Mo 60 2024-2026

What is the Mo 60

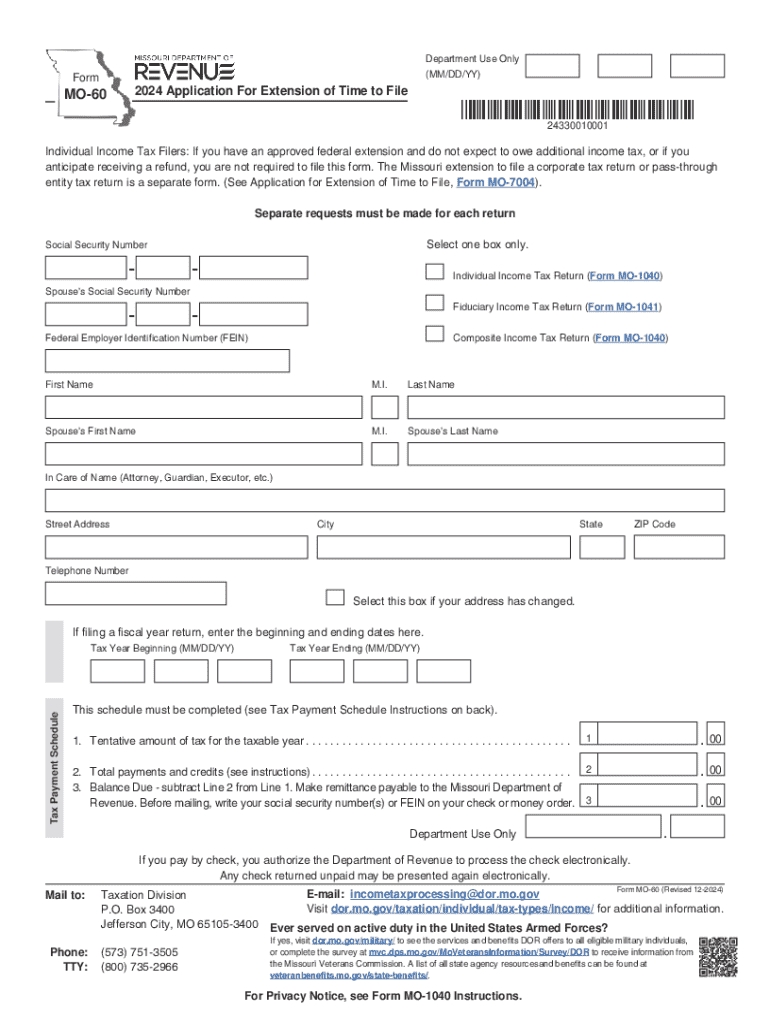

The Mo 60 is a specific form used primarily for reporting certain tax-related information to the appropriate authorities. This form serves as a crucial document for individuals and businesses in the United States, ensuring compliance with federal and state regulations. It is important to understand the purpose of the Mo 60 to effectively utilize it in various financial scenarios.

How to use the Mo 60

Using the Mo 60 involves several steps that ensure accurate completion and submission. First, gather all necessary information related to your financial activities that require reporting. Next, fill out the form with precise details, including your identification information and the specific financial data required. Once completed, review the form for accuracy before submitting it to the appropriate agency, either electronically or via mail.

Steps to complete the Mo 60

Completing the Mo 60 requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant documentation, such as income statements and previous tax returns.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check your entries for any errors or omissions.

- Sign and date the form where required.

- Submit the form to the designated agency, ensuring you meet any filing deadlines.

Legal use of the Mo 60

The Mo 60 must be used in accordance with federal and state laws. It is essential to understand the legal implications of submitting this form, as inaccuracies or omissions can lead to penalties. Ensure that the information provided is truthful and complete to maintain compliance with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Mo 60 can vary based on specific circumstances, such as the type of income being reported. Generally, it is advisable to file the form by the end of the tax year to avoid any late penalties. Be aware of any state-specific deadlines that may apply, as these can differ from federal requirements.

Required Documents

To complete the Mo 60, you will need several supporting documents. These typically include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Any additional documentation that supports the information reported on the form.

Who Issues the Form

The Mo 60 is issued by the relevant tax authority, which may vary depending on the state or type of tax being reported. In most cases, the Internal Revenue Service (IRS) is the primary issuer of tax forms, including the Mo 60, for federal reporting purposes. Always ensure you are using the most current version of the form as provided by the issuing authority.

Create this form in 5 minutes or less

Find and fill out the correct mo 60

Create this form in 5 minutes!

How to create an eSignature for the mo 60

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Mo 60 and how does it relate to airSlate SignNow?

Mo 60 is a powerful feature within airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, making it easier to send and sign documents efficiently. With Mo 60, businesses can improve their productivity and reduce turnaround times.

-

How much does airSlate SignNow with Mo 60 cost?

The pricing for airSlate SignNow with Mo 60 is competitive and designed to fit various business needs. We offer flexible subscription plans that cater to different user requirements. For detailed pricing information, please visit our pricing page or contact our sales team.

-

What features does Mo 60 offer?

Mo 60 includes a range of features such as customizable templates, automated workflows, and real-time tracking of document status. These features are designed to enhance user experience and ensure that documents are managed efficiently. With Mo 60, users can also integrate with other tools for a seamless workflow.

-

What are the benefits of using Mo 60 for eSigning?

Using Mo 60 for eSigning provides numerous benefits, including increased efficiency and reduced paper usage. It allows businesses to send documents for signature quickly and securely, ensuring compliance with legal standards. Additionally, Mo 60 enhances collaboration by enabling multiple signers to review and sign documents simultaneously.

-

Can Mo 60 integrate with other software applications?

Yes, Mo 60 is designed to integrate seamlessly with various software applications, enhancing its functionality. This includes popular CRM systems, cloud storage solutions, and productivity tools. These integrations help businesses streamline their processes and improve overall efficiency.

-

Is Mo 60 suitable for small businesses?

Absolutely! Mo 60 is tailored to meet the needs of small businesses by providing an affordable and user-friendly eSigning solution. It helps small businesses save time and resources while ensuring that their document management processes are efficient and effective.

-

How secure is the Mo 60 eSigning process?

The Mo 60 eSigning process is highly secure, utilizing advanced encryption and authentication measures to protect sensitive information. airSlate SignNow complies with industry standards and regulations to ensure that your documents are safe. Users can trust that their data is handled with the utmost care and security.

Get more for Mo 60

- Lee county solid waste division leegov form

- Rider lease preferential form

- Arizona religious exemption 2016 2019 form

- Remplissable formulaire mandat protection future

- Form 1366

- Service request affidavit brightstar device protection form

- National recoveries forms

- Children with intensive needs cwin referral form

Find out other Mo 60

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed