Oregon Corporation Business Form

What is the Oregon Corporation Business

The Oregon Corporation Business refers to the legal framework and requirements for establishing and operating a corporation within the state of Oregon. This includes understanding the necessary filings, compliance with state regulations, and maintaining good standing with the Oregon Secretary of State. Corporations in Oregon can take various forms, including C corporations and S corporations, each with distinct tax implications and operational guidelines. Understanding these distinctions is crucial for business owners to make informed decisions about their corporate structure.

Steps to complete the Oregon Corporation Business

Completing the Oregon Corporation Business involves several key steps that ensure compliance with state laws. The process typically includes:

- Choosing a Business Name: The name must be unique and not already in use by another registered entity in Oregon.

- Filing Articles of Incorporation: This document must be submitted to the Oregon Secretary of State, detailing the corporation's purpose, registered agent, and other essential information.

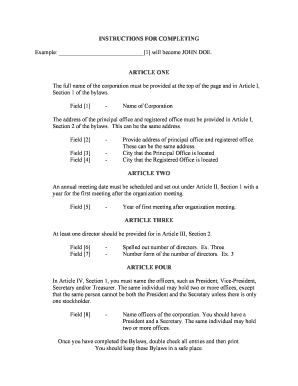

- Creating Bylaws: Bylaws outline the internal governance of the corporation, including roles of directors and procedures for meetings.

- Obtaining Necessary Licenses and Permits: Depending on the business type, additional licenses may be required at the local, state, or federal level.

- Registering for Taxes: Corporations must obtain an Employer Identification Number (EIN) from the IRS and register for state taxes.

Legal use of the Oregon Corporation Business

The legal use of the Oregon Corporation Business encompasses adhering to state laws and regulations governing corporate operations. This includes maintaining accurate records, holding regular meetings, and filing annual reports with the Secretary of State. Corporations must also comply with federal regulations, such as tax obligations and employment laws. Ensuring legal compliance protects the corporation's status and limits personal liability for its owners and directors.

Required Documents

To successfully establish an Oregon Corporation, several key documents are required, including:

- Articles of Incorporation: This foundational document outlines the corporation's structure and purpose.

- Bylaws: Bylaws provide the rules for governance and operation of the corporation.

- Employer Identification Number (EIN): Issued by the IRS, this number is necessary for tax purposes.

- Business Licenses: Depending on the industry, specific licenses may be required to operate legally.

State-specific rules for the Oregon Corporation Business

Oregon has specific rules that govern the formation and operation of corporations, which include requirements for annual reporting, fees, and compliance with state laws. Corporations must file an annual report that includes updated information about the business and its officers. Additionally, Oregon law mandates that corporations maintain a registered agent within the state to receive legal documents. Understanding these state-specific rules is essential for ensuring compliance and maintaining good standing.

How to obtain the Oregon Corporation Business

Obtaining the Oregon Corporation Business involves a systematic approach to filing the necessary paperwork and fulfilling state requirements. This process begins with selecting a unique business name and preparing the Articles of Incorporation. Once these documents are completed, they must be submitted to the Oregon Secretary of State, along with the required filing fee. After approval, the corporation is officially recognized, allowing it to operate legally within Oregon.

Quick guide on how to complete oregon corporation business

Effortlessly prepare Oregon Corporation Business on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents swiftly without any delays. Manage Oregon Corporation Business on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Oregon Corporation Business without hassle

- Locate Oregon Corporation Business and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight crucial sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Oregon Corporation Business and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's pricing for Oregon corporation businesses?

airSlate SignNow offers flexible pricing plans tailored specifically for Oregon corporation businesses. Depending on your needs, you can choose from various subscription options that provide cost-effective solutions to facilitate document signing and management. Pricing details are clearly outlined on our website, allowing you to select a plan that fits your budget.

-

How does airSlate SignNow support document eSigning for Oregon corporations?

airSlate SignNow provides a straightforward platform for Oregon corporations to eSign documents securely and efficiently. With our intuitive interface, users can easily upload, send, and manage documents for electronic signatures, streamlining business processes. This enhances productivity while maintaining compliance with state and federal laws.

-

What features does airSlate SignNow offer specifically for Oregon corporation businesses?

AirSlate SignNow includes a robust set of features tailored for the needs of Oregon corporation businesses. These features include customizable templates, bulk sending options, and mobile accessibility, making it an ideal solution for businesses looking to enhance their document workflow. With these tools, businesses can ensure seamless collaboration and timely completion of important documents.

-

Can airSlate SignNow integrate with other tools used by Oregon corporations?

Yes, airSlate SignNow offers seamless integrations with popular applications and tools that Oregon corporations frequently use. These integrations allow for smooth workflows and enhanced productivity, enabling businesses to manage their documents alongside existing software like CRM systems, cloud storage, and other productivity tools.

-

How does airSlate SignNow enhance document security for Oregon corporation businesses?

AirSlate SignNow prioritizes security, providing encryption and secure access protocols to protect sensitive information for Oregon corporation businesses. Our platform complies with industry standards and regulations, ensuring that your eSigned documents remain confidential and tamper-proof. This commitment to security assures businesses that their documents are safe throughout the signing process.

-

What are the benefits of using airSlate SignNow for Oregon corporation businesses?

Using airSlate SignNow offers numerous benefits for Oregon corporation businesses, including time savings, cost reduction, and improved efficiency in document handling. Our solution simplifies the signing process, allowing businesses to focus on their core operations while ensuring necessary paperwork is managed quickly and effectively. Additionally, the user-friendly design ensures an effortless experience for all users.

-

Is there customer support available for Oregon corporation businesses using airSlate SignNow?

Absolutely, airSlate SignNow provides dedicated customer support tailored to the needs of Oregon corporation businesses. We offer various support channels, including live chat, email, and phone assistance. Our knowledgeable support team is ready to assist with any questions or issues you may encounter while using our platform.

Get more for Oregon Corporation Business

- License agreement by and between casi pharmaceuticals inc form

- License agreement the wodehouse no 3 trust and ask form

- Contaminant plume locations western municipal water district form

- Hco cape may llc offering statement 1 a 1 a form

- 21 form single track license

- Teknik digital arts inc form sb 2a received 0301

- Exclusive sponsorship agreement amazoncom inc and form

- Balloon svg png icon free download 560034 form

Find out other Oregon Corporation Business

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple