Oklahoma Oklahoma Installments Fixed Rate Promissory Note Secured by Residential Real Estate Form

Understanding the Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate

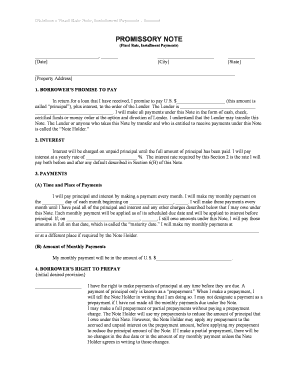

The Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines the terms of a loan secured by real estate in Oklahoma. This form is essential for borrowers who wish to formalize a loan agreement with fixed repayment terms. It specifies the amount borrowed, the interest rate, the repayment schedule, and the consequences of default. This note serves as a binding agreement between the lender and borrower, ensuring that both parties understand their rights and obligations.

Steps to Complete the Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Completing the Oklahoma Installments Fixed Rate Promissory Note requires careful attention to detail. Start by entering the names and addresses of both the borrower and lender. Next, specify the loan amount and the interest rate. Clearly outline the repayment schedule, including the frequency of payments and the total number of installments. It is important to include provisions for late payments and default scenarios. Finally, both parties must sign the document, ideally in the presence of a notary, to ensure its legal validity.

Legal Use of the Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate

This promissory note is legally recognized in Oklahoma, provided it meets specific requirements under state law. It must include essential elements such as the loan amount, interest rate, repayment terms, and signatures of both parties. By adhering to these legal stipulations, the note can be enforced in a court of law if necessary. It is advisable for both parties to retain a copy of the signed document for their records.

Key Elements of the Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Several key elements must be included in the Oklahoma Installments Fixed Rate Promissory Note to ensure its effectiveness. These include:

- Borrower and Lender Information: Full names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate applied to the loan.

- Repayment Schedule: Detailed information on payment frequency and total number of payments.

- Default Provisions: Terms outlining what happens in case of non-payment.

- Signatures: Required signatures of both parties, ideally notarized.

Obtaining the Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate

To obtain the Oklahoma Installments Fixed Rate Promissory Note, individuals can access templates online or consult with legal professionals for customized documents. Many legal websites offer downloadable forms that comply with Oklahoma state laws. It is important to ensure that the chosen template includes all necessary elements to be legally binding. Additionally, consulting a lawyer can provide guidance tailored to specific situations and needs.

State-Specific Rules for the Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate

Oklahoma has specific regulations governing promissory notes, including requirements for interest rates and repayment terms. It is crucial for both lenders and borrowers to familiarize themselves with these state laws to ensure compliance. For instance, Oklahoma law may dictate maximum allowable interest rates and necessary disclosures. Understanding these rules can help prevent future legal disputes and ensure that the agreement is enforceable.

Quick guide on how to complete oklahoma oklahoma installments fixed rate promissory note secured by residential real estate

Effortlessly Create Oklahoma Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents promptly without any holdups. Manage Oklahoma Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate across any device with the airSlate SignNow applications for Android or iOS and enhance your document-related processes today.

How to Modify and Electronically Sign Oklahoma Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate with Ease

- Locate Oklahoma Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Oklahoma Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Oklahoma Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

An Oklahoma Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines the terms of a loan secured by a residential property. It allows the borrower to pay the loan in installments at a fixed interest rate, providing clarity and predictability in repayment. This type of note is commonly used in real estate transactions to ensure both parties understand their obligations.

-

How does the pricing work for the Oklahoma Oklahoma Installments Fixed Rate Promissory Note?

Pricing for the Oklahoma Oklahoma Installments Fixed Rate Promissory Note may vary depending on the loan amount and terms negotiated between lender and borrower. Typically, lenders may charge an application fee, and interest rates will be fixed based on market conditions. It’s essential to review all terms and expenses involved to understand the total cost of the loan.

-

What are the benefits of using an Oklahoma Oklahoma Installments Fixed Rate Promissory Note?

The primary benefit of an Oklahoma Oklahoma Installments Fixed Rate Promissory Note is the predictability in repayment due to fixed installments. This structure helps borrowers manage their finances effectively and ensures lenders have a secured investment in residential real estate. Additionally, this note can facilitate smoother transactions and provide legal protections for both parties involved.

-

Can I customize the terms of my Oklahoma Oklahoma Installments Fixed Rate Promissory Note?

Yes, you can customize the terms of your Oklahoma Oklahoma Installments Fixed Rate Promissory Note to meet your specific needs. Factors such as interest rate, payment schedule, and loan term duration are negotiable between the lender and borrower. This flexibility enables you to tailor the agreement to fit your financial situation.

-

What integrations are available with the airSlate SignNow platform for handling promissory notes?

AirSlate SignNow provides several integrations that streamline the process of creating and managing Oklahoma Oklahoma Installments Fixed Rate Promissory Notes. You can integrate it with popular applications like Google Drive, Salesforce, and Microsoft Office to enhance productivity and document management. This allows for a seamless experience in eSigning and document collaboration.

-

Is it easy to eSign my Oklahoma Oklahoma Installments Fixed Rate Promissory Note?

Yes, eSigning your Oklahoma Oklahoma Installments Fixed Rate Promissory Note is straightforward with airSlate SignNow. The platform offers an intuitive interface that allows you and other parties to sign documents securely and efficiently. You can complete the signing process from anywhere, making it convenient for all involved.

-

How long does it take to complete the Oklahoma Oklahoma Installments Fixed Rate Promissory Note process?

The time to complete the Oklahoma Oklahoma Installments Fixed Rate Promissory Note process can vary, but with airSlate SignNow, it can be done quickly. Once all terms are agreed upon, your document can be prepared and sent for signing in just a few minutes. Factors such as responsiveness from participants and complexity of the terms may impact overall duration.

Get more for Oklahoma Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- Sec interpretation independent directors of investment form

- Software license agreementtrusona form

- Sample managed service agreement provided by axcient form

- Managed network agreement form

- Amendment no 6 to managed network agreement between form

- Services agreement and statement of work by secgov form

- Sprint communications company ampamp sprint spectrum agreement form

- Sprint master application and services agreement secgov form

Find out other Oklahoma Oklahoma Installments Fixed Rate Promissory Note Secured By Residential Real Estate

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors