Pennsylvania Assignment of Mortgage by Individual Mortgage Holder