Chime Bank Direct Deposit Form

What is the Chime Bank Direct Deposit Form

The Chime Bank Direct Deposit Form is a crucial document that allows individuals to authorize their employers or other payment sources to deposit funds directly into their Chime bank accounts. This process simplifies the payment experience, ensuring that funds are available immediately without the need for physical checks. By using this form, users can set up direct deposits for various types of payments, including salaries, government benefits, and other recurring payments.

How to use the Chime Bank Direct Deposit Form

Using the Chime Bank Direct Deposit Form is straightforward. First, users need to fill out the form with their personal information, including their name, address, and Chime account details. This typically includes the Chime number and routing number. Once completed, the form should be submitted to the employer or payment provider. It is essential to ensure that all information is accurate to avoid any delays in receiving funds.

Steps to complete the Chime Bank Direct Deposit Form

Completing the Chime Bank Direct Deposit Form involves several key steps:

- Gather necessary information, such as your Chime account number and routing number.

- Fill in personal details, including your full name and address.

- Indicate the type of deposit, whether it is for salary, benefits, or other payments.

- Review the information for accuracy to prevent any issues with the deposit.

- Submit the completed form to your employer or payment provider.

Legal use of the Chime Bank Direct Deposit Form

The Chime Bank Direct Deposit Form is legally binding once signed and submitted. It complies with federal regulations governing direct deposits, ensuring that funds are transferred securely and efficiently. Users should ensure that they understand the terms of the direct deposit agreement and keep a copy of the completed form for their records. This documentation may be necessary for future reference or in case of disputes.

Key elements of the Chime Bank Direct Deposit Form

Several key elements must be included in the Chime Bank Direct Deposit Form to ensure its effectiveness:

- Personal Information: Full name, address, and contact details.

- Chime Account Information: Chime account number and routing number.

- Deposit Type: Specify whether the deposit is for salary, benefits, or other payments.

- Signature: A signature is required to authorize the direct deposit.

How to obtain the Chime Bank Direct Deposit Form

Obtaining the Chime Bank Direct Deposit Form is simple. Users can download the form directly from the Chime website or request it from their employer or payment provider. It is important to ensure that the most current version of the form is used to avoid any compliance issues. If needed, users can also contact Chime customer service for assistance in acquiring the form.

