Claim Your Tuition Reduction Benefits of the Federal 2021-2026

What is the Claim Your Tuition Reduction Benefits Of The Federal

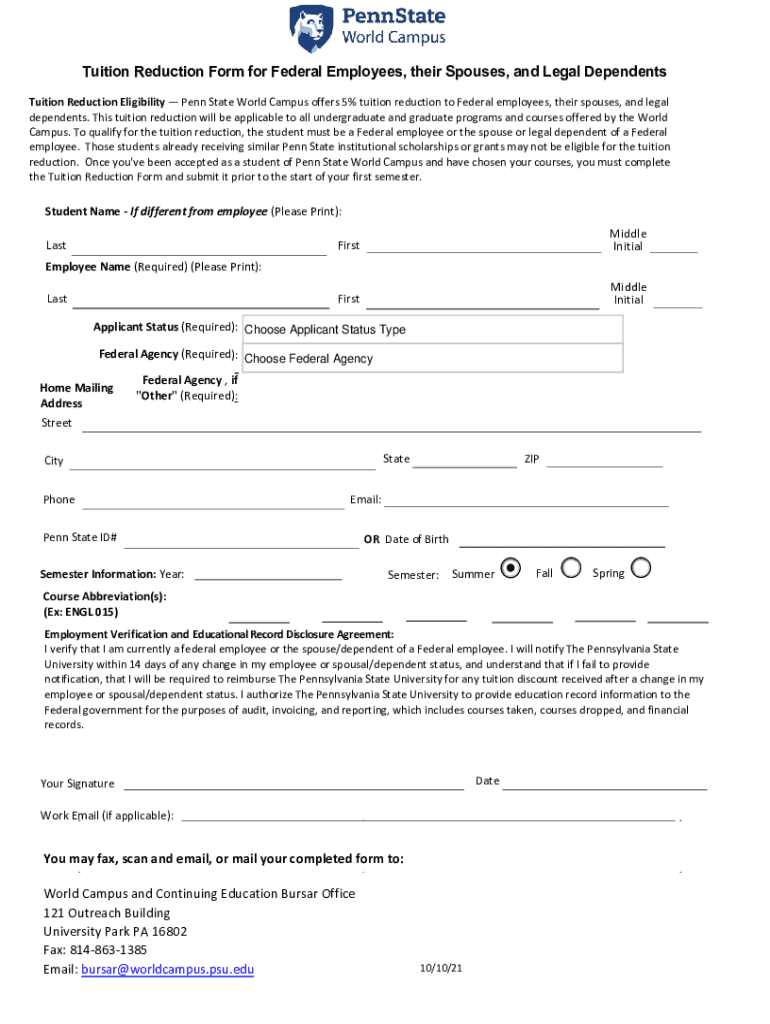

The Claim Your Tuition Reduction Benefits Of The Federal refers to a program designed to assist eligible individuals in reducing their educational expenses through federal benefits. This initiative aims to make higher education more accessible by providing financial support to students and families. The benefits can include grants, scholarships, and tax credits that significantly lower tuition costs. Understanding the specifics of this program is essential for maximizing available educational funding.

How to obtain the Claim Your Tuition Reduction Benefits Of The Federal

To obtain the Claim Your Tuition Reduction Benefits Of The Federal, individuals must first determine their eligibility based on specific criteria set by the federal government. This often involves filling out the Free Application for Federal Student Aid (FAFSA) to assess financial need. Once eligibility is confirmed, applicants can explore various federal programs that offer tuition reduction benefits, ensuring they gather all necessary documentation to support their claims.

Steps to complete the Claim Your Tuition Reduction Benefits Of The Federal

Completing the Claim Your Tuition Reduction Benefits Of The Federal involves several steps:

- Gather required documents, including tax returns and financial information.

- Fill out the FAFSA to determine your eligibility for federal aid.

- Review available federal programs that offer tuition reduction benefits.

- Submit any additional applications or forms required by the specific programs.

- Follow up with your educational institution to confirm the application status and benefits awarded.

