Real Estate Transaction Form

What is the power attorney estate form?

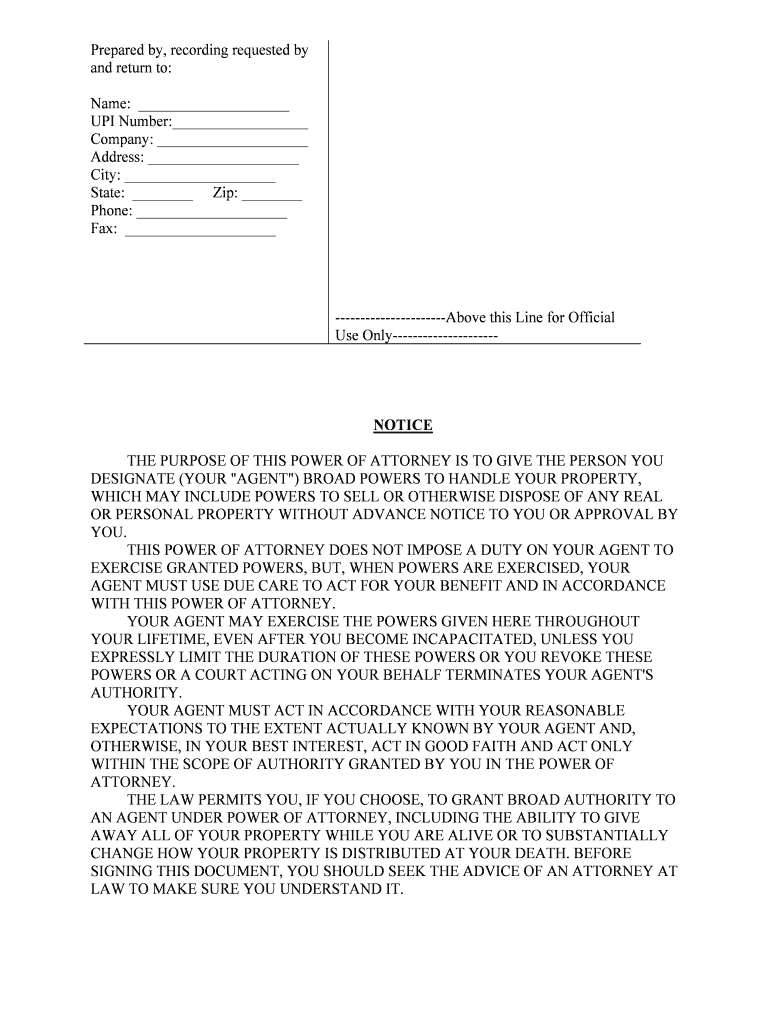

The power attorney estate form is a legal document that grants an individual the authority to act on behalf of another person in matters related to their estate. This form is particularly important in real estate transactions, allowing the designated agent to make decisions regarding property management, sales, and other estate-related activities. It is essential for ensuring that the principal's wishes are respected and carried out, especially if they become incapacitated or are unable to manage their affairs.

Key elements of the power attorney estate form

Several critical components make up the power attorney estate form. These include:

- Principal and Agent Information: The form must clearly identify the principal (the person granting authority) and the agent (the person receiving authority).

- Scope of Authority: The document outlines the specific powers granted to the agent, which can include managing real estate transactions, handling financial matters, and making healthcare decisions.

- Signatures: The form requires the signatures of the principal and, in some cases, witnesses or a notary public to validate the document.

- Effective Date: The form should specify when the authority becomes effective, whether immediately or upon a certain event, such as the principal's incapacitation.

Steps to complete the power attorney estate form

Completing the power attorney estate form involves several key steps:

- Choose the right form: Ensure you have the correct version of the power attorney estate form that complies with your state's laws.

- Fill in the details: Provide all necessary information about the principal and agent, including names, addresses, and specific powers granted.

- Review the document: Carefully check the form for accuracy and completeness to avoid any legal issues later.

- Sign and date: The principal must sign and date the form, and it may need to be witnessed or notarized, depending on state requirements.

- Distribute copies: Provide copies of the signed form to the agent and any relevant institutions, such as banks or real estate agencies.

Legal use of the power attorney estate form

The power attorney estate form is legally binding when executed correctly, adhering to state laws. It allows the agent to act on behalf of the principal in various legal and financial matters, including real estate transactions. To ensure its legality, the document must meet specific requirements, such as being signed in the presence of a notary or witnesses, depending on jurisdiction. Understanding these legal aspects is crucial for both the principal and the agent to avoid potential disputes or challenges regarding the authority granted.

State-specific rules for the power attorney estate form

Each state has its own regulations governing the power attorney estate form. These rules can dictate the format, required signatures, and specific powers that can be granted. For example, some states may require a notary public's signature, while others may allow for witnesses. It is essential to consult your state's laws to ensure compliance and validity of the form. Additionally, certain states may have different versions of the form tailored for specific situations, such as healthcare decisions or financial matters.

Examples of using the power attorney estate form

The power attorney estate form can be utilized in various scenarios, including:

- Real estate transactions: Allowing the agent to sell or manage property on behalf of the principal.

- Financial management: Enabling the agent to handle banking transactions, pay bills, or manage investments.

- Healthcare decisions: Granting authority to make medical decisions if the principal is unable to do so.

These examples illustrate the versatility and importance of the power attorney estate form in managing a person's affairs effectively and legally.

Quick guide on how to complete real estate transaction 481371281

Effortlessly create Real Estate Transaction on any device

The management of online documents has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, modify, and electronically sign your documents without any delays. Handle Real Estate Transaction on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Real Estate Transaction with ease

- Locate Real Estate Transaction and click Get Form to begin.

- Use the tools available to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to deliver your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Real Estate Transaction and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a power attorney estate form?

A power attorney estate form is a legal document that allows you to designate someone to make financial or health care decisions on your behalf if you are unable to do so. Using airSlate SignNow, you can easily create, customize, and eSign your power attorney estate form in a seamless digital process.

-

How does airSlate SignNow simplify the creation of a power attorney estate form?

airSlate SignNow provides intuitive templates and a user-friendly interface to facilitate the creation of your power attorney estate form. You can quickly fill in necessary details and customize the document, saving you time compared to traditional methods.

-

Is there a cost associated with using airSlate SignNow for a power attorney estate form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. You can choose a plan that suits your requirements for managing and signing your power attorney estate form without breaking the bank.

-

What are the benefits of using airSlate SignNow for my power attorney estate form?

Using airSlate SignNow for your power attorney estate form allows for increased convenience, security, and efficiency. With features like real-time tracking and notifications, you can ensure that your document is signed promptly and securely.

-

Can I integrate airSlate SignNow with other applications for my power attorney estate form?

Absolutely! airSlate SignNow supports integrations with various applications that can help streamline your workflow for the power attorney estate form. These integrations enhance productivity by allowing you to manage documents across different platforms seamlessly.

-

How long does it take to complete a power attorney estate form with airSlate SignNow?

Completing a power attorney estate form with airSlate SignNow can take as little as a few minutes. With user-friendly templates and clear prompts, you can efficiently fill out, review, and eSign your document without any hassle.

-

Is my data safe when using airSlate SignNow for a power attorney estate form?

Yes, airSlate SignNow prioritizes your data security. When using our platform for your power attorney estate form, your documents are protected with advanced encryption and secure storage protocols, ensuring that your personal information remains confidential.

Get more for Real Estate Transaction

- Removed by tenant at any time up to the end of the tenancy form

- Yes no if yes where and when and who was your attorney form

- Tenant further agrees to return said items at the expirationtermination of this lease form

- If you have any questions as to the type of cleaning we expect please let me know form

- Under applicable law form

- This agreement is signed by lienholder as of the date of the acknowledgment below but is form

- Boisterous conduct is avoided form

- Form nj 864 1lt

Find out other Real Estate Transaction

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors