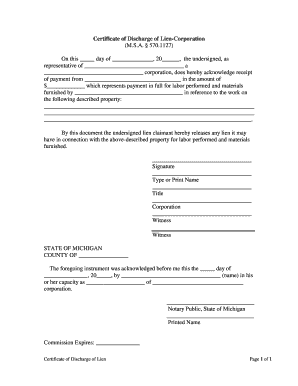

Michigan Discharge Lien Form

What is the Michigan Discharge Lien

The Michigan discharge lien is a legal document that serves to release a lien placed on a property or asset after a debt has been satisfied. This form is essential for individuals or businesses, such as a Michigan LLC company, that wish to clear their records of any claims against their property. It signifies that the creditor no longer has a legal claim to the asset, ensuring that the property can be freely transferred or sold without encumbrances. Understanding this form is crucial for maintaining clear ownership and protecting your interests in any real estate or personal property transactions.

Steps to Complete the Michigan Discharge Lien

Completing the Michigan discharge lien involves several important steps to ensure that the document is legally valid. Here’s a streamlined process:

- Gather necessary information, including details about the property, the lien, and the parties involved.

- Obtain the appropriate discharge lien form from the Michigan Department of Licensing and Regulatory Affairs.

- Fill out the form accurately, ensuring all required fields are completed.

- Sign the form in the presence of a notary public to validate the document.

- Submit the completed form to the appropriate county register of deeds office for recording.

Following these steps helps ensure that the discharge lien is processed correctly, providing peace of mind regarding the status of your property.

Legal Use of the Michigan Discharge Lien

The legal use of the Michigan discharge lien is primarily to formally terminate a creditor's claim against a property. This document is recognized under Michigan law and must meet specific legal requirements to be enforceable. It is important to ensure that the discharge lien is filed correctly to avoid potential disputes or complications in the future. This form is particularly relevant for limited liability companies (LLCs) that may have taken on debts secured by liens on their assets. Properly executing and filing this form protects the company’s interests and maintains compliance with state regulations.

Required Documents

To successfully file a Michigan discharge lien, certain documents are necessary. These typically include:

- The completed discharge lien form.

- Proof of payment or satisfaction of the debt that the lien was securing.

- Identification documents of the parties involved, such as a driver’s license or state ID.

- Any previous lien documentation that verifies the original claim.

Having these documents ready can expedite the filing process and ensure that all legal requirements are met.

Who Issues the Form

The Michigan discharge lien form is issued by the Michigan Department of Licensing and Regulatory Affairs. This governmental body oversees the regulation of various business activities within the state, including the management of liens and related documentation. Individuals or businesses, such as a Michigan corporation company, can obtain the form directly from their website or through local government offices. Ensuring that you have the correct form is crucial for the validity of the discharge process.

Penalties for Non-Compliance

Failing to properly file a Michigan discharge lien can result in significant penalties. Non-compliance may lead to the continued existence of a lien on the property, which can hinder the ability to sell or transfer ownership. Additionally, there may be financial repercussions, including potential legal fees or costs associated with resolving disputes arising from improperly managed liens. It is essential for individuals and businesses to understand these implications to avoid complications in their property dealings.

Quick guide on how to complete michigan discharge lien

Complete Michigan Discharge Lien smoothly on any device

Managing documents online has gained signNow traction among companies and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and eSign your documents swiftly without delays. Handle Michigan Discharge Lien on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest method to modify and eSign Michigan Discharge Lien effortlessly

- Locate Michigan Discharge Lien and click Get Form to begin.

- Employ the tools we offer to complete your form.

- Mark relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in a few clicks from any device you choose. Modify and eSign Michigan Discharge Lien and ensure exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a MI LLC company and why should I consider forming one?

A MI LLC company, or Michigan Limited Liability Company, provides business owners with liability protection and flexible tax options. Forming a MI LLC company is beneficial because it combines elements of a corporation and a partnership, thus protecting your personal assets from business debts and lawsuits.

-

How can airSlate SignNow help in managing my MI LLC company’s documentation?

airSlate SignNow offers a user-friendly platform for eSigning and sending documents, which simplifies the management of your MI LLC company’s documentation. You can easily create, send, and store essential business documents securely, ensuring compliance with Michigan state regulations.

-

What are the pricing options for using airSlate SignNow with a MI LLC company?

airSlate SignNow offers flexible pricing plans suitable for any MI LLC company, starting from cost-effective options for small startups to more comprehensive plans for larger businesses. You can choose a plan that fits your budget while providing all the essential features needed for seamless document management.

-

What features does airSlate SignNow provide for my MI LLC company?

With airSlate SignNow, your MI LLC company can enjoy features such as eSigning, document templates, real-time tracking, and secure cloud storage. These features are designed to streamline your workflows while ensuring the security and accessibility of vital documents.

-

Are there any benefits of using airSlate SignNow for my MI LLC company over traditional methods?

Yes, using airSlate SignNow provides numerous benefits for your MI LLC company, including enhanced security, faster turnaround times, and reduced operational costs. By digitizing your document processes, you can also ensure compliance and improve overall efficiency compared to traditional paper methods.

-

Does airSlate SignNow integrate with other tools relevant to my MI LLC company?

Absolutely! airSlate SignNow integrates seamlessly with various tools and software applications that your MI LLC company may already be using. This flexibility allows for a more streamlined workflow and enhances productivity by connecting existing systems.

-

How secure is airSlate SignNow for my MI LLC company’s sensitive documents?

airSlate SignNow prioritizes security, utilizing advanced encryption and compliance with industry standards to protect your MI LLC company’s sensitive documents. This ensures that your data remains confidential and secure while you manage your documents online.

Get more for Michigan Discharge Lien

- Control number la p060 pkg form

- Control number la p061 pkg form

- Control number la p062 pkg form

- Shop tax free and save money in louisianalouisiana tax form

- Control number la p066 pkg form

- Control number la p067 pkg form

- Control number la p072 pkg form

- Kybackground check law may receive revisions form

Find out other Michigan Discharge Lien

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free