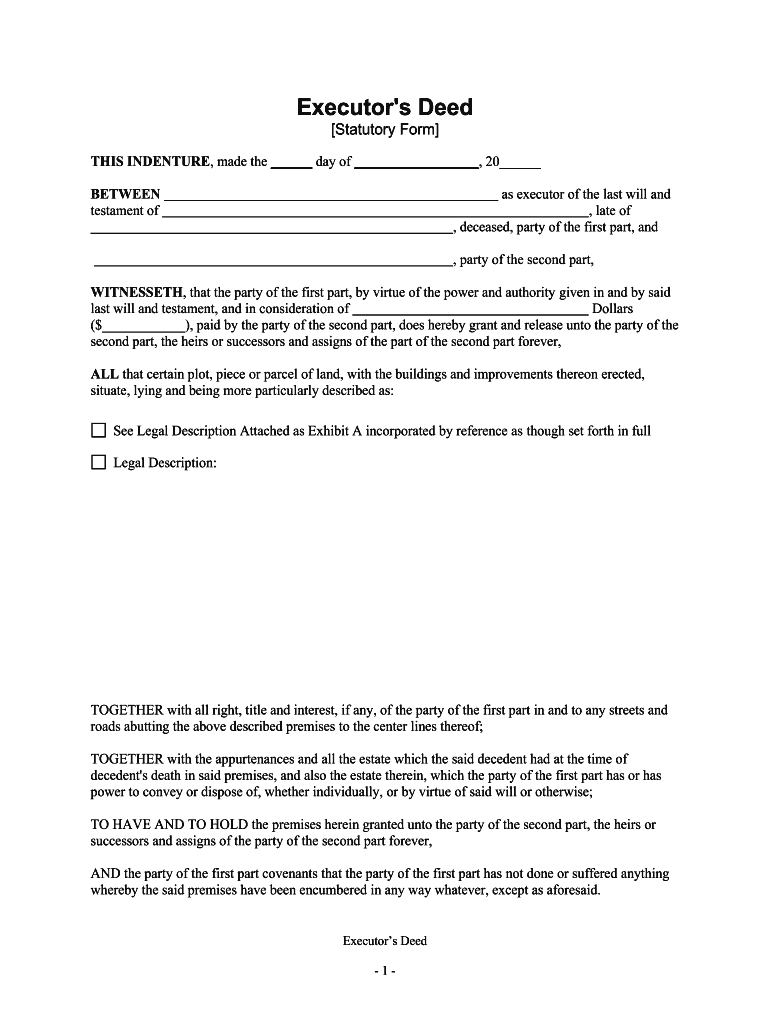

Executors Form

What is the Executors

The term "executors" refers to individuals appointed in a will to manage the estate of a deceased person. Their primary responsibility is to ensure that the deceased's wishes are carried out as outlined in the will. Executors are tasked with gathering assets, paying debts, and distributing the remaining property to beneficiaries. This role is crucial in the probate process, which is the legal procedure for validating a will and overseeing the distribution of assets.

Steps to complete the Executors

Completing the executors estate involves several key steps to ensure compliance with legal requirements and proper management of the estate. Here are the essential steps:

- Obtain a copy of the will: The executor should secure the original will and any codicils, which are amendments to the will.

- File the will with the probate court: The executor must submit the will to the appropriate probate court in the jurisdiction where the deceased resided.

- Notify beneficiaries and heirs: All individuals named in the will, as well as potential heirs, must be informed of the probate proceedings.

- Inventory the estate: The executor should compile a detailed list of all assets, including real estate, bank accounts, and personal property.

- Pay debts and taxes: The executor is responsible for settling any outstanding debts and filing necessary tax returns for the estate.

- Distribute assets: Once debts and taxes are settled, the executor can distribute the remaining assets to beneficiaries as outlined in the will.

Legal use of the Executors

The legal use of executors is governed by state laws, which dictate their authority and responsibilities. Executors must act in the best interest of the estate and its beneficiaries, adhering to fiduciary duties that require honesty and transparency. They are legally obligated to manage the estate's assets prudently and to keep accurate records of all transactions. Failure to comply with these legal obligations can result in personal liability for the executor.

State-specific rules for the Executors

Each state has its own rules and regulations regarding the role and responsibilities of executors. These laws can affect how the probate process is conducted, the timeline for completing the estate administration, and the required documentation. Executors should familiarize themselves with the specific laws in their state, as these can vary significantly. For example, some states may require the executor to obtain a bond, while others may not.

Required Documents

To effectively carry out their duties, executors need to gather and prepare several important documents. These typically include:

- The original will and any codicils.

- A death certificate to verify the passing of the deceased.

- An inventory of the estate's assets.

- Documentation of debts and liabilities.

- Tax returns for the deceased and the estate.

Examples of using the Executors

Executors play a vital role in various scenarios related to estate management. For instance, in a situation where a person passes away leaving behind a house, the executor must ensure the property is maintained, appraised, and ultimately sold or transferred to the beneficiaries. In another example, if the deceased had outstanding debts, the executor must negotiate with creditors and settle these obligations before distributing any assets. These examples illustrate the diverse responsibilities that executors must handle during the estate administration process.

Quick guide on how to complete executors

Effortlessly Prepare Executors on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents promptly and without holdups. Manage Executors on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Executors with Ease

- Find Executors and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to submit your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Executors and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of executors in an estate?

Executors are responsible for managing the estate of a deceased person, ensuring that the assets are distributed according to the will. They oversee various tasks, including paying debts and handling taxes, which can be streamlined using platforms like airSlate SignNow to efficiently sign and send necessary documents.

-

How can airSlate SignNow assist executors in managing estate documents?

airSlate SignNow provides executors with an easy-to-use platform for sending and eSigning essential documents. By simplifying document management, executors of estate can focus on fulfilling their obligations without getting bogged down by paperwork.

-

What are the pricing options for using airSlate SignNow for executors estate management?

airSlate SignNow offers competitive pricing plans suitable for executors managing estates. With various tiers available, users can choose a plan that best fits their needs, ensuring they only pay for the features they require while effectively managing the executors estate.

-

Does airSlate SignNow provide templates for estate documents?

Yes, airSlate SignNow offers a variety of templates specifically designed for executors estate documentation. These templates help streamline the process, ensuring that the necessary forms are filled out correctly and efficiently signed, allowing executors to focus on other important responsibilities.

-

Is airSlate SignNow secure for handling sensitive estate information?

Absolutely! airSlate SignNow prioritizes security, utilizing advanced encryption and authentication methods to protect sensitive information related to an executors estate. Users can trust that their documents are safe and secure throughout the eSigning process.

-

Can airSlate SignNow integrate with other software used by executors?

Yes, airSlate SignNow easily integrates with various software platforms that executors may already be using for estate management. This seamless integration enhances workflow efficiency, allowing executors to manage documents without the need for switching between multiple applications.

-

What benefits does airSlate SignNow offer to executors managing an estate?

airSlate SignNow offers several benefits for executors managing estates, including time-saving document handling, secure eSigning, and streamlined communication. By leveraging this platform, executors can enhance their productivity and ensure a smoother process for all parties involved.

Get more for Executors

- Justia disclosure of compensation of bankruptcy form

- Official bankruptcy forms moses apsan

- 31 printable college savings calculator forms and

- United states bankruptcy court district of oregon in re form

- In the united states bankruptcy court debtor order form

- Application for order to compel form

- Application of debtor in possession to employ attorneys form

- Lamie v us trustee brief meritsosgdepartment of form

Find out other Executors

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free