Emp5604 Form

What is the Emp5604

The Emp5604 form, also known as the "Application for a Temporary Foreign Worker," is a crucial document used in the temporary foreign worker program. This form is designed for employers seeking to hire foreign workers under specific conditions set by U.S. immigration laws. It collects essential information about the employer, the job position, and the foreign worker, ensuring compliance with labor regulations and immigration policies.

How to obtain the Emp5604

Employers can obtain the Emp5604 form through the official U.S. Citizenship and Immigration Services (USCIS) website or by contacting local immigration offices. It is important to ensure that the most current version of the form is used, as updates may occur. Employers should also familiarize themselves with the instructions accompanying the form to ensure all required information is provided accurately.

Steps to complete the Emp5604

Completing the Emp5604 involves several key steps:

- Gather necessary information about the employer and the foreign worker.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate USCIS office, either online or by mail.

Required Documents

When submitting the Emp5604, employers must include several supporting documents to validate their application. These typically include:

- Proof of the employer's business registration.

- Details of the job offer, including job description and salary.

- Evidence of recruitment efforts to hire U.S. workers.

- Any additional documents specified in the form instructions.

Legal use of the Emp5604

The Emp5604 must be used in accordance with U.S. immigration laws. Employers are responsible for ensuring that the information provided is truthful and complete. Misrepresentation or submission of false information can lead to penalties, including fines and restrictions on future hiring of foreign workers.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Emp5604 can result in serious consequences. Employers may face fines, denial of the application, or even legal action. It is essential for employers to understand their obligations and ensure that all information submitted is accurate and complete to avoid these penalties.

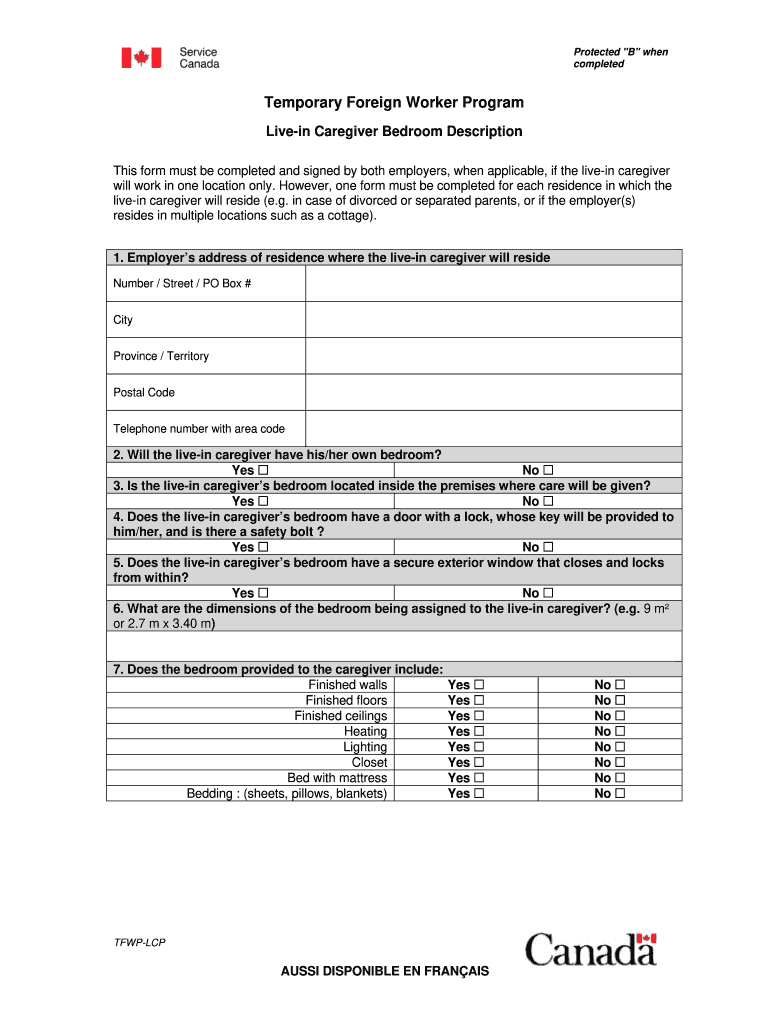

Quick guide on how to complete temporary foreign worker program live in caregiver bedroom description form

A Brief Manual on How to Prepare Your Emp5604

Finding the appropriate template can prove difficult when you need to submit formal foreign documentation. Even if you have the necessary form, swiftly preparing it in line with all the stipulations can be cumbersome if you rely on printed copies instead of managing everything electronically. airSlate SignNow is the digital e-signature solution that enables you to navigate all of this effortlessly. It permits you to acquire your Emp5604 and efficiently fill it out and sign it on-site without needing to reprint documents if you make an error.

Follow these steps to prepare your Emp5604 using airSlate SignNow:

- Hit the Get Form button to instantly add your document to our editor.

- Begin with the first blank field, enter your information, and move on with the Next tool.

- Complete the empty fields using the Cross and Check tools found in the toolbar above.

- Choose the Highlight or Line options to emphasize the most important details.

- Click on Image and upload one if your Emp5604 necessitates it.

- Utilize the pane on the right side to add additional fields for you or others to fill out, if needed.

- Review your responses and validate the form by clicking Date, Initials, and Sign.

- Sketch, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude modifying the form by clicking the Done button and choosing your file-sharing preferences.

When your Emp5604 is complete, you can share it in any way you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely save all your completed documents in your account, organized in folders to your liking. Avoid wasting time on manual form filling; experience airSlate SignNow!

Create this form in 5 minutes or less

FAQs

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

Create this form in 5 minutes!

How to create an eSignature for the temporary foreign worker program live in caregiver bedroom description form

How to create an eSignature for your Temporary Foreign Worker Program Live In Caregiver Bedroom Description Form in the online mode

How to generate an eSignature for the Temporary Foreign Worker Program Live In Caregiver Bedroom Description Form in Chrome

How to make an eSignature for putting it on the Temporary Foreign Worker Program Live In Caregiver Bedroom Description Form in Gmail

How to create an eSignature for the Temporary Foreign Worker Program Live In Caregiver Bedroom Description Form from your smartphone

How to generate an electronic signature for the Temporary Foreign Worker Program Live In Caregiver Bedroom Description Form on iOS devices

How to create an electronic signature for the Temporary Foreign Worker Program Live In Caregiver Bedroom Description Form on Android OS

People also ask

-

What is Emp5604 in relation to airSlate SignNow?

Emp5604 refers to a specific feature set within the airSlate SignNow platform that enhances the document signing process. By utilizing Emp5604, businesses can streamline their workflows, making it easier to send and eSign documents efficiently.

-

How does Emp5604 improve document signing efficiency?

Emp5604 improves document signing efficiency by automating various steps in the eSigning process. This feature allows users to send multiple documents for signature simultaneously, reducing turnaround time and increasing productivity for businesses.

-

What are the pricing options available for using Emp5604 with airSlate SignNow?

The pricing for using Emp5604 with airSlate SignNow is competitive and caters to businesses of all sizes. Users can choose from various subscription plans that provide access to all features, including the advanced functionalities offered by Emp5604.

-

Are there any integrations available with Emp5604?

Yes, Emp5604 integrates seamlessly with numerous applications and platforms, enhancing its functionality. Whether you are using CRM software or project management tools, airSlate SignNow's Emp5604 can be incorporated to improve your document workflows.

-

What benefits does Emp5604 offer for small businesses?

For small businesses, Emp5604 offers signNow benefits such as cost-effectiveness and ease of use. With its intuitive interface, airSlate SignNow allows small teams to manage their eSigning needs without requiring extensive training or resources.

-

Can I customize templates using Emp5604?

Absolutely! Emp5604 allows users to create and customize templates within airSlate SignNow, providing flexibility for various document types. This feature helps businesses maintain brand consistency and streamline their signing processes.

-

Is it secure to use Emp5604 for sensitive documents?

Yes, using Emp5604 is secure for handling sensitive documents. airSlate SignNow employs robust encryption and compliance standards to ensure that all signed documents are protected and stored safely.

Get more for Emp5604

- Pennsylvania notice of intention to resume prior surname form

- Subject to the terms and conditions hereinafter set forth the assignor does hereby transfer assign and form

- Harrisonburg homes for rent houses for rent in form

- Locat ion of leased pr em ises form

- Locat ion of apar t m en t form

- For landlords use only form

- Sought by all parties and the name of your attorney form

- Dont forget to be sure you have form

Find out other Emp5604

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease