Ancient Mortgage Form

What is the ancient mortgage?

The ancient mortgage is a legal document that serves as a security interest in real property. It allows a lender to take possession of a property if the borrower defaults on their loan obligations. This type of mortgage is rooted in historical practices and has evolved to meet modern legal standards. In the United States, it is essential for both parties to understand the terms outlined in the ancient mortgage, including the rights and responsibilities of the borrower and lender. The document typically includes details such as the loan amount, interest rate, repayment schedule, and any conditions for default.

How to use the ancient mortgage

Using the ancient mortgage involves several key steps. First, the borrower and lender must agree on the loan terms, which are then documented in the ancient mortgage form. Once completed, both parties should sign the document, ensuring that it is executed according to state laws. After signing, the ancient mortgage must be recorded with the appropriate local government office to provide public notice of the lender's security interest in the property. This recording is crucial for protecting the lender's rights and establishing the priority of their claim in case of default.

Steps to complete the ancient mortgage

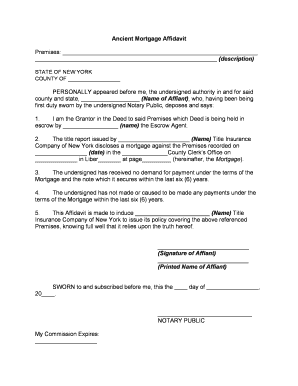

Completing the ancient mortgage form requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including borrower and lender details, property description, and loan terms.

- Fill out the ancient mortgage form accurately, ensuring all fields are completed.

- Review the document for any errors or omissions.

- Both parties should sign the form in the presence of a notary public to ensure legal validity.

- Record the signed document with the local county recorder's office to protect the lender's interest.

Legal use of the ancient mortgage

The legal use of the ancient mortgage is governed by state-specific laws and regulations. To ensure compliance, it is important to understand the legal framework surrounding mortgages in your state. This includes adhering to requirements for disclosures, interest rates, and the rights of both borrowers and lenders. Additionally, the ancient mortgage must meet the standards set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act, which governs the use of electronic signatures in the United States. This ensures that the document is legally binding when executed electronically.

Key elements of the ancient mortgage

Several key elements are essential for the validity of the ancient mortgage. These include:

- Identification of parties: Clearly state the names and addresses of the borrower and lender.

- Property description: Provide a detailed description of the property being mortgaged.

- Loan terms: Outline the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Default conditions: Specify the conditions under which the lender may take action in case of default.

- Signatures: Ensure that both parties sign the document, preferably in the presence of a notary.

State-specific rules for the ancient mortgage

State-specific rules for the ancient mortgage can vary significantly across the United States. Each state has its own laws regarding the execution, recording, and enforcement of mortgages. It is important for borrowers and lenders to familiarize themselves with these laws to avoid potential legal issues. For example, some states may require specific disclosures or impose limits on interest rates. Consulting with a legal professional who specializes in real estate can help ensure compliance with all relevant state regulations.

Quick guide on how to complete ancient mortgage

Prepare Ancient Mortgage effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Ancient Mortgage on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to edit and eSign Ancient Mortgage with ease

- Find Ancient Mortgage and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a standard wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Ancient Mortgage and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an ancient mortgage, and how does it relate to airSlate SignNow?

An ancient mortgage is a traditional form of securing a loan through property. With airSlate SignNow, you can create, manage, and eSign mortgage documents efficiently, ensuring that your ancient mortgage agreements are processed quickly and securely.

-

How can airSlate SignNow help with managing my ancient mortgage documents?

airSlate SignNow provides tools to digitize and automate the signing process for your ancient mortgage documents. This ensures that you can manage your contracts seamlessly, reducing paperwork and eliminating the risk of losing important documentation.

-

What are the pricing options for using airSlate SignNow with ancient mortgage agreements?

airSlate SignNow offers various pricing plans to suit different business needs when dealing with ancient mortgage agreements. These plans are designed to be cost-effective, allowing you to choose the option that provides the best value based on your volume of transactions.

-

Does airSlate SignNow integrate with other tools for managing an ancient mortgage?

Yes, airSlate SignNow seamlessly integrates with various accounting and document management tools that can assist you in managing your ancient mortgage. These integrations enhance workflow efficiency, making it easier to maintain and track your mortgage-related documents.

-

What are the benefits of using airSlate SignNow for ancient mortgage processing?

Using airSlate SignNow for ancient mortgage processing ensures greater efficiency, reduced processing times, and enhanced security for your documents. Additionally, the platform's user-friendly interface allows for quick access and easy navigation, streamlining your workflow.

-

Is airSlate SignNow secure for storing ancient mortgage documents?

Absolutely, airSlate SignNow employs robust security measures, including encryption and secure data storage, to protect your ancient mortgage documents. You can trust that your sensitive information is safeguarded while you manage your agreements digitally.

-

Can I access my ancient mortgage documents through mobile with airSlate SignNow?

Yes, airSlate SignNow offers a mobile-friendly platform that allows you to access your ancient mortgage documents on the go. This accessibility ensures that you can review, edit, and eSign your documents anytime, anywhere.

Get more for Ancient Mortgage

- Rule of thumb a five year overview of domestic violence in form

- Small claims arizona judicial branch form

- Have exemptions form

- Name of judgment creditor plaintiff form

- Ntroduction to small claims court unc school of government form

- Order designating exempt property aoc cv 409 form

- Lawsuitsnorth carolina judicial branch form

- Or judgment docket book amp page no form

Find out other Ancient Mortgage

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors