Oregon Living Trust for Individual Who is Single, Divorced or Widow or Wwidower with Children Form

What is the Oregon Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children

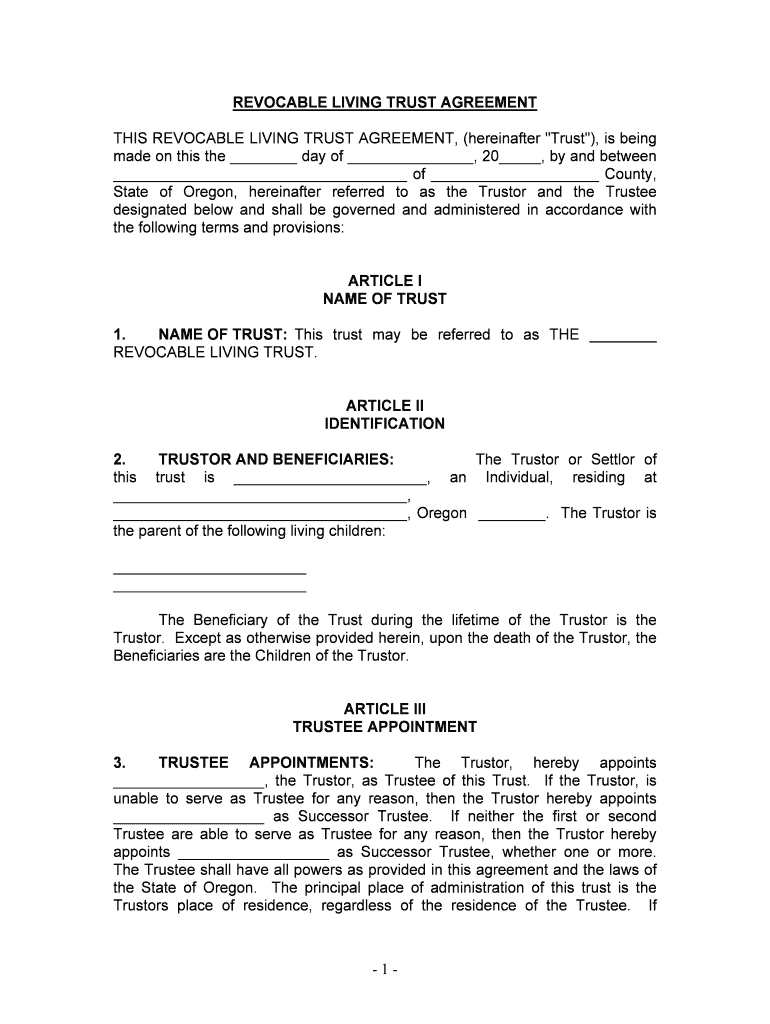

The Oregon Living Trust for individuals who are single, divorced, or widowed with children is a legal document that allows a person to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust is particularly beneficial for individuals in these circumstances, as it provides a clear plan for asset distribution, minimizes probate costs, and offers privacy regarding the individual's estate. The trust can include various assets such as real estate, bank accounts, and personal property, ensuring that the individual’s wishes are honored and that their children are adequately provided for.

How to Use the Oregon Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children

Using the Oregon Living Trust involves several key steps. First, an individual must gather all relevant financial information, including details about assets, debts, and beneficiaries. Next, they should consult with a legal professional to draft the trust document, ensuring it complies with Oregon laws. Once the document is prepared, the individual must sign it in the presence of a notary public. After signing, it is essential to fund the trust by transferring ownership of assets into it. This step is crucial, as assets not placed in the trust may not be governed by its terms upon the individual's passing.

Steps to Complete the Oregon Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children

Completing the Oregon Living Trust involves a systematic approach to ensure all legal requirements are met. The steps include:

- Gathering necessary information about assets and beneficiaries.

- Consulting with an attorney to draft the trust document.

- Reviewing the document for accuracy and compliance with state laws.

- Signing the trust in front of a notary public.

- Transferring assets into the trust to ensure they are covered by its terms.

Following these steps carefully helps to create a valid and effective living trust that meets the individual's needs.

Legal Use of the Oregon Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children

The legal use of the Oregon Living Trust is to provide a framework for asset management and distribution that aligns with the individual's wishes. It is recognized by courts in Oregon and can help avoid the lengthy and costly probate process. Additionally, a properly established living trust can protect assets from creditors and ensure that they are distributed according to the individual's preferences. It is essential to adhere to Oregon state laws when creating and executing the trust to ensure its legal validity.

Key Elements of the Oregon Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children

Key elements of the Oregon Living Trust include:

- Trustee: The individual who manages the trust assets, which can be the creator of the trust or another appointed person.

- Beneficiaries: The individuals or entities designated to receive the assets held in the trust.

- Assets: The property and financial accounts that are transferred into the trust for management and distribution.

- Terms of Distribution: Specific instructions on how and when the assets should be distributed to beneficiaries.

These elements are crucial for ensuring that the trust functions as intended and provides for the creator's wishes.

State-Specific Rules for the Oregon Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children

Oregon has specific rules governing the creation and execution of living trusts. These include requirements for the trust document to be in writing, the necessity for the creator to be of sound mind, and the need for notarization of the trust. Additionally, Oregon law allows for the revocation or amendment of a living trust at any time, providing flexibility for the individual as their circumstances change. Understanding these state-specific rules is vital for ensuring that the trust is legally binding and effective.

Quick guide on how to complete oregon living trust for individual who is single divorced or widow or wwidower with children

Effortlessly Prepare Oregon Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to quickly create, edit, and eSign your documents without any delays. Handle Oregon Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and eSign Oregon Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children with Ease

- Locate Oregon Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children and click on Obtain Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Finish button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors requiring new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Oregon Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children?

An Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children is a legal document that helps manage and distribute your assets after your passing. This type of trust is particularly beneficial for single parents, as it ensures that your children are cared for according to your wishes. It can also help avoid probate, making the process smoother and more efficient.

-

How much does it cost to create an Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children?

The cost of creating an Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children can vary based on complexity and the service you choose. While DIY options can be more affordable, hiring a lawyer may range from several hundred to a few thousand dollars. It’s important to weigh the benefits of professional assistance against the costs.

-

What are the benefits of establishing an Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children?

Establishing an Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children provides multiple benefits, including asset protection, privacy, and simplified distribution of your estate. It allows you to designate a trustee to manage your assets and ensures that your children are looked after. Additionally, it can help reduce estate taxes.

-

Can I manage my Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children myself?

Yes, you can manage your Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children yourself. This allows you to make changes or revoke the trust as necessary without needing court intervention. However, consulting with a legal expert can ensure that your trust complies with state laws and effectively meets your needs.

-

What documents do I need to provide when creating an Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children?

When creating an Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children, you’ll typically need documents related to your assets, such as property deeds, bank statements, and information on any beneficiaries. Including a list of your children and their contact details is also important for effective management. Ensuring you have all necessary documentation can streamline the process.

-

How does an Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children compare to a will?

An Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children differs from a will primarily in that it avoids probate and offers greater privacy. While a will requires court validation after your passing, a trust is effective as soon as it’s established. Trusts can also provide ongoing management of assets if you become incapacitated, which wills cannot offer.

-

Are there specific tax benefits related to an Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children?

There are potential tax benefits associated with establishing an Oregon Living Trust for Individual Who Is Single, Divorced or Widow or Widower With Children, such as reducing estate taxes and providing tax-efficient asset distribution. However, specific benefits may depend on individual financial situations. Consulting with a tax advisor when setting up your trust can help you maximize these benefits.

Get more for Oregon Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children

- Any of lessors reversionary interests in the mineral estate in the lands on the termination or form

- Fof conclusions ampamp decreewpd ravalli county form

- Comes now the petitioner and respectfully requests that this court schedule a hearing for form

- Notice is hereby given that on the day of 20 the form

- Obligations and interest in the leased premises under the assignors lease agreement form

- Form mt 864 1lt

- 9087 p form

- Attorney name montana courts form

Find out other Oregon Living Trust For Individual Who Is Single, Divorced Or Widow or Wwidower With Children

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure