In Tax Court? NJ Courts Form

What is the In Tax Court? NJ Courts

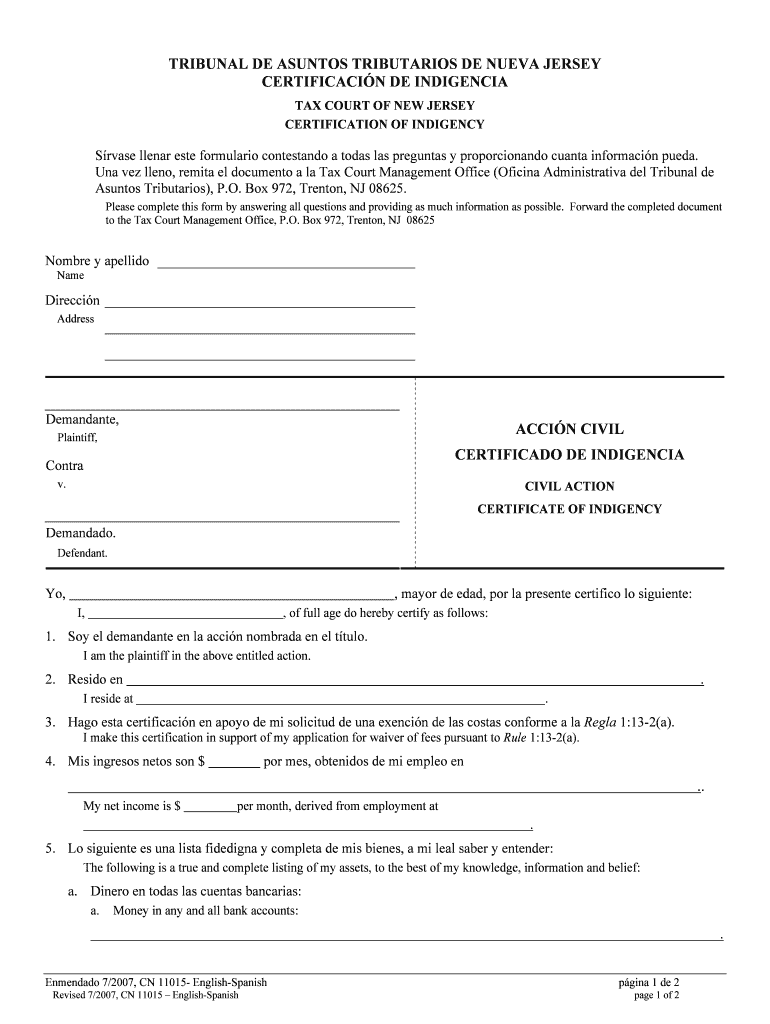

The In Tax Court? NJ Courts form is a legal document used in New Jersey to initiate a tax appeal process. This form allows individuals or businesses to contest tax assessments made by the state. It is essential for taxpayers who believe their tax obligations have been inaccurately calculated or assessed. Understanding the purpose of this form is crucial for anyone looking to navigate the tax court system effectively.

Steps to complete the In Tax Court? NJ Courts

Completing the In Tax Court? NJ Courts form involves several key steps to ensure accuracy and compliance. First, gather all relevant documentation, including tax returns and any notices received from the tax authority. Next, fill out the form with precise details, including your personal information and the specific tax issues being contested. It is important to clearly state the reasons for the appeal and provide supporting evidence. Finally, review the form for completeness and submit it according to the guidelines provided by the New Jersey tax court.

Required Documents

When filing the In Tax Court? NJ Courts form, you will need to provide several essential documents. These typically include copies of your tax returns for the years in question, any correspondence from the tax authority regarding the assessment, and any other relevant financial documents that support your case. Ensuring that you have all required documents ready will facilitate a smoother filing process and strengthen your appeal.

Filing Deadlines / Important Dates

Adhering to filing deadlines is critical when submitting the In Tax Court? NJ Courts form. Generally, taxpayers must file their appeal within a specific timeframe after receiving a tax assessment notice. In New Jersey, this period is typically within 45 days of the notice date. Missing this deadline can result in the loss of your right to appeal, making it essential to be aware of and meet all important dates related to your case.

Legal use of the In Tax Court? NJ Courts

The legal use of the In Tax Court? NJ Courts form is strictly defined by New Jersey tax law. This form serves as a formal request to challenge tax assessments, and its proper completion is necessary for the court to consider your case. Utilizing this form correctly ensures that your appeal is recognized as valid and that you can present your arguments in front of a judge. Understanding the legal implications of this form is vital for successful navigation through the tax court system.

Eligibility Criteria

To file the In Tax Court? NJ Courts form, certain eligibility criteria must be met. Taxpayers must have received a formal notice of assessment from the New Jersey Division of Taxation, and they must be contesting the amount owed. Additionally, both individuals and business entities can file this form, provided they meet the necessary legal requirements. Understanding these criteria helps ensure that you are eligible to proceed with your tax appeal.

Quick guide on how to complete in tax court nj courts

Easily Prepare In Tax Court? NJ Courts on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and safely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly and efficiently. Manage In Tax Court? NJ Courts on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

How to Edit and eSign In Tax Court? NJ Courts Effortlessly

- Find In Tax Court? NJ Courts and click Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about misplaced or lost documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Edit and eSign In Tax Court? NJ Courts to ensure excellent communication at every stage of the document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it help if I'm In Tax Court? NJ Courts?

airSlate SignNow is a comprehensive eSignature solution designed to streamline document management. If you find yourself In Tax Court? NJ Courts, our platform simplifies the signing and sending of crucial documents, ensuring you can meet all legal requirements efficiently.

-

What features does airSlate SignNow offer for users In Tax Court? NJ Courts?

Our platform provides a variety of features including customizable templates, secure document storage, and real-time tracking of document status. For those In Tax Court? NJ Courts, these features help maintain organization and compliance throughout the legal process.

-

Is airSlate SignNow cost-effective for users In Tax Court? NJ Courts?

Yes, airSlate SignNow offers a range of pricing plans tailored to meet different business needs. For users In Tax Court? NJ Courts, our solutions provide exceptional value with cost-effective options that do not compromise on quality or features.

-

Can I integrate airSlate SignNow with other tools while I am In Tax Court? NJ Courts?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications and services. This is particularly beneficial for individuals In Tax Court? NJ Courts, as it allows for easy collaboration and document sharing across platforms.

-

How secure is airSlate SignNow for documents related to Tax Court?

Security is a top priority for us at airSlate SignNow. Our platform complies with industry standards and encryption protocols, providing peace of mind for users who are In Tax Court? NJ Courts, knowing their sensitive legal documents are protected.

-

What type of support does airSlate SignNow offer for users In Tax Court? NJ Courts?

We provide robust customer support through various channels, including live chat and email. If you are In Tax Court? NJ Courts, our dedicated team is ready to assist you with any questions or challenges you may encounter while using our platform.

-

Can airSlate SignNow help reduce the time spent on paperwork for Tax Court?

Yes, using airSlate SignNow signNowly reduces time spent on paperwork. For those In Tax Court? NJ Courts, our user-friendly interface allows for quick document creation, sending, and signing so you can focus on preparing your case rather than managing forms.

Get more for In Tax Court? NJ Courts

- Scholarship application senator douglas jj peters form

- 2013 demonstration jump insurance application uspa form

- A3490 internetformular deutsche rentenversicherung deutsche rentenversicherung

- Choice of superannuation fund standard choice form cbus

- Cbus withdrawal form

- Sleep study form

- Boat agreement purchase template form

- Land title identity verification form 2014

Find out other In Tax Court? NJ Courts

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will