Arizona Deed Beneficiary Form

What is the Arizona Deed Beneficiary

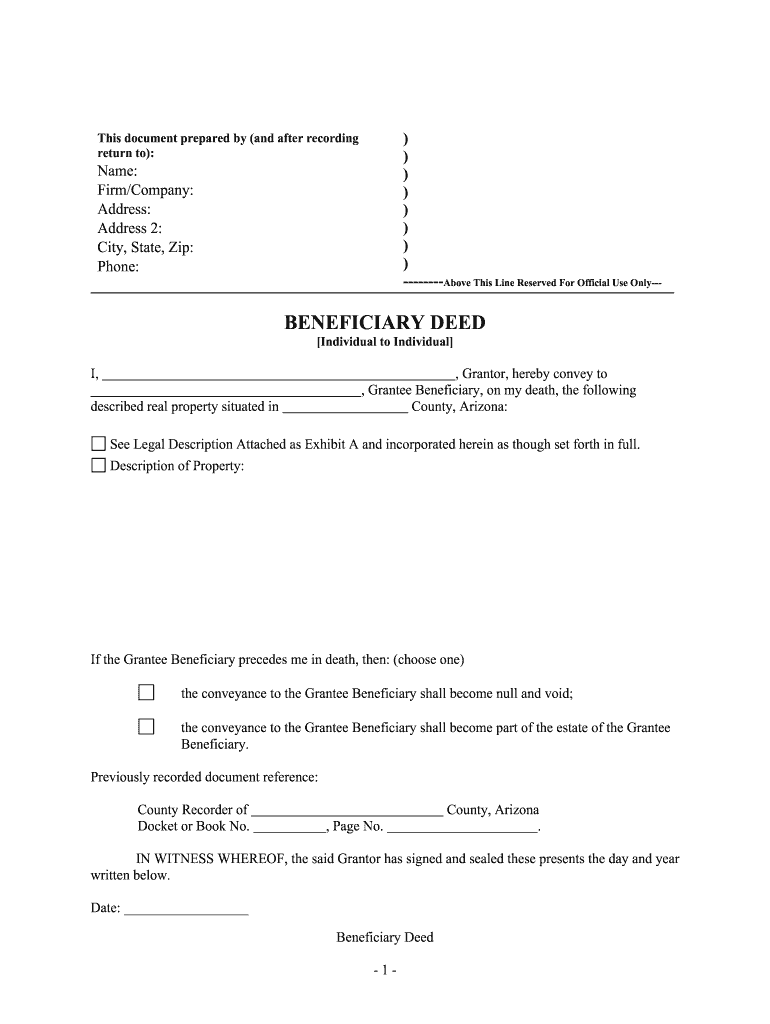

The Arizona deed beneficiary refers to a legal instrument that allows property owners to designate one or more beneficiaries to inherit their property upon their death, without the need for probate. This form is often referred to as a transfer on death (TOD) deed. By completing this document, property owners can ensure that their assets are transferred directly to their chosen beneficiaries, streamlining the process and reducing potential legal complications.

Steps to Complete the Arizona Deed Beneficiary

Completing the Arizona beneficiary deed involves several important steps to ensure that the document is legally valid and accurately reflects the property owner's wishes. Here are the key steps:

- Identify the property: Clearly describe the property being transferred, including its legal description.

- Choose beneficiaries: Select one or more individuals or entities to receive the property upon the owner's death.

- Complete the form: Fill out the Arizona beneficiary form with the necessary details, ensuring all information is accurate.

- Sign the document: The property owner must sign the deed in the presence of a notary public to validate the document.

- Record the deed: Submit the completed deed to the appropriate county recorder's office to make it effective.

Legal Use of the Arizona Deed Beneficiary

The Arizona deed beneficiary is legally recognized under Arizona law, allowing property owners to transfer ownership automatically upon death. This legal framework is designed to bypass the probate process, which can be lengthy and costly. To ensure compliance with state laws, it is crucial that the form is executed correctly, including proper notarization and recording.

Key Elements of the Arizona Deed Beneficiary

Several key elements must be included in the Arizona beneficiary deed to ensure its validity:

- Grantor information: The full name and address of the property owner.

- Beneficiary details: Names and addresses of the designated beneficiaries.

- Property description: A complete legal description of the property being transferred.

- Signature and notarization: The grantor's signature must be notarized to validate the deed.

- Recording: The deed must be recorded with the county recorder's office to be effective.

Who Issues the Form

The Arizona beneficiary form is typically not issued by a specific agency but is a document that property owners can create or obtain through legal resources. Many legal websites, attorneys, and real estate professionals provide templates for the Arizona deed beneficiary. It is advisable to consult with a legal expert to ensure that the form meets all legal requirements and accurately reflects the owner's intentions.

Required Documents

To complete the Arizona beneficiary deed, the following documents are typically required:

- The Arizona beneficiary deed form, properly filled out.

- A valid form of identification for the grantor, such as a driver's license or passport.

- Any existing property deeds or documents that establish ownership.

Eligibility Criteria

To use the Arizona beneficiary deed, the property owner must meet certain eligibility criteria:

- The property must be located in Arizona.

- The owner must be of legal age and mentally competent to execute the deed.

- The property must not be subject to any liens or encumbrances that would prevent transfer.

Quick guide on how to complete arizona deed beneficiary

Complete Arizona Deed Beneficiary effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage Arizona Deed Beneficiary on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Arizona Deed Beneficiary with ease

- Find Arizona Deed Beneficiary and click Get Form to begin.

- Utilize the tools we provide to fill in your form.

- Select relevant sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign Arizona Deed Beneficiary to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Arizona beneficiary form and why is it important?

An Arizona beneficiary form is a legal document that allows individuals to designate beneficiaries for their assets, ensuring a clear transfer of ownership upon their passing. This form is crucial for estate planning as it helps avoid probate, simplifies asset distribution, and provides peace of mind to the individuals involved.

-

How can airSlate SignNow help with the Arizona beneficiary form?

airSlate SignNow streamlines the process of completing and sending your Arizona beneficiary form electronically. Our platform empowers you to eSign documents securely, reducing paperwork and making it easier to manage your estate planning documents from anywhere, at any time.

-

Is there a cost associated with using airSlate SignNow for the Arizona beneficiary form?

airSlate SignNow offers competitive pricing for its services, including the ability to handle the Arizona beneficiary form. Users can choose from various subscription plans based on their needs, ensuring cost-effective solutions for both individuals and businesses managing multiple documents.

-

What features does airSlate SignNow provide for managing my Arizona beneficiary form?

airSlate SignNow provides features like customizable templates, secure eSigning, and automated workflows specifically designed to simplify the handling of your Arizona beneficiary form. Additionally, our user-friendly interface makes it easy for anyone to navigate and complete their documents efficiently.

-

Can I access my Arizona beneficiary form on mobile devices?

Yes, you can access your Arizona beneficiary form through the airSlate SignNow mobile app. This feature allows you to manage, sign, and send your documents on-the-go, providing flexibility and convenience for users who are often away from their desks.

-

Does airSlate SignNow integrate with other tools for managing documents?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enhancing the management of your Arizona beneficiary form. This compatibility allows users to sync their work across platforms, making it easier to share and collaborate on essential documents.

-

What security measures are in place for the Arizona beneficiary form on airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and secure cloud storage to protect your Arizona beneficiary form and other sensitive documents, ensuring that your information remains confidential and safe from unauthorized access.

Get more for Arizona Deed Beneficiary

- Public works california department of industrial relations form

- Free dwc ca form 10214 a reset form findformscom

- Internal use only united states court of appeals for the form

- Name address of party or attorney us legal forms

- California attorneys fees cases retainer agreements form

- Complaint for rescission form

- Attorney or party without attorney nicolaserosdefiori form

- Judgment of default and permanent injunction form

Find out other Arizona Deed Beneficiary

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement