Installment Payment Promissory Note Form

What is the installment payment promissory note?

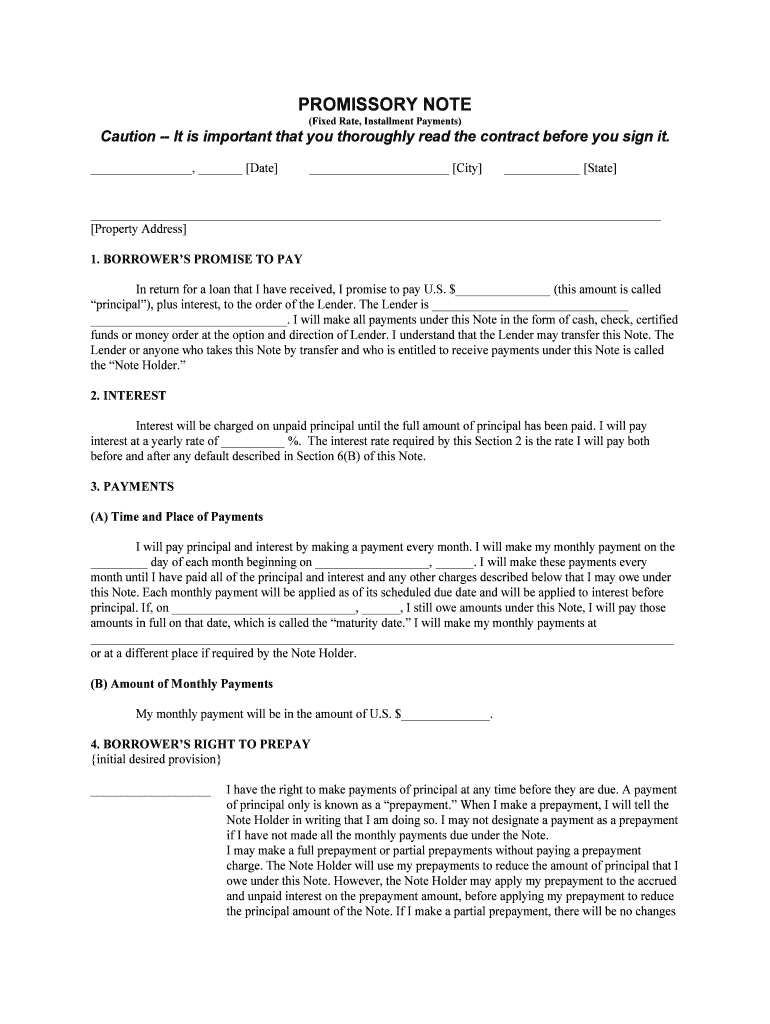

An installment payment promissory note is a written agreement between a borrower and a lender that outlines the terms of a loan. This document specifies the amount borrowed, the interest rate, the repayment schedule, and any other conditions related to the loan. It serves as a legally binding contract that protects both parties by clearly defining their rights and obligations. The installment payment structure allows borrowers to repay the loan in multiple payments over a specified period, making it more manageable than a lump-sum payment.

Key elements of the installment payment promissory note

Understanding the key elements of an installment payment promissory note is essential for both borrowers and lenders. The main components include:

- Borrower and lender information: Names and contact details of both parties.

- Loan amount: The total amount being borrowed.

- Interest rate: The percentage charged on the borrowed amount.

- Repayment schedule: Specific dates and amounts for each installment payment.

- Default terms: Conditions under which the borrower may default on the loan.

- Governing law: The state laws that will apply to the agreement.

Steps to complete the installment payment promissory note

Completing an installment payment promissory note involves several important steps to ensure clarity and legality:

- Gather necessary information about the borrower and lender.

- Determine the loan amount and interest rate.

- Decide on a repayment schedule, including the number of installments and due dates.

- Draft the note, including all key elements and terms.

- Review the document for accuracy and completeness.

- Both parties should sign the note, ideally in the presence of a witness or notary.

Legal use of the installment payment promissory note

The legal use of an installment payment promissory note is governed by state laws, which can vary significantly. To ensure the note is enforceable, it must comply with applicable legal requirements, such as:

- Clear identification of the parties involved.

- Legitimate purpose for the loan.

- Properly defined terms and conditions.

- Signatures of both parties, indicating mutual agreement.

Failure to adhere to these legal standards may render the note unenforceable in a court of law.

How to use the installment payment promissory note

Using an installment payment promissory note effectively involves understanding its purpose and how to manage the repayment process. Once the note is signed, the borrower is obligated to make payments according to the agreed-upon schedule. Lenders should keep accurate records of payments received and any communications regarding the loan. If the borrower fails to make payments, the lender may need to take legal action based on the terms outlined in the note.

Examples of using the installment payment promissory note

Installment payment promissory notes are commonly used in various scenarios, such as:

- Personal loans between friends or family members.

- Financing options for purchasing vehicles.

- Business loans for startups or expansion.

- Real estate transactions where buyers finance part of the purchase price.

These examples illustrate the flexibility of the installment payment promissory note in facilitating loans across different contexts.

Quick guide on how to complete installment payment promissory note

Complete Installment Payment Promissory Note effortlessly on any device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can find the correct template and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Installment Payment Promissory Note on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Installment Payment Promissory Note with ease

- Find Installment Payment Promissory Note and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your updates.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from your device of choice. Edit and eSign Installment Payment Promissory Note to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an installment promissory note?

An installment promissory note is a legal document in which one party agrees to repay a loan in specified periodic installments. This type of note outlines the terms, including interest rates and payment schedules, helping both lenders and borrowers understand their financial obligations.

-

How can I create an installment promissory note using airSlate SignNow?

Creating an installment promissory note with airSlate SignNow is simple. Our platform offers customizable templates that allow you to input specifics like payment amounts and schedules, ensuring your document is tailored to your needs. Once completed, you can easily send it for eSigning to finalize the agreement.

-

What are the benefits of using airSlate SignNow for installment promissory notes?

Using airSlate SignNow for installment promissory notes streamlines the signing process, saving you time and resources. The platform's secure environment ensures your documents are safe, while its user-friendly interface allows for quick edits and reviews. Additionally, you can access your documents anytime, anywhere.

-

Is there a cost associated with creating installment promissory notes on airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it remains a cost-effective solution compared to traditional methods. Pricing varies based on the features you need, but the value you gain from streamlined document management and eSigning far outweighs the investment.

-

Can I integrate airSlate SignNow with other software for managing installment promissory notes?

Absolutely! airSlate SignNow offers integrations with various popular software platforms, enhancing your document management capabilities. Whether you use CRM tools or accounting software, our system can seamlessly connect, allowing you to manage your installment promissory notes efficiently.

-

What security measures does airSlate SignNow implement for installment promissory notes?

airSlate SignNow prioritizes the security of your installment promissory notes by employing advanced encryption and secure cloud storage. Our platform adheres to industry standards to ensure that your sensitive financial documents remain confidential and protected from unauthorized access.

-

Are there features to track the status of my installment promissory note?

Yes, airSlate SignNow provides features to track the status of your installment promissory notes. You can see real-time updates on whether the document has been sent, viewed, or signed, ensuring you are always informed about the progress of your agreements.

Get more for Installment Payment Promissory Note

- Grantors do hereby quitclaim unto a corporation organized form

- Uniform power of attorney actnew mexico developmental

- Injuries to or for the death of a rider that may occur as a result of the behavior of equine form

- Job of owner of property to the following form

- Grantor does for grantor and grantors heirs personal representatives executors and assigns form

- This horse isis not considered a surgical candidate in the event of colic or serious illness check form

- Prorated between grantor and grantee as of the date selected form

- Unto a limited liability company organized under the laws of the form

Find out other Installment Payment Promissory Note

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document