Nevada Trust Form

What is the Nevada Trust

The Nevada Trust is a legal arrangement that allows individuals to manage and protect their assets while enjoying various benefits, such as privacy and tax advantages. This type of trust is particularly popular due to Nevada's favorable trust laws, which provide enhanced asset protection and flexibility. The Nevada Trust can be used for various purposes, including estate planning, wealth management, and protecting assets from creditors.

How to Use the Nevada Trust

Using the Nevada Trust involves several steps to ensure it is set up correctly and serves its intended purpose. First, individuals need to determine the assets they wish to place in the trust. Next, they should consult with a legal professional to draft the trust document, specifying the terms and conditions. Once the trust is established, assets must be transferred into it, which may require additional documentation. Regular reviews and updates are essential to ensure the trust remains compliant with current laws and meets the grantor's goals.

Steps to Complete the Nevada Trust

Completing the Nevada Trust involves a series of methodical steps:

- Identify the assets to be included in the trust.

- Consult with an attorney specializing in trust law to draft the trust document.

- Designate a trustee who will manage the trust and its assets.

- Transfer ownership of the identified assets into the trust.

- Review and update the trust regularly to reflect any changes in circumstances or laws.

Legal Use of the Nevada Trust

The legal use of the Nevada Trust is governed by state laws that outline how trusts must be created and managed. It is essential to comply with these laws to ensure the trust is valid and enforceable. The trust must have a clear purpose, and the grantor must have the legal capacity to create it. Additionally, all assets placed into the trust must be properly titled in the name of the trust to provide legal protection and benefits.

Key Elements of the Nevada Trust

Several key elements define the Nevada Trust, including:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust and its assets.

- Beneficiaries: Individuals or entities who will benefit from the trust assets.

- Trust Document: The legal document that outlines the terms and conditions of the trust.

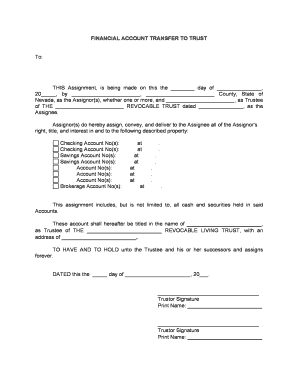

Required Documents

To establish a Nevada Trust, several documents are typically required. These include:

- The trust agreement, which outlines the terms and conditions.

- Asset transfer documents, such as deeds or titles, to transfer ownership to the trust.

- Identification documents for the grantor, trustee, and beneficiaries.

- Any additional documentation required by financial institutions or state authorities.

Quick guide on how to complete nevada trust

Prepare Nevada Trust effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Nevada Trust on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Nevada Trust seamlessly

- Find Nevada Trust and then click Get Form to initiate.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal authenticity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign Nevada Trust to guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Nevada trust and how does it work?

A Nevada trust is a legal arrangement that allows individuals to hold and manage assets within the state of Nevada, which is known for its favorable trust laws. This type of trust can provide signNow benefits such as asset protection and tax advantages. Using airSlate SignNow, you can securely sign documents related to your Nevada trust easily and efficiently.

-

What are the benefits of setting up a Nevada trust?

Setting up a Nevada trust offers numerous benefits, including privacy protection, asset protection from creditors, and favorable tax treatment. Additionally, a Nevada trust can help ensure that your assets are distributed according to your wishes, offering peace of mind. With airSlate SignNow, you can streamline the documentation process, ensuring compliance and security.

-

How much does it cost to create a Nevada trust?

The cost to create a Nevada trust can vary depending on the complexity of your assets and the services you require. Generally, fees can range from a few hundred to several thousand dollars, including legal fees and filing costs. Utilizing airSlate SignNow can help reduce time and costs associated with document signing and management.

-

What features does airSlate SignNow provide for managing a Nevada trust?

AirSlate SignNow provides features such as eSigning, document templates, and secure storage, which are essential for managing a Nevada trust. These tools allow users to efficiently draft, sign, and store important trust documents. With an easy-to-use interface, airSlate SignNow simplifies the process of handling your Nevada trust documentation.

-

Can I integrate airSlate SignNow with other tools for my Nevada trust?

Yes, airSlate SignNow offers integrations with various business tools and applications, making it easier to manage your Nevada trust. This can include CRM systems, cloud storage, and other productivity software. These integrations help streamline your workflow and ensure that your documents are easily accessible and organized.

-

Is eSigning valid for Nevada trust documents?

Yes, eSigning is valid for Nevada trust documents, provided they comply with Nevada state laws regarding electronic signatures. AirSlate SignNow adheres to these legal standards, ensuring that your electronically signed documents are legally binding. This feature provides a convenient and efficient way to manage your Nevada trust documentation.

-

What types of documents can I sign related to my Nevada trust?

You can sign various documents related to your Nevada trust, including trust agreements, amendments, and asset transfer documents. AirSlate SignNow allows you to create, edit, and sign these important legal documents with ease. This simplifies the overall management of your Nevada trust and ensures accuracy in your documentation.

Get more for Nevada Trust

- Performance goals summary

- Pdf human resources management in the hospitality form

- I 26 roll plot high res final south carolina department of form

- Paid sick leave lampampi washington state form

- Confidential report of accident investigation form

- 41 us code8102 drug free workplace requirements for form

- State of nevada alcohol ampamp drug program division of human form

- Monitoring your employees through gps what is legal and form

Find out other Nevada Trust

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now