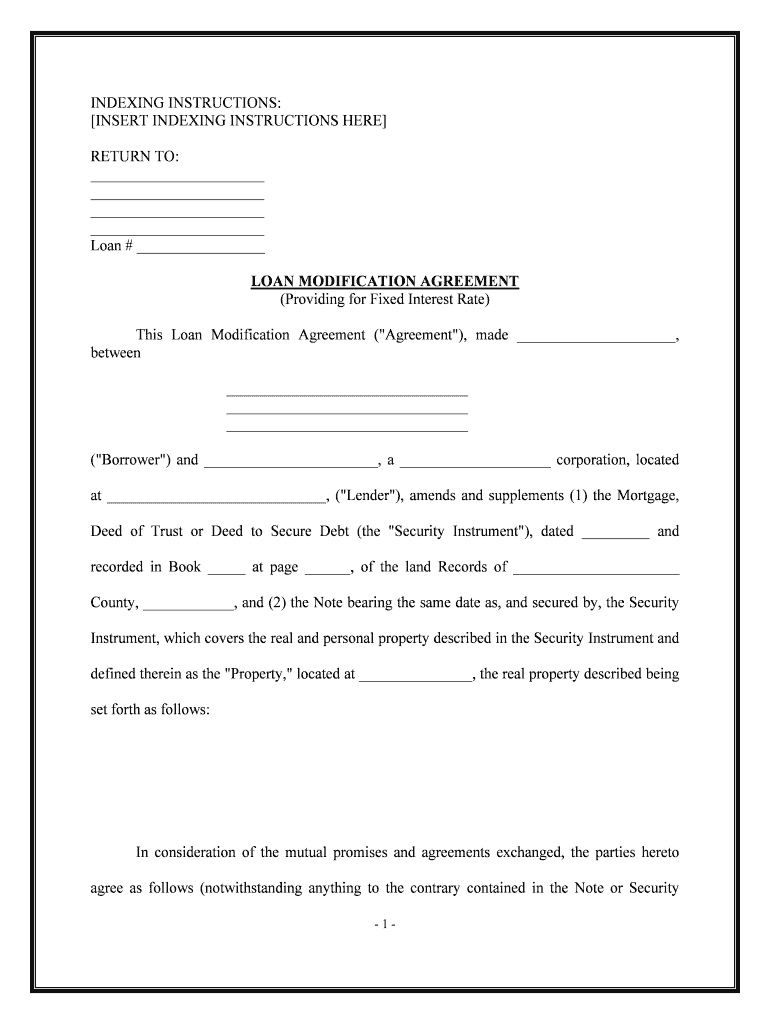

Loan Modification Form

What is the loan modification?

A loan modification is a change made to the terms of an existing loan, typically aimed at making the loan more affordable for the borrower. This can involve adjusting the interest rate, extending the loan term, or altering the monthly payment amount. Loan modifications are often pursued by homeowners facing financial difficulties, as they provide a way to avoid foreclosure and maintain home ownership. In the United States, lenders may offer modifications as part of government programs or their own internal policies.

Steps to complete the loan modification

Completing a loan modification involves several key steps:

- Gather documentation: Collect necessary financial documents, including income statements, tax returns, and information about your current mortgage.

- Contact your lender: Reach out to your loan servicer to discuss your situation and express your interest in a modification.

- Complete the application: Fill out the loan modification form accurately, providing all required details about your financial situation.

- Submit your application: Send the completed loan modification form and supporting documents to your lender, ensuring you keep copies for your records.

- Follow up: Regularly check in with your lender to track the status of your application and provide any additional information they may request.

Required documents

When applying for a loan modification, you will typically need to provide various documents to support your application. Commonly required documents include:

- Proof of income, such as pay stubs or bank statements

- Tax returns for the past two years

- A hardship letter explaining your financial difficulties

- Current mortgage statement

- Property tax statements

Having these documents ready can help streamline the process and improve your chances of approval.