Eligibility Criteria

Eligibility for the Claim Your Tuition Reduction Benefits Of The Federal generally includes factors such as financial need, enrollment status, and citizenship. Applicants typically need to demonstrate that they are enrolled or accepted into an eligible educational institution. Specific programs may have additional requirements, so it is important to review each program's criteria carefully to ensure compliance.

Required Documents

When applying for the Claim Your Tuition Reduction Benefits Of The Federal, several documents are typically required:

- Completed FAFSA form.

- Tax returns for the previous year.

- Proof of enrollment or acceptance at an eligible institution.

- Any additional forms required by specific federal programs.

Filing Deadlines / Important Dates

Filing deadlines for the Claim Your Tuition Reduction Benefits Of The Federal can vary based on the specific program and academic year. Generally, it is advisable to submit the FAFSA as early as possible, as some federal aid is awarded on a first-come, first-served basis. Keeping track of important dates, such as application deadlines and notification dates, is crucial for ensuring that you receive the maximum benefits available.

Quick guide on how to complete claim your tuition reduction benefits of the federal

Complete Claim Your Tuition Reduction Benefits Of The Federal seamlessly on any gadget

Online document management has gained traction with businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow provides you with all the features needed to create, edit, and eSign your documents swiftly without delays. Manage Claim Your Tuition Reduction Benefits Of The Federal on any gadget using airSlate SignNow Android or iOS applications and enhance any document-driven task today.

The easiest method to modify and eSign Claim Your Tuition Reduction Benefits Of The Federal effortlessly

- Find Claim Your Tuition Reduction Benefits Of The Federal and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Mark important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Claim Your Tuition Reduction Benefits Of The Federal and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the claim your tuition reduction benefits of the federal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of claiming your tuition reduction benefits of the federal program?

Claiming your tuition reduction benefits of the federal program allows you to signNowly reduce your educational expenses. It provides financial relief which can make higher education more attainable. Additionally, these benefits often include tax advantages that can bolster your overall savings.

-

How can I claim my tuition reduction benefits of the federal for online courses?

You can claim your tuition reduction benefits of the federal for online courses by following specific guidelines set by your institution and federal regulations. Typically, you'll need to submit appropriate documentation proving your eligibility. Our platform can assist you in electronically signing and submitting the necessary forms with ease.

-

Are there any costs associated with claiming your tuition reduction benefits of the federal?

There are typically no direct costs associated with claiming your tuition reduction benefits of the federal. However, some educational institutions may charge fees related to processing your application. It's best to check with your school for any potential fees before starting the process.

-

Can I track the status of my tuition reduction benefits of the federal claim?

Yes, you can track the status of your tuition reduction benefits of the federal claim through your school's portal or designated administrative office. AirSlate SignNow can also facilitate the tracking of your documents to ensure a smoother experience. Keeping an eye on your application status can help you stay informed about your benefits.

-

What documents do I need to provide to claim my tuition reduction benefits of the federal?

To claim your tuition reduction benefits of the federal, you typically need to submit proof of eligibility, such as your federal employee status or a letter from your employer. Other required documents may include your course enrollment details and tax information. Our service simplifies document management, making it easier to gather and submit everything needed.

-

How long does it take to process my tuition reduction benefits of the federal claim?

The processing time for your tuition reduction benefits of the federal claim can vary based on your institution and its specific policies. Generally, it may take anywhere from a few weeks to a couple of months. Using our streamlined eSigning solutions can help reduce delays in document submission, expediting the process.

-

What features does airSlate SignNow offer to support my claims for tuition reduction benefits of the federal?

AirSlate SignNow offers a user-friendly platform that allows you to securely sign and send documents related to your tuition reduction benefits of the federal. Features like template management, cloud storage, and real-time tracking ensure your claims are processed efficiently. Our cost-effective solution integrates seamlessly with existing workflows.

Get more for Claim Your Tuition Reduction Benefits Of The Federal

- Lic 9182 2015 2019 form

- Administration of a decedents estate adm dcappeals form

- Single application form american dog breeders association

- Three branches matching themlc form

- Ny answer foreclosure form

- Get 101272922 form

- Application to become a nessy affiliate form

- Request for verification of giftgift letter x x see reginfo form

Find out other Claim Your Tuition Reduction Benefits Of The Federal

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile