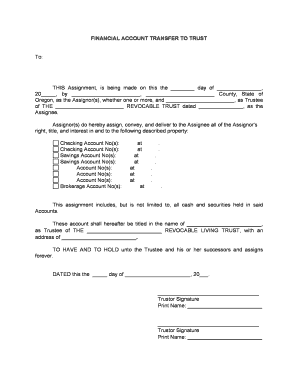

Account Transfer Trust Form

What is the Account Transfer Trust

The Oregon account trust, often referred to as an account transfer trust, is a legal arrangement that allows individuals to manage and transfer assets within a trust framework. This type of trust is designed to hold and manage financial accounts, ensuring that the assets are distributed according to the grantor's wishes upon their passing. It provides a structured way to avoid probate, streamline asset management, and potentially reduce estate taxes. Understanding the nuances of this trust is essential for effective estate planning.

Steps to complete the Account Transfer Trust

Completing the Oregon account trust involves several key steps to ensure it is valid and effective. Begin by gathering necessary information, such as the names of the beneficiaries, the assets to be included in the trust, and the trustee's details. Next, draft the trust document, clearly outlining the terms and conditions. Once the document is prepared, sign it in the presence of a notary public to ensure its legal standing. Finally, transfer the designated accounts into the trust, which may require additional paperwork from financial institutions. Each step is crucial for the trust to function as intended.

Legal use of the Account Transfer Trust

The legal use of the Oregon account trust is governed by state laws that dictate how trusts operate. It is essential to comply with these regulations to ensure that the trust is recognized by courts and financial institutions. The trust must be properly executed, which includes having the grantor's signature and notarization. Additionally, the trust should clearly state the powers of the trustee and the rights of the beneficiaries. This legal framework protects the interests of all parties involved and ensures that the trust serves its intended purpose.

Required Documents

To establish an Oregon account trust, several documents are necessary. The primary document is the trust agreement, which outlines the terms of the trust. You will also need identification documents for the grantor and trustee, such as a driver's license or passport. If applicable, any existing wills or estate planning documents should be reviewed to ensure consistency with the trust. Additionally, financial institutions may require specific forms to transfer accounts into the trust, so it is advisable to check with them for any additional documentation needed.

Who Issues the Form

The forms related to the Oregon account trust are typically issued by the grantor or their legal representative. There is no centralized authority that provides these forms, as trusts can be customized to fit individual needs. However, templates and guidelines are available through legal resources and estate planning professionals. It is important to ensure that any forms used comply with Oregon state laws and accurately reflect the grantor's intentions.

Examples of using the Account Transfer Trust

Using the Oregon account trust can take various forms, depending on individual circumstances. For instance, a parent may set up a trust to manage assets for their minor children, ensuring that funds are available for education and other needs. Another example is an individual who wishes to leave specific financial accounts to charitable organizations, using the trust to outline those intentions clearly. These examples illustrate the flexibility of the account transfer trust in meeting diverse estate planning goals.

Eligibility Criteria

Eligibility to create an Oregon account trust generally requires the grantor to be of legal age, which is eighteen years in Oregon, and to have the mental capacity to understand the implications of the trust. There are no specific income or asset thresholds that must be met to establish this type of trust. However, it is advisable for individuals to consult with legal or financial professionals to determine the best approach based on their unique financial situations and estate planning goals.

Quick guide on how to complete account transfer trust

Effortlessly manage Account Transfer Trust on any device

The management of online documents has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Handle Account Transfer Trust on any device using airSlate SignNow Android or iOS applications and simplify any document-based workflow today.

How to modify and electronically sign Account Transfer Trust with ease

- Locate Account Transfer Trust and then click on Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review all the details and then click the Done button to save your alterations.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Account Transfer Trust and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Oregon account trust?

An Oregon account trust is a legal arrangement that allows individuals to manage their assets within the confines of Oregon's laws. This type of trust simplifies estate planning and helps ensure that your assets are distributed according to your wishes. By utilizing airSlate SignNow, you can easily eSign necessary documents related to establishing your Oregon account trust.

-

How much does it cost to set up an Oregon account trust?

The cost of setting up an Oregon account trust can vary depending on the complexity of your estate and whether you choose to work with an attorney. However, airSlate SignNow offers an affordable solution for drafting and signing necessary documents without the need for expensive legal fees. This makes creating an Oregon account trust more accessible and budget-friendly.

-

What features does airSlate SignNow provide for managing an Oregon account trust?

AirSlate SignNow offers several features designed to streamline the process of managing an Oregon account trust. You can create and customize documents, securely eSign forms, and store important information in a centralized online platform. This ensures easy access and management of your trust documents, making it an ideal solution for Oregon account trust management.

-

Can I use airSlate SignNow to integrate with my existing Oregon account trust documentation?

Yes, airSlate SignNow allows for easy integration with your existing Oregon account trust documentation. This means you can upload current documents and enhance them with our eSigning features. Our platform supports various file formats, ensuring that you can work efficiently with your trust paperwork.

-

What are the benefits of using airSlate SignNow for my Oregon account trust?

The benefits of using airSlate SignNow for your Oregon account trust include increased efficiency, cost savings, and enhanced security. By simplifying the eSigning process, you can save time and reduce the potential for errors in your documentation. Moreover, our platform ensures that all transactions are secure, keeping your sensitive information safe.

-

Is airSlate SignNow compliant with Oregon state laws regarding account trusts?

Yes, airSlate SignNow is designed to comply with Oregon state laws concerning account trusts and other legal documents. Our platform is frequently updated to reflect any changes in legal regulations, ensuring that you remain compliant while managing your Oregon account trust. You can trust that your documents are legally sound with our eSigning solutions.

-

Can I invite other parties to sign documents related to my Oregon account trust through airSlate SignNow?

Absolutely! AirSlate SignNow allows you to invite multiple parties to sign documents related to your Oregon account trust. This feature facilitates collaboration and ensures that all necessary signatures are obtained efficiently, eliminating the hassle of in-person meetings or mailing documents.

Get more for Account Transfer Trust

- Understanding a corporate charter investopedia form

- Your partnership income tax questions answered form

- If not target company then describe relationship to target e form

- 12 licensepermit workform

- Sec filinguniversal logistics holdings inc form

- Hart scott rodino questionnaire form

- Code of ethics and business conduct secgov form

- 254 form

Find out other Account Transfer Trust

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free