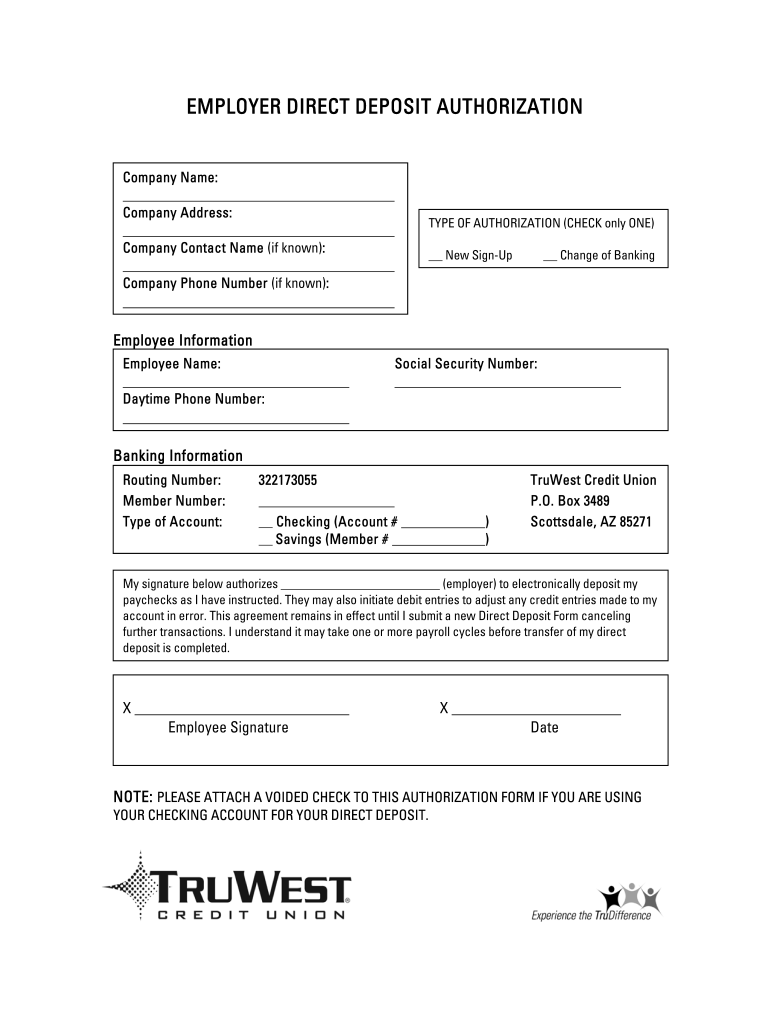

Quick guide on how to complete direct deposit form truwest credit union truwest

The simplest method to locate and endorse Chime Bank Direct Deposit Form

On a broad scale throughout a business, ineffective procedures concerning paper approvals can consume a signNow amount of work hours. Signing papers like Chime Bank Direct Deposit Form is an inherent aspect of operations in any sector, which is why the effectiveness of every agreement’s lifecycle signNowly impacts the organization’s overall performance. With airSlate SignNow, endorsing your Chime Bank Direct Deposit Form is as straightforward and quick as possible. This platform provides the latest version of nearly any document. Even better, you can sign it instantly without the need for installing additional software on your computer or printing out hard copies.

How to obtain and endorse your Chime Bank Direct Deposit Form

- Explore our collection by category or utilize the search feature to find the document you require.

- Check the document preview by clicking on Learn more to confirm it is the correct one.

- Click Get form to start editing immediately.

- Fill out your document and include any essential information using the toolbar.

- When finished, click the Sign tool to endorse your Chime Bank Direct Deposit Form.

- Choose the signature method that is most suitable for you: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to finalize editing and move on to document-sharing options as necessary.

With airSlate SignNow, you possess everything required to handle your documents effectively. You can locate, complete, modify, and even send your Chime Bank Direct Deposit Form in one window without difficulty. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Is it fishy if a company wants you to fill out the direct deposit form before you receive any paper work about being hired?

Hi, To give a little more context, if you are worried about completing a direct deposit form, which should be for receiving remuneration of your wages, then request a your employment contract and tell them you will complete the direct deposit form after the employment has been received. Always be open and honest with a potential em0ployer and set parameters for your employment relationship from the get go. you would like to follow procedures. Every Employer will respect you more for that. I do not think it is fishy but a little odd

-

How can I get an installment loan to get out of debt? I owe taxes and 2 payday loans. I only make about $700 every 2 weeks and only pay for rent which is $790 a month. I also have no credit and no car and no direct deposit to my bank.

The payday loan debt trap is a very common experience for many payday loan borrowers, but there are a number of ways that borrowers are able to climb out,” according to Liana Molina, director of community engagement with California Reinvestment Coalition.Below are some steps you should take to take care of your payday debt, pay it off, and eventually get out of the payday loan trap.How to get out of payday loan debtReview all your debts togetherWhen you try to figure out payday loans, it is possible to get hyper-focused on the amount you need to pay. For instance, how to come up with the exact $375 you owe by your next due date.But if you take a look at your whole financial picture, it is possible you will find other opportunities to save or repay this debt.“The starting point should always be to build a comprehensive picture of your debt, including all loans, credit cards, etc.,” according to Barry Stewart, an insolvency expert with 180 Advisory Solutions. “Make sure you record both amounts and interest rates on each.”Prioritize high-interest debtsOnce you know what debt you owe, to whom, and how much each debt will cost you, you are able to can prioritize your payments.“Prioritize the debt with the highest interest rate,” Stewart says. “Paying off those first and then moving onto debt with lower interest rates cuts the total you’ll end up paying.”With fees that are equal to three-digit APRs, payday loans will most likely to be your most expensive debts. Worse still, you only have until your next paycheck to produce the full balance – or you’ll likely face fees to renew the loan.To eliminate a payday loan completely, you need to either restructure the debt or figure out how to come up with the full amount as quickly as possible.signNow out for an extended payment planWe understand that the way payday lenders structure payday loans makes them expensive and difficult to repay. That said, try and find a way to restructure your payday debt.“You can ask to negotiate a payment plan with your lender,” Molina recommends.Ask your payday lender if you can get on an extended payment plan(EPP), which will break your loan up into smaller installmental payments. With this, you’ll have more time to repay the loan, and you won’t be hit with those worrisome additional fees or interest in the meantime.Payday lenders that belong to the Community Financial Services Association of America (CFSAA) tend to be more flexible and will usually give you an EPP. Just remember that you’ll need to ask before closing on the last business day before your loan is due.It’s possible, you’ll also most likely sign a new loan agreement with the terms of your extended payment plan. So do well to read it carefully and understand the full terms before you agree.Refinance with a personal loanIf your payday lender is not part of the CFSAA or proves unwilling to give you an EPP, I would encourage you to consider going elsewhere for money to cover this debt.For instance, it is possible you can try payday loan debt consolidation with a personal loan. Please bear in mind that you’ll need at least fair credit inorder to qualify for most personal loans. Some online lending platforms, such as Avant, usually accept loan applicants with credit scores as low as 580.If you possess a credit card, you should also try getting a cash advance on the card to repay your payday loan. Please exercise caution since credit card debt is also high-interest debt. Plus, having high credit card balances can damage your credit.Related Post: How to Remove a Cosginer from a Student LoanGet a credit union payday alternative loanRead more: Comprehensive Guide on how to Break Out of the Payday Loan Debt Cycle

Create this form in 5 minutes!

How to create an eSignature for the direct deposit form truwest credit union truwest

How to generate an electronic signature for the Direct Deposit Form Truwest Credit Union Truwest in the online mode

How to create an electronic signature for the Direct Deposit Form Truwest Credit Union Truwest in Chrome

How to make an eSignature for putting it on the Direct Deposit Form Truwest Credit Union Truwest in Gmail

How to make an electronic signature for the Direct Deposit Form Truwest Credit Union Truwest straight from your mobile device

How to make an eSignature for the Direct Deposit Form Truwest Credit Union Truwest on iOS

How to generate an eSignature for the Direct Deposit Form Truwest Credit Union Truwest on Android

People also ask

-

What is the Chime direct deposit form and how do I use it?

The Chime direct deposit form is a document that allows you to set up direct deposits into your Chime account. To use it, fill out the necessary details such as your account number and routing number, and submit the form to your employer or any other entity that will send you funds. It's a fast and secure way to receive payments directly.

-

How can airSlate SignNow help with signing the Chime direct deposit form?

airSlate SignNow makes it easy to electronically sign the Chime direct deposit form securely online. You can quickly upload the form, add your signature, and send it directly to your employer without the need for printing or scanning. This streamlines the process, saving you time and hassle.

-

Is there a fee associated with using the Chime direct deposit form?

Using the Chime direct deposit form itself is free, as Chime does not charge for setting up direct deposits. However, if you want to use a service like airSlate SignNow to sign the form electronically, there may be subscription costs involved. It’s important to review pricing options tailored to your needs.

-

What are the benefits of using the Chime direct deposit form?

The Chime direct deposit form allows for faster payment processing, meaning your funds can be available sooner than traditional methods. Direct deposits are also more secure, reducing the risk of lost or stolen checks. Using airSlate SignNow adds further convenience by enabling fast and secure electronic signatures.

-

Can I integrate the Chime direct deposit form with other software?

Yes, airSlate SignNow supports integration with various platforms, allowing you to manage your Chime direct deposit form alongside other financial tools. This seamless integration helps keep your processes organized and boosts workflow efficiency. Check for specific integrations available on airSlate’s platform.

-

What information do I need to provide on the Chime direct deposit form?

To complete the Chime direct deposit form, you will need to provide your Chime account number, routing number, and relevant personal information like your name and address. This ensures that your direct deposits are processed correctly and linked to your account. Always double-check for accuracy to avoid delays.

-

How quickly can I start receiving funds after submitting the Chime direct deposit form?

Once you submit the Chime direct deposit form, it may take one to two pay cycles for the direct deposit to start. The timing can depend on your employer's payroll system and processing times. However, once set up, you'll enjoy a seamless payment process going forward.

Get more for Chime Bank Direct Deposit Form

Find out other Chime Bank Direct Deposit Form

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer