New York Lien Form

What is the New York Lien

A New York lien is a legal claim against a property or asset that secures the payment of a debt or obligation. This claim can arise from various circumstances, such as unpaid taxes, loans, or judgments. When a lien is placed on a property, it prevents the owner from selling or refinancing it until the debt is resolved. Understanding the nature of a lien is crucial for property owners and businesses in New York, as it affects their financial standing and property rights.

How to obtain the New York Lien

To obtain a New York lien, the creditor must follow specific legal procedures. This typically involves filing a lien notice with the appropriate county clerk's office where the property is located. The notice must include details such as the debtor's name, the amount owed, and a description of the property. Once filed, the lien becomes a matter of public record, providing the creditor with a legal claim against the property. It is advisable to consult with a legal professional to ensure compliance with all state regulations during this process.

Steps to complete the New York Lien

Completing a New York lien involves several key steps:

- Determine the basis for the lien, such as unpaid debts or judgments.

- Gather necessary documentation, including contracts, invoices, and any relevant court orders.

- Prepare the lien notice, ensuring all required information is accurately included.

- File the lien notice with the appropriate county clerk's office, paying any associated fees.

- Notify the debtor of the lien filing to comply with legal requirements.

Legal use of the New York Lien

The legal use of a New York lien is governed by state law, which outlines the rights and responsibilities of both creditors and debtors. A lien must be based on a legitimate debt and properly filed to be enforceable. Creditors can use liens to secure payment, while debtors have the right to contest a lien if they believe it is unjustified. Understanding these legal parameters is essential for both parties to navigate potential disputes effectively.

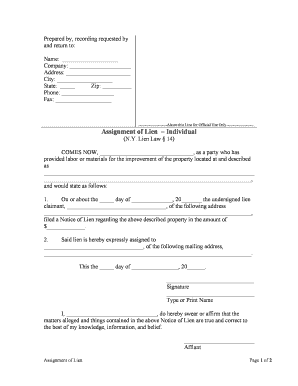

Key elements of the New York Lien

Several key elements characterize a New York lien:

- Creditor Information: The name and contact details of the creditor seeking the lien.

- Debtor Information: The name and address of the individual or business that owes the debt.

- Property Description: A clear description of the property subject to the lien.

- Amount Owed: The total amount of the debt that the lien secures.

- Date of Filing: The date when the lien notice is filed with the county clerk.

Filing Deadlines / Important Dates

Filing deadlines for a New York lien can vary based on the type of debt and the nature of the claim. Generally, it is advisable to file a lien as soon as the debt becomes due to protect the creditor's interests. For certain types of liens, such as mechanic's liens, specific deadlines must be adhered to, often requiring filing within a limited timeframe after the work is completed or the debt arises. Keeping track of these deadlines is essential to ensure the enforceability of the lien.

Quick guide on how to complete new york lien

Complete New York Lien seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage New York Lien on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign New York Lien with ease

- Obtain New York Lien and click on Get Form to begin.

- Utilize the tools we offer to submit your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Wave goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Modify and eSign New York Lien to ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New York lien?

A New York lien is a legal claim against a property that ensures the payment of a debt or obligation. Understanding lien types in New York is crucial for businesses engaging in property transactions or financing. Whether you need information on tax liens or mechanics' liens, knowing how they work can protect your interests.

-

How can airSlate SignNow help with New York lien documentation?

airSlate SignNow simplifies the process of preparing and signing documents related to New York liens. With our eSignature solution, you can quickly send lien documents to relevant parties for signature, ensuring compliance and efficiency. This digital approach enhances document management for lien filings, making your workflow more efficient.

-

What are the costs associated with using airSlate SignNow for New York lien documents?

Pricing for airSlate SignNow varies based on the features you choose, but it remains an affordable solution for handling New York lien documents. We offer various subscription plans that cater to different business sizes and needs, ensuring you only pay for what you use. By reducing paperwork, you can potentially save on costs associated with delays and errors in lien filing.

-

Are there benefits of using airSlate SignNow for New York lien filings?

Yes, using airSlate SignNow for New York lien filings provides numerous benefits, including streamlined processes and enhanced security. Our platform ensures that your documents are legally binding and securely stored. Additionally, you can track the status of your lien documents in real-time, providing peace of mind throughout the filing process.

-

Can I integrate airSlate SignNow with other applications for managing New York liens?

Absolutely! airSlate SignNow integrates seamlessly with various productivity tools and apps, making it easy to manage New York liens alongside your existing workflows. Whether you use CRM systems or cloud storage solutions, our integrations help streamline your document management. This means you can access and send lien documents from your preferred platforms without hassle.

-

Is it easy to send and receive New York lien documents using airSlate SignNow?

Yes, airSlate SignNow is designed for ease of use, allowing you to send and receive New York lien documents with just a few clicks. Our intuitive interface guides you through the signing process, making it accessible for all users. This reduced complexity means you can focus on your business rather than getting bogged down by paperwork.

-

What security measures does airSlate SignNow have for New York lien documents?

airSlate SignNow implements stringent security measures to protect New York lien documents from unauthorized access. We utilize encrypted data transmission and secure cloud storage to ensure your sensitive information remains confidential. Our commitment to security means you can confidently manage your lien transactions with peace of mind.

Get more for New York Lien

- Release of claims for future accidental injuries or death by form

- Web site design maintenance and leasing agreement form

- I am requesting that i receive my six weeks of maternity leave starting on date and ending form

- Usps postmaster address request letter us department of form

- Agreement for sale of real property from the santa clara form

- Terms of subscription services agreement form

- Employment of executive nonprofit corporation form

- Aircraft lease for successive terms form

Find out other New York Lien

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer