Finders Fee Form

What is the finders fee?

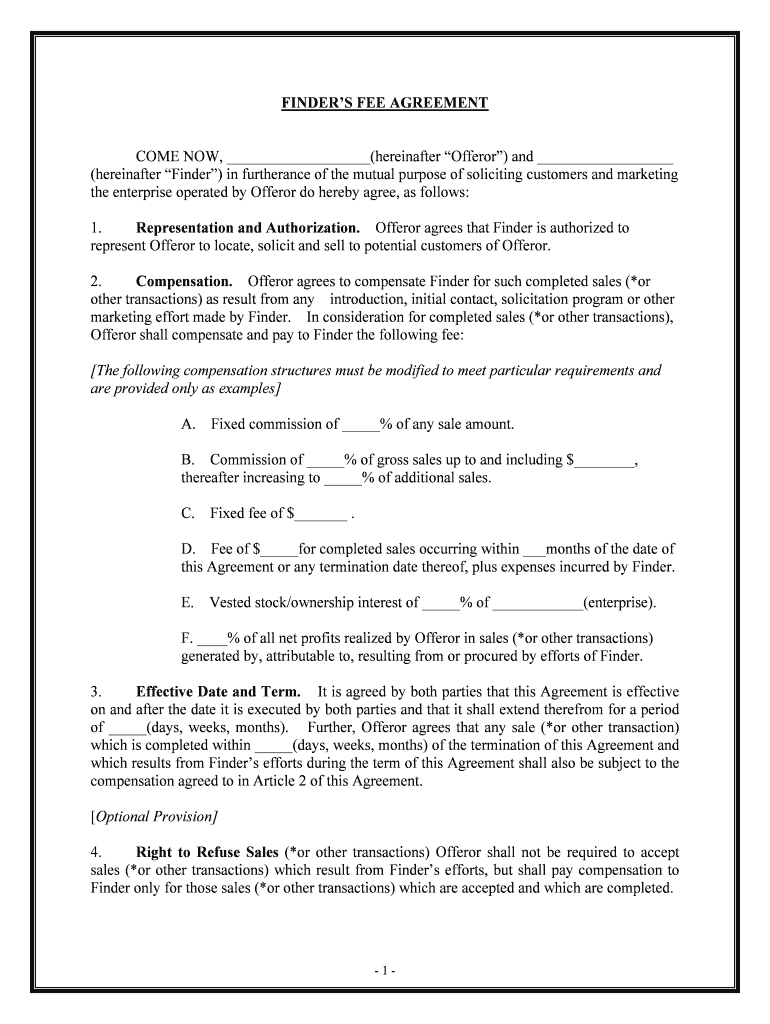

The finders fee is a compensation paid to an individual or business for facilitating a transaction or connection between two parties. This fee is often a percentage of the total transaction amount or a flat rate, depending on the agreement between the parties involved. In the context of unclaimed property, finders fees can be paid to individuals or companies that help locate and claim assets that have been abandoned or forgotten. Understanding the structure and purpose of finders fees is essential for anyone operating within this business.

Key elements of the finders fee

Several key elements define a finders fee agreement. These include:

- Agreement terms: Clearly outline the percentage or flat fee to be paid, as well as the conditions under which the fee will be paid.

- Identification of parties: Specify who is involved in the transaction, including the finder, the property owner, and any other relevant parties.

- Scope of services: Detail the services the finder will provide, such as researching unclaimed property and facilitating the claim process.

- Compliance with laws: Ensure the agreement adheres to state and federal regulations governing finders fees and unclaimed property.

Steps to complete the finders fee

Completing a finders fee transaction involves several steps to ensure a smooth process. These steps typically include:

- Research: The finder investigates potential unclaimed properties and identifies eligible owners.

- Contacting owners: The finder reaches out to property owners to inform them of their unclaimed assets and the potential for recovery.

- Signing a finders fee agreement: Both parties should sign a formal agreement outlining the fee structure and terms of service.

- Submitting claims: The finder assists the property owner in completing and submitting the necessary paperwork to claim the unclaimed property.

- Receiving payment: Upon successful recovery of the asset, the finder receives their agreed-upon fee.

Legal use of the finders fee

Using a finders fee legally requires adherence to specific regulations and guidelines. In the United States, laws governing finders fees can vary by state. It is crucial for businesses and individuals to familiarize themselves with local regulations to ensure compliance. This may include:

- Registration: Some states require finders to register as licensed agents or obtain permits.

- Disclosure: Finders must disclose their fees and services to property owners transparently.

- Limitations: Certain states may impose caps on the percentage that can be charged as a finders fee.

Required documents

To successfully navigate the unclaimed property business and finders fee agreements, specific documents are typically required. These may include:

- Finders fee agreement: A signed document detailing the terms of the fee arrangement.

- Identification: Proof of identity for both the finder and the property owner, such as a government-issued ID.

- Claim forms: Official forms required by state authorities to claim unclaimed property.

- Supporting documentation: Any additional documents that validate the claim, such as proof of ownership or prior correspondence.

Examples of using the finders fee

Understanding practical applications of the finders fee can provide valuable insights into its function. Common examples include:

- Real estate transactions: A finder may connect a buyer with a seller, earning a fee based on the sale price.

- Investment opportunities: Finders can facilitate introductions between investors and businesses seeking funding, receiving a fee for their efforts.

- Unclaimed property recovery: Individuals or companies may assist property owners in claiming unclaimed funds, earning a percentage of the recovered amount.

Quick guide on how to complete finders fee

Complete Finders Fee effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Handle Finders Fee on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Finders Fee seamlessly

- Locate Finders Fee and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information using the tools specially designed by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional handwritten signature.

- Review the details and click the Done button to preserve your changes.

- Choose how you prefer to send your document, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhaustive form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Finders Fee and guarantee excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is unclaimed property business?

An unclaimed property business assists organizations in locating and recovering lost or unclaimed assets that belong to individuals or entities. This business can help streamline the process of asset recovery, ensuring compliance with regulations while maximizing the value returned to rightful owners.

-

How can airSlate SignNow benefit my unclaimed property business?

airSlate SignNow provides a user-friendly platform for your unclaimed property business to send, sign, and manage documents electronically. With its robust eSignature capabilities, you can enhance the efficiency of transactions and ensure that your documentation process remains secure and compliant.

-

What features does airSlate SignNow offer for unclaimed property businesses?

airSlate SignNow offers features like customizable templates, advanced security measures, and real-time tracking of documents, making it ideal for your unclaimed property business. These tools help streamline workflows, reduce turnaround times, and ensure that you never lose track of important documentation.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored for businesses of all sizes, including plans that cater specifically to the unclaimed property business. Depending on your volume of transactions and required features, you can choose a plan that fits your budget while maximizing your investment.

-

Is airSlate SignNow secure for handling sensitive information in unclaimed property transactions?

Yes, airSlate SignNow employs advanced security measures such as encryption and two-factor authentication to protect sensitive information. This is particularly important for your unclaimed property business, where handling confidential data is a daily requirement.

-

Can I integrate airSlate SignNow with other tools used in my unclaimed property business?

Absolutely! airSlate SignNow seamlessly integrates with various applications and platforms, allowing your unclaimed property business to streamline operations and improve productivity. This compatibility ensures you can maintain a smooth workflow without needing to switch between different tools.

-

How quickly can I implement airSlate SignNow in my unclaimed property business?

Implementing airSlate SignNow in your unclaimed property business is fast and hassle-free, with a setup process that can often be completed within a few hours. This quick implementation allows you to begin enjoying the benefits of electronic document management and eSigning without delay.

Get more for Finders Fee

- Change name andor address complete form

- Free ucc5 correction statement the filing o findformscom

- Something that was not their intent form

- Be named as your personal representative or form

- Have a life estate in the property form

- Executor to administer your estate and who will form

- Fourth 211 taxonomy form

- Executor to administer your estate who you will form

Find out other Finders Fee

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe