Wage Loss Form

What is the Wage Loss

The term wage loss refers to the reduction in income that an individual experiences due to various circumstances, such as injury, illness, or job displacement. It is essential for individuals to understand the implications of wage loss, especially when seeking compensation or benefits. This concept is often tied to legal claims, insurance benefits, and workers' compensation cases, where documentation is required to substantiate claims for lost earnings.

Steps to Complete the Wage Loss

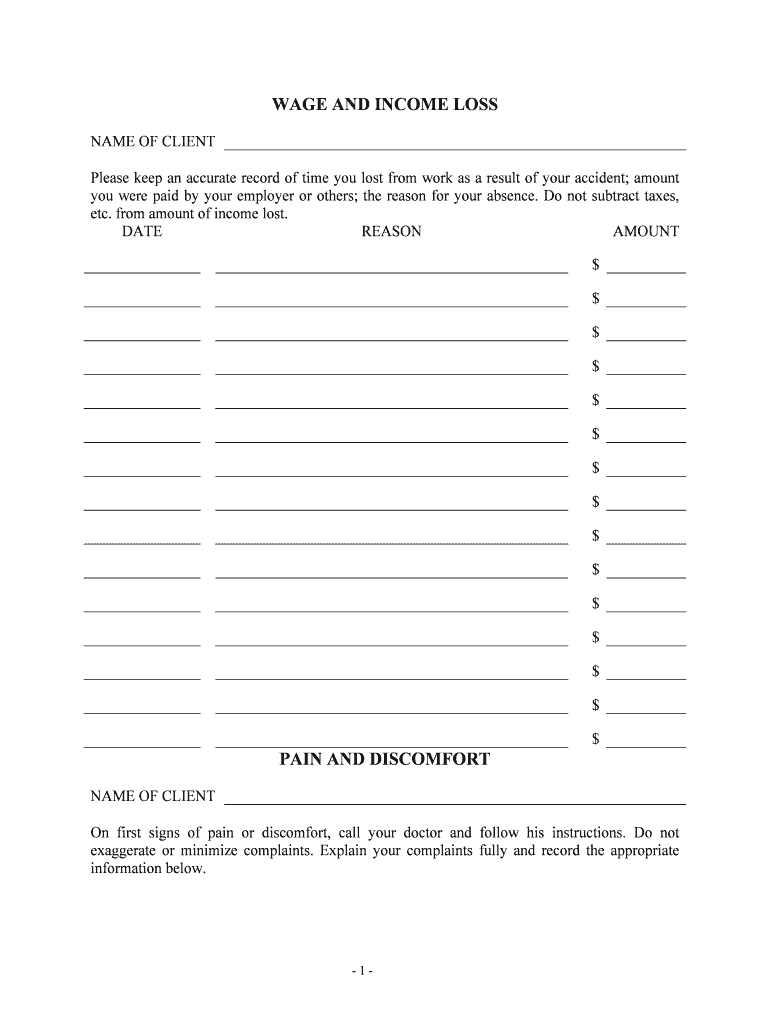

Completing a wage loss form involves several steps to ensure accuracy and compliance. Here are the key steps to follow:

- Gather necessary documentation, such as pay stubs, tax returns, and any relevant medical records.

- Fill out the wage loss form, ensuring all fields are completed accurately. Include details about the period of lost income and the reasons for the loss.

- Attach supporting documents that validate your claim, such as a loss of income letter from your employer.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the appropriate channels, whether online, by mail, or in person, depending on the requirements.

Legal Use of the Wage Loss

The legal use of wage loss documentation is critical in various contexts, such as personal injury claims or workers' compensation cases. To be considered legally binding, the wage loss form must meet specific criteria, including accurate representation of lost earnings and proper signature verification. Compliance with regulations such as the ESIGN Act ensures that electronic signatures on these documents are recognized legally, provided that the signing process adheres to established guidelines.

Required Documents

When filing for wage loss, certain documents are typically required to support your claim. These may include:

- Pay stubs or income statements to demonstrate earnings prior to the loss.

- A loss of income letter from your employer, detailing the circumstances of your wage loss.

- Medical records, if applicable, to substantiate claims related to health issues affecting your ability to work.

- Tax returns from previous years to provide a comprehensive view of your income history.

Examples of Using the Wage Loss

Wage loss forms are utilized in various scenarios. Common examples include:

- Individuals recovering from an accident who are unable to work and need to claim lost wages through their insurance.

- Employees filing for workers' compensation after an injury sustained on the job.

- Self-employed individuals documenting income loss due to business interruptions caused by unforeseen events.

Filing Deadlines / Important Dates

Filing deadlines for wage loss claims can vary based on the context and jurisdiction. It is crucial to be aware of these dates to ensure timely submission. Generally, deadlines may include:

- Workers' compensation claims typically require filing within a specific timeframe after the injury.

- Insurance claims may have deadlines based on policy terms, often ranging from thirty to ninety days.

- Legal claims for wage loss may be subject to statutes of limitations, which can vary by state.

Quick guide on how to complete wage loss

Easily Prepare Wage Loss on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed documents that require signatures, as you can acquire the necessary form and securely store it online. airSlate SignNow provides all the features you need to create, modify, and electronically sign your documents quickly and efficiently. Manage Wage Loss on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related tasks today.

The Easiest Way to Edit and Electronically Sign Wage Loss

- Locate Wage Loss and select Get Form to begin.

- Make use of the tools available to fill out your document.

- Highlight important parts of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Wage Loss and maintain effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an income statement form PDF?

An income statement form PDF is a standardized document that summarizes a company's revenues and expenses over a specific period. This form provides essential insights into profitability and is crucial for financial reporting. Using airSlate SignNow, you can easily create, send, and eSign your income statement form PDF without hassle.

-

How can I create an income statement form PDF using airSlate SignNow?

Creating an income statement form PDF with airSlate SignNow is simple. You can either upload an existing document or utilize our templates to generate a new one. Once your income statement form PDF is ready, it can be sent for eSignature directly from our platform.

-

What are the pricing options for using airSlate SignNow for income statement forms?

airSlate SignNow offers flexible pricing plans tailored to different business needs. You can choose a plan that best suits your requirements, whether you're a solo entrepreneur or a larger organization. Each plan includes features that allow you to efficiently manage your income statement form PDFs.

-

Is airSlate SignNow secure for handling income statement form PDFs?

Yes, airSlate SignNow provides robust security features to protect your data. All income statement form PDFs sent through our platform are encrypted and compliant with industry standards. You can confidently manage sensitive financial documents knowing they are secure.

-

Can I integrate airSlate SignNow with other applications for managing income statement forms?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive and Dropbox. You can manage your income statement form PDFs alongside your existing tools, streamlining your workflow and increasing efficiency.

-

What benefits does airSlate SignNow provide for income statement form PDF management?

Using airSlate SignNow for your income statement form PDFs enhances efficiency, reduces turnaround time, and ensures compliance. The eSignature feature allows you to get documents signed faster, while templates save you time on future filings. Experience hassle-free document management with our intuitive platform.

-

Can I track the status of my income statement form PDFs in airSlate SignNow?

Yes, with airSlate SignNow, you can easily track the status of your income statement form PDFs. The platform provides notifications when documents are viewed, signed, or completed, ensuring you are always updated on your financial documents' progress.

Get more for Wage Loss

- Civil non domestic differentiated case management plan form

- Application instructionschecklist new jersey division of form

- In tax court nj courts form

- New jersey tax court decisions justia law form

- Family get divorced and move on plus domestic violence cases form

- Order title madison title agency form

- Record is inaccurate form

- Bill of sale form south carolina first report of injury or illness

Find out other Wage Loss

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP