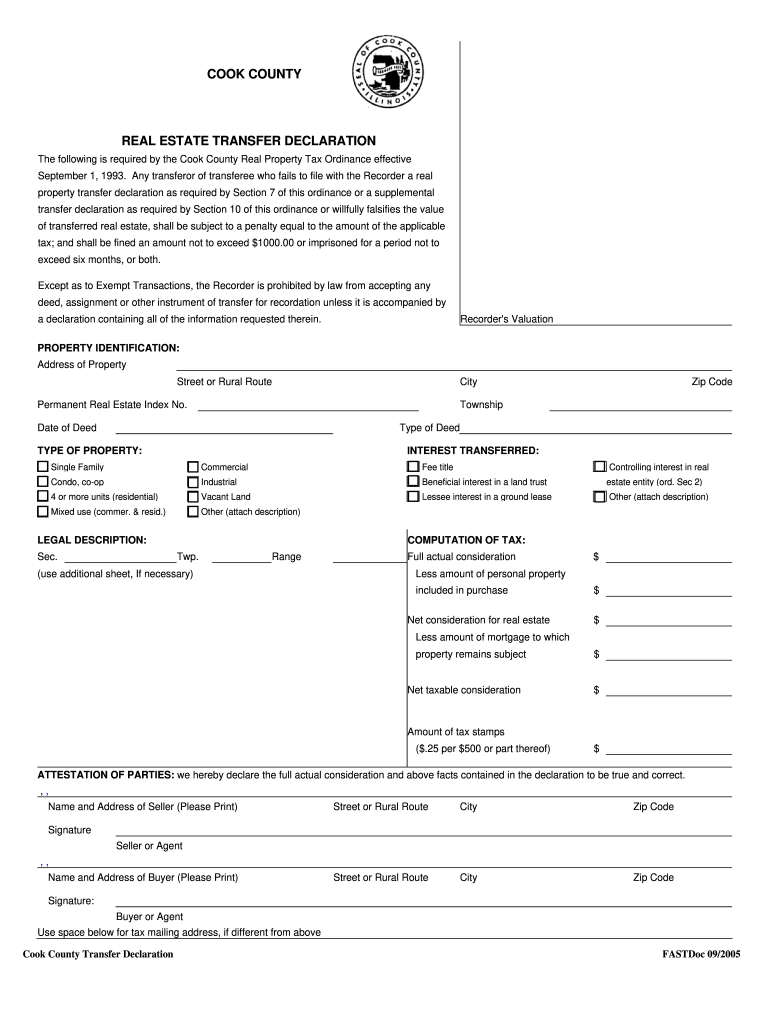

The Transfer Declaration Estate is a legal document used in Cook County, Illinois, to report the transfer of real property. This form is essential for ensuring that the transfer is accurately recorded and that any applicable transfer taxes are assessed. It includes vital information about the buyer, seller, and the property being transferred, such as the property's address, its assessed value, and the sale price. This declaration serves as a formal record that helps local authorities track real estate transactions and enforce tax regulations.

Steps to Complete the Transfer Declaration Estate

Completing the Cook County Transfer Declaration Estate involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information about both the buyer and seller, including full names and addresses. Next, obtain the property's legal description, which can usually be found in the property's deed. Fill out the form with details such as the sale price and any exemptions that may apply. After completing the form, both parties must sign it to validate the transaction. Finally, submit the completed declaration to the appropriate county office, either online or in person, to finalize the transfer.

Key Elements of the Transfer Declaration Estate

Understanding the key elements of the Transfer Declaration Estate is crucial for proper completion. Essential components include:

- Property Description: A detailed legal description of the property being transferred.

- Buyer and Seller Information: Full names and addresses of all parties involved in the transaction.

- Sale Price: The agreed-upon price for the property, which is critical for tax assessment.

- Signatures: Required signatures from both the buyer and seller to validate the form.

Legal Use of the Transfer Declaration Estate

The legal use of the Transfer Declaration Estate is governed by local laws and regulations. This document must be accurately filled out and submitted to ensure compliance with Cook County's real estate transfer tax requirements. Failure to submit the declaration can result in penalties, including fines or delays in the property transfer process. It is important to consult local regulations or a legal professional if there are any uncertainties regarding the form's completion or submission.

Form Submission Methods

The Cook County Transfer Declaration Estate can be submitted through various methods. Options include:

- Online Submission: Many counties offer electronic submission through their official websites, allowing for a quicker and more efficient process.

- Mail: Completed forms can be mailed to the appropriate county office, ensuring they are sent with sufficient time to meet any deadlines.

- In-Person: Individuals may also choose to submit the form in person at designated county offices, where staff can assist with any questions.

Required Documents

To complete the Cook County Transfer Declaration Estate, several documents may be required. These typically include:

- Proof of Identity: Identification for both the buyer and seller may be necessary to verify their identities.

- Property Deed: A copy of the property's deed provides the legal description needed for the transfer declaration.

- Sales Agreement: The purchase agreement outlines the terms of the sale and may be requested for reference.