Legal use of the loan modification

Loan modifications are legally binding agreements between the borrower and the lender. For a modification to be enforceable, it must comply with applicable laws and regulations. This includes adhering to federal laws such as the Truth in Lending Act and the Real Estate Settlement Procedures Act. Additionally, lenders must ensure that the modified terms are clearly outlined in a written agreement that both parties sign. Understanding the legal implications of a loan modification is crucial to protect your rights as a borrower.

Eligibility criteria

To qualify for a loan modification, borrowers typically need to meet certain eligibility criteria set by their lender or the specific modification program. Common criteria include:

- Demonstrating financial hardship, such as a job loss or medical emergency

- Being current on mortgage payments or having a limited number of missed payments

- Providing proof of income and other financial information

- Owning and occupying the property as your primary residence

Each lender may have different requirements, so it is essential to check with your specific loan servicer for their guidelines.

How to obtain the loan modification

Obtaining a loan modification involves a systematic approach. Start by contacting your lender to express your need for a modification. They will guide you through their specific process, which may include filling out a loan modification form and submitting required documentation. It is important to be proactive and persistent, as the process can take time. Additionally, consider seeking assistance from housing counselors or legal advisors who can provide guidance tailored to your situation.

Quick guide on how to complete loan modification

Accomplish Loan Modification effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as it allows you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to generate, modify, and eSign your documents swiftly without delays. Manage Loan Modification using the airSlate SignNow applications for Android or iOS and simplify any document-related procedure today.

How to modify and eSign Loan Modification with ease

- Obtain Loan Modification and then click Get Form to begin.

- Utilize the tools at your disposal to finish your form.

- Emphasize important sections of the documents or obscure sensitive data using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your method of submitting your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign Loan Modification and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a loan modification form?

A loan modification form is a document used to request changes to the terms of an existing loan. It can help borrowers adjust their payment schedule, interest rates, and other conditions to better fit their financial situation. By completing this form, you can communicate your needs to your lender effectively.

-

How can airSlate SignNow assist with loan modification forms?

airSlate SignNow provides an easy-to-use platform to create, send, and eSign loan modification forms. Its intuitive design streamlines the process of document management, ensuring you can submit requests quickly and securely. This helps eliminate delays and keeps your modification process moving forward.

-

Is there a cost associated with using airSlate SignNow for loan modification forms?

airSlate SignNow offers a cost-effective solution for managing loan modification forms. Pricing varies depending on the features and number of users, but the platform typically provides excellent value for the services offered. You can try it out with a free trial to see if it meets your needs.

-

What features does airSlate SignNow offer for loan modification forms?

airSlate SignNow includes features like customizable templates, real-time collaboration, and secure eSigning for loan modification forms. These tools ensure that your documents are professional and easy to track. Additionally, you can automate reminders and notifications to keep the process on schedule.

-

Can I integrate airSlate SignNow with other applications for my loan modification forms?

Yes, airSlate SignNow offers integrations with various applications such as CRM systems and cloud storage services. This allows you to manage your loan modification forms seamlessly within your existing workflows. Integrating these tools can help streamline your overall approach to document management.

-

What are the benefits of using airSlate SignNow for loan modification forms?

Using airSlate SignNow for loan modification forms provides several benefits, including increased efficiency, security, and ease of use. You can fill out and sign documents remotely, saving time and reducing paperwork. The ability to track the status of your forms ensures you stay informed throughout the modification process.

-

Is the loan modification form process secure with airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security measures to protect your loan modification forms and personal information. This includes encryption, secure access, and compliance with industry regulations. You can feel confident that your documents are safe and secure when using our platform.

Get more for Loan Modification

- Workers compensation california health information

- Workers compensation and you information for injured

- Husband and wife two individuals to a form

- Justia workers response to complaint new mexico workers form

- Control number nm 029 78 form

- Article 13 table of contents rldstatenmus form

- Unmarried as joint tenants with the right of survivorship and not as tenants in common form

- Materialmans request individual form

Find out other Loan Modification

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online