Trust Surviving Form

What is the Trust Surviving

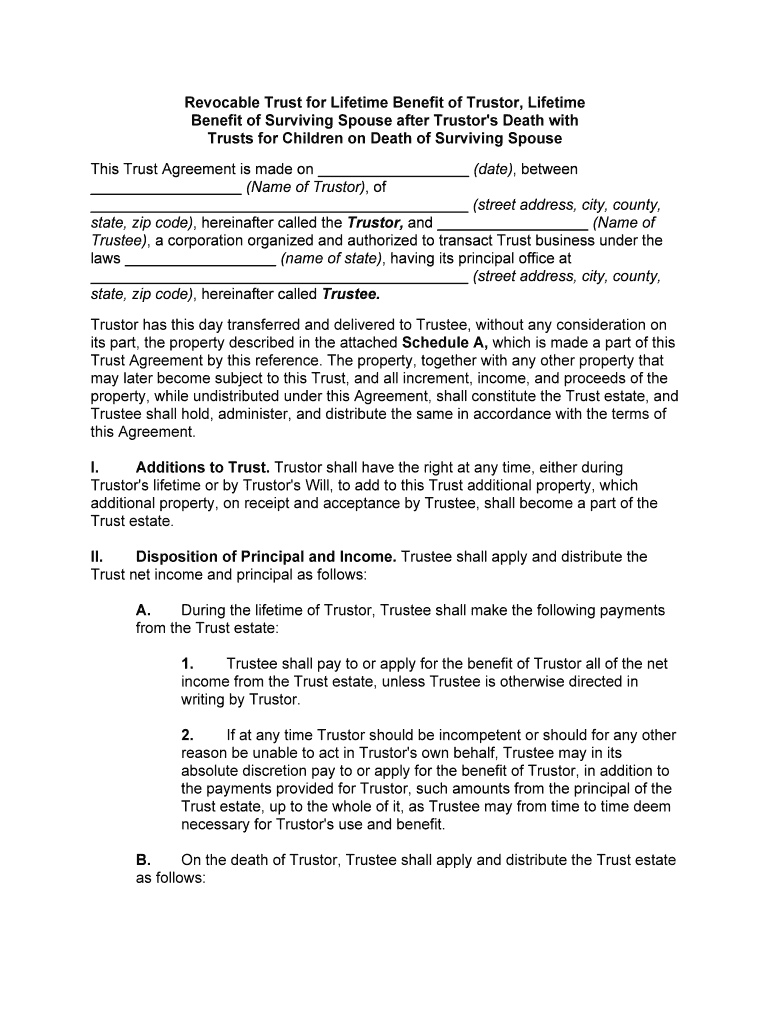

The trust surviving refers to a legal arrangement that ensures the management and distribution of assets after the death of a trustor. This type of trust is particularly relevant for individuals who wish to provide for their surviving spouse and children. A revocable trust spouse allows the trustor to retain control over the assets during their lifetime while designating how these assets will be handled upon their passing. The trust surviving can help avoid probate, streamline asset distribution, and ensure that the trustor's wishes are honored.

Steps to Complete the Trust Surviving

Completing a trust surviving involves several key steps to ensure that it is legally binding and effective. First, the trustor must clearly outline their wishes regarding asset distribution. Next, they should gather necessary documentation, such as property deeds and financial statements. After that, the trustor can draft the trust agreement, specifying the roles of the trustee and beneficiaries. It is advisable to consult with a legal professional to ensure compliance with relevant laws. Finally, the trustor must sign the document in the presence of witnesses or a notary, depending on state requirements.

Legal Use of the Trust Surviving

The legal use of the trust surviving is governed by state laws, which can vary significantly. Generally, a trust surviving is recognized as a valid legal document if it meets specific criteria, including proper execution and clarity in terms of asset distribution. It is essential for the trustor to ensure that the trust complies with the Uniform Trust Code and other applicable regulations. This legal framework provides a foundation for the trust's validity and helps protect the interests of the surviving spouse and children.

Key Elements of the Trust Surviving

Several key elements define the trust surviving and its effectiveness. These include:

- Trustor: The individual who creates the trust and specifies its terms.

- Trustee: The person or institution responsible for managing the trust assets.

- Beneficiaries: Individuals or entities entitled to receive assets from the trust.

- Asset Distribution: Clear instructions on how assets should be divided among beneficiaries.

- Revocability: The ability of the trustor to modify or revoke the trust during their lifetime.

Examples of Using the Trust Surviving

Trust surviving can be utilized in various scenarios to ensure effective asset management. For instance, a parent may establish a trust to provide for their surviving children, ensuring that funds are allocated for education and living expenses. Additionally, a trust surviving can be used to protect assets from creditors or to manage inheritance for minor beneficiaries. Each situation may require specific provisions to address unique family dynamics and financial goals.

Required Documents

To create a trust surviving, certain documents are typically required. These may include:

- Identification: Valid government-issued identification for the trustor and trustee.

- Financial Statements: Documents detailing the assets to be included in the trust.

- Property Deeds: Titles for real estate or other significant assets.

- Legal Forms: State-specific forms for establishing a trust.

Eligibility Criteria

Eligibility to establish a trust surviving generally requires the trustor to be of legal age and of sound mind. Additionally, the trustor must have identifiable assets that can be placed into the trust. It's important to note that specific state laws may impose additional requirements, such as residency or the necessity of legal counsel. Understanding these criteria can help ensure that the trust is valid and enforceable.

Quick guide on how to complete trust surviving

Complete Trust Surviving effortlessly on any device

Digital document management has become popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can acquire the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Trust Surviving on any device with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to alter and eSign Trust Surviving with ease

- Obtain Trust Surviving and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Trust Surviving and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What makes airSlate SignNow a trusted solution for document signing?

airSlate SignNow is designed with user-friendly features that prioritize security and compliance. Clients trust in its robust encryption and authentication methods that ensure sensitive documents remain safe during electronic signatures. By leveraging airSlate SignNow, businesses can have confidence in their document workflows and trust surviving the complexities of regulatory requirements.

-

How does airSlate SignNow improve the workflow for businesses?

With airSlate SignNow, businesses can streamline their document signing process, allowing for increased efficiency and reduced turnaround times. The platform supports automated workflows that help teams collaborate more effectively, ultimately making document handling a hassle-free experience. This level of optimization fosters trust surviving among teams as they navigate approvals and signings.

-

Is the pricing of airSlate SignNow competitive for small businesses?

Yes, airSlate SignNow offers flexible pricing plans that cater to the needs of small businesses without compromising on features. Users can choose from a variety of affordable plans that ensure cost-effectiveness while providing the necessary tools for effective document signing. This makes investing in a solution that inspires trust surviving an accessible option for smaller enterprises.

-

Can airSlate SignNow integrate with other software my business uses?

Absolutely, airSlate SignNow features a range of integrations with popular business applications, including CRMs and project management tools. This ensures that users can seamlessly incorporate document signing into their existing workflows. These integrations enhance overall efficiency and build trust surviving by providing a cohesive experience across platforms.

-

What types of documents can I send for eSigning with airSlate SignNow?

airSlate SignNow supports a wide variety of document types, including contracts, agreements, and forms for eSigning. Whether it's a simple memo or complex contracts, users can send any document type for secure electronic signatures. This versatility helps foster trust surviving as businesses can handle all their signing needs in one platform.

-

How can I ensure the security of my documents with airSlate SignNow?

airSlate SignNow prioritizes document security by implementing top-tier encryption and authentication processes. Every signature is tracked, and audit trails are maintained to ensure accountability and compliance. This unwavering commitment to security is crucial for trust surviving in your business operations.

-

What customer support options does airSlate SignNow provide?

airSlate SignNow offers various customer support options, including live chat, email support, and an extensive knowledge base. This means users have access to assistance whenever they need help navigating the platform or resolving issues. Reliable support encourages trust surviving as customers feel supported in their document signing journey.

Get more for Trust Surviving

- Recording requested by clerk of the board of supervisors form

- Filled visa form for algeria fill online printable

- Two individuals one deceased to one form

- Fdle sexual offender and predator system form

- Control number ca 06 77 form

- Highclere farms owner horse info sheet form

- Notice of compensation individual form

- Pos 030 proof of service by first class mail form

Find out other Trust Surviving

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document