Quick guide on how to complete real estate transfer declaration form

Perfect your t's and i's on Transfer Declaration Estate

Handling agreements, overseeing listings, coordinating meetings, and property showings—real estate professionals oscillate between a variety of responsibilities daily. Many of these responsibilities involve extensive documentation, such as Transfer Declaration Estate, that needs to be processed swiftly and as accurately as possible.

airSlate SignNow is a comprehensive solution that aids individuals in the real estate sector in alleviating the paperwork strain and allows them to focus more on their clients' goals throughout the entire negotiation journey, helping them secure the most favorable terms on the transaction.

Steps to complete Transfer Declaration Estate with airSlate SignNow:

- Access the Transfer Declaration Estate page or utilize our library's search functions to locate the form you require.

- Click Get form—you will be immediately directed to the editor.

- Begin filling out the form by selecting fillable areas and typing your information into them.

- Add new text and modify its parameters if necessary.

- Choose the Sign option in the upper toolbar to generate your electronic signature.

- Explore additional features available for annotating and enhancing your document, such as drawing, highlighting, adding shapes, etc.

- Click the comment tab and include notes related to your form.

- Conclude the process by downloading, sharing, or emailing your document to your designated users or organizations.

Bid farewell to paper permanently and simplify the home purchasing process with our intuitive and robust platform. Experience enhanced convenience when filling out Transfer Declaration Estate and other real estate documents online. Try our tool today!

Create this form in 5 minutes or less

FAQs

-

How do I fill out Form 30 for ownership transfer?

Form 30 for ownership transfer is a very simple self-explanatory document that can filled out easily. You can download this form from the official website of the Regional Transport Office of a concerned state. Once you have downloaded this, you can take a printout of this form and fill out the request details.Part I: This section can be used by the transferor to declare about the sale of his/her vehicle to another party. This section must have details about the transferor’s name, residential address, and the time and date of the ownership transfer. This section must be signed by the transferor.Part II: This section is for the transferee to acknowledge the receipt of the vehicle on the concerned date and time. A section for hypothecation is also provided alongside in case a financier is involved in this transaction.Official Endorsement: This section will be filled by the RTO acknowledging the transfer of vehicle ownership. The transfer of ownership will be registered at the RTO and copies will be provided to the seller as well as the buyer.Once the vehicle ownership transfer is complete, the seller will be free of any responsibilities with regard to the vehicle.

Create this form in 5 minutes!

How to create an eSignature for the real estate transfer declaration form

How to make an eSignature for the Real Estate Transfer Declaration Form in the online mode

How to generate an electronic signature for the Real Estate Transfer Declaration Form in Google Chrome

How to generate an eSignature for signing the Real Estate Transfer Declaration Form in Gmail

How to create an electronic signature for the Real Estate Transfer Declaration Form right from your smartphone

How to make an eSignature for the Real Estate Transfer Declaration Form on iOS devices

How to make an eSignature for the Real Estate Transfer Declaration Form on Android

People also ask

-

What is a Transfer Declaration Estate?

A Transfer Declaration Estate is a legal document required to transfer ownership of an estate or property from one party to another. This document ensures that the transfer is recorded properly and complies with relevant regulations. Understanding how to create and manage a Transfer Declaration Estate is essential for a smooth property transaction.

-

How can airSlate SignNow help with Transfer Declaration Estate documents?

airSlate SignNow simplifies the process of creating and signing Transfer Declaration Estate documents. Our platform provides customizable templates and electronic signature capabilities, making it easy to prepare, send, and eSign documents securely. This efficiency saves time and reduces the hassle associated with traditional paper processes.

-

What are the pricing options for using airSlate SignNow for Transfer Declaration Estate?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes looking to manage their Transfer Declaration Estate documents efficiently. You can choose from monthly or annual subscriptions with various features included. Visit our pricing page to find the plan that best suits your needs.

-

Are there any integrations available for managing Transfer Declaration Estate documents?

Yes, airSlate SignNow seamlessly integrates with various third-party applications to enhance the management of your Transfer Declaration Estate documents. Connect with popular tools like Google Drive, Salesforce, and more to streamline your workflow and keep all pertinent information accessible in one place.

-

What features does airSlate SignNow offer for creating Transfer Declaration Estate documents?

airSlate SignNow provides a suite of features designed to facilitate the creation of Transfer Declaration Estate documents, including customizable templates, bulk sending options, and real-time tracking of document status. These features ensure that you can manage your documents efficiently while maintaining compliance.

-

Is it secure to use airSlate SignNow for Transfer Declaration Estate transactions?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Transfer Declaration Estate documents are protected. Our platform uses advanced encryption methods and is compliant with industry standards, giving you peace of mind as you eSign and share sensitive documents.

-

Can I track the status of my Transfer Declaration Estate documents with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Transfer Declaration Estate documents in real time. You will receive notifications when documents are viewed, signed, or completed, helping you stay informed throughout the signing process.

Get more for Transfer Declaration Estate

- City oklahoma or a form

- Records department oklahoma workers compensation form

- Lessor shall be responsible for all maintenance of the grounds and improvements on the form

- The husband to settle all financial matters by mutual form

- The husband to settle all financial matters by form

- Oklahoma petition for divorce form county course hero

- Domestic relations cover sheet oklahoma fill online form

- Receipt adequacy and sufficiency of which are hereby acknowledged the assignor hereby agrees with the assignee form

Find out other Transfer Declaration Estate

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed