Official Form 202 Declaration under Penalty of Perjury for Non

Understanding the Official Form 202 Declaration Under Penalty of Perjury

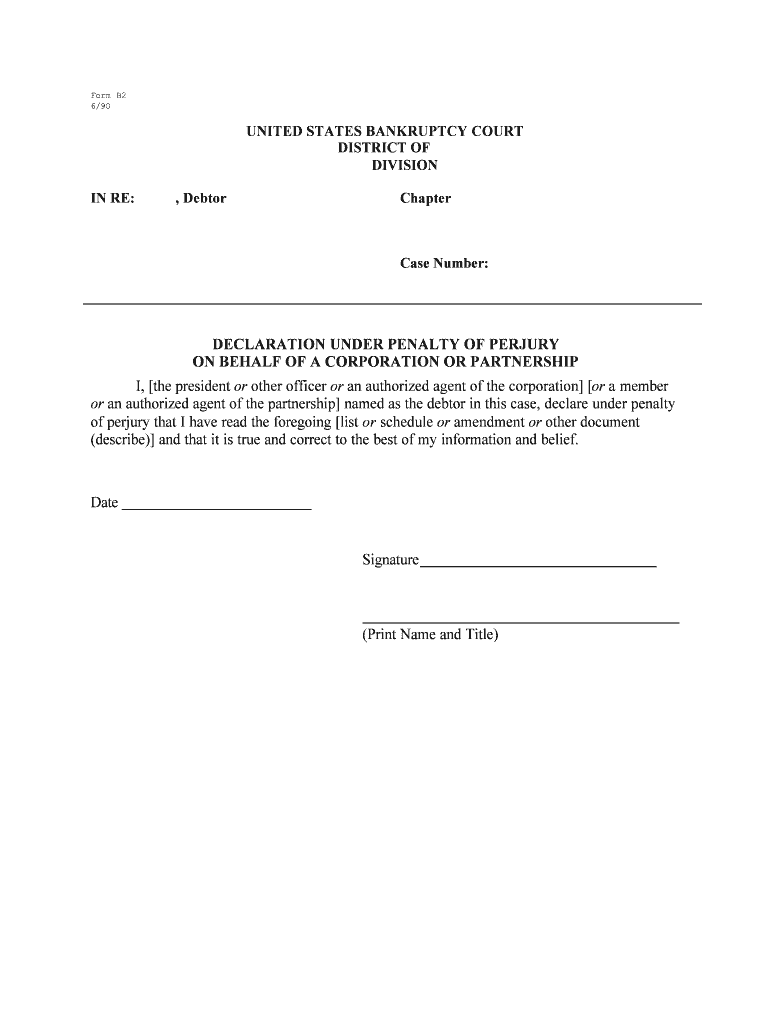

The Official Form 202 Declaration Under Penalty of Perjury is a crucial document used in various legal and administrative processes in the United States. This form is often required to affirm the truthfulness of information provided in official documents, ensuring that the signer acknowledges the legal implications of providing false information. The declaration serves as a legal statement that the signer understands the penalties associated with perjury, which can include fines and imprisonment.

Steps to Complete the Official Form 202 Declaration Under Penalty of Perjury

Completing the Official Form 202 involves several key steps to ensure accuracy and compliance with legal standards. First, gather all necessary information that will be required on the form, including personal identification details and any relevant case numbers. Next, carefully fill out each section of the form, ensuring that all information is truthful and complete. Once completed, review the form for any errors or omissions before signing. Finally, sign the form in the designated area, acknowledging that you declare under penalty of perjury that the information provided is true and correct.

Legal Use of the Official Form 202 Declaration Under Penalty of Perjury

The Official Form 202 is utilized in various legal contexts, including tax filings, immigration applications, and court proceedings. Its primary function is to provide a sworn statement that the information submitted is accurate. This form is particularly important in situations where false statements can lead to severe legal consequences. Understanding when and how to use this form correctly is essential for compliance with legal requirements.

Obtaining the Official Form 202 Declaration Under Penalty of Perjury

The Official Form 202 can typically be obtained from various government agencies, including the IRS or state departments. It is often available online as a downloadable PDF, which can be filled out electronically or printed for manual completion. Ensure that you are using the most current version of the form, as outdated versions may not be accepted by authorities.

Penalties for Non-Compliance with the Official Form 202 Declaration Under Penalty of Perjury

Failing to comply with the requirements of the Official Form 202 can result in serious repercussions. Individuals who submit false information or fail to complete the form accurately may face legal penalties, including fines and potential imprisonment. Understanding the gravity of this declaration is crucial, as it reinforces the importance of honesty and accuracy in all legal matters.

Examples of Using the Official Form 202 Declaration Under Penalty of Perjury

The Official Form 202 is commonly used in various scenarios, such as tax returns where taxpayers must declare the accuracy of their income and deductions. It is also employed in legal cases where parties must affirm the truthfulness of their claims or defenses. These examples highlight the form's versatility and its critical role in maintaining the integrity of legal processes.

Quick guide on how to complete official form 202 declaration under penalty of perjury for non

Prepare Official Form 202 Declaration Under Penalty Of Perjury For Non with ease on any device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the needed form and securely store it in the cloud. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Official Form 202 Declaration Under Penalty Of Perjury For Non on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Official Form 202 Declaration Under Penalty Of Perjury For Non effortlessly

- Find Official Form 202 Declaration Under Penalty Of Perjury For Non and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Decide how you wish to share your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Official Form 202 Declaration Under Penalty Of Perjury For Non and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a penalty of perjury statement?

A penalty of perjury statement is a declaration made by an individual that their statements are true and correct, under the threat of legal penalty. Using airSlate SignNow, you can easily include this statement in your documents to ensure authenticity and legal validity.

-

How does airSlate SignNow help with penalty of perjury statements?

airSlate SignNow provides the ability to integrate a penalty of perjury statement into your documents seamlessly. By using our platform, you can enhance the integrity of your documents and ensure all parties understand the seriousness of their declarations.

-

Is there a cost associated with adding a penalty of perjury statement using airSlate SignNow?

airSlate SignNow offers a cost-effective solution for managing electronic signatures, including documents that require a penalty of perjury statement. Pricing plans are tailored to meet various business needs, ensuring you pay only for the features required.

-

What features does airSlate SignNow offer for eSigning documents with a penalty of perjury statement?

With airSlate SignNow, you can customize your documents to include a penalty of perjury statement, eSign them securely, and manage signatures with ease. Our user-friendly interface simplifies the process, making it accessible for all users.

-

Can I integrate airSlate SignNow with other software to manage penalty of perjury statements?

Yes, airSlate SignNow allows for seamless integration with various applications to enhance your workflow. This means you can easily manage documents with penalty of perjury statements alongside other business tools you already use.

-

What are the benefits of using airSlate SignNow for creating penalty of perjury statements?

The benefits of using airSlate SignNow include improved document security, quicker transaction times, and enhanced compliance. By utilizing our platform, you can confidently create documents with a penalty of perjury statement, knowing they meet legal standards.

-

Is it legally binding to use a penalty of perjury statement with airSlate SignNow?

Yes, documents signed via airSlate SignNow that include a penalty of perjury statement are legally binding. Our platform complies with U.S. eSignature laws, ensuring your statements hold legal weight in various jurisdictions.

Get more for Official Form 202 Declaration Under Penalty Of Perjury For Non

- Nys health care proxy 2007 form

- For medical orifagreement printable form

- Doh 154 form

- Completed sample of a part822 chemical dependence outpatient services comprehensive psychosocial evaluation 2011 form

- Annual water form

- Mta certificate metropolitan transportation authority form

- Doh 5178a form

- Hipaa form 2016 2005

Find out other Official Form 202 Declaration Under Penalty Of Perjury For Non

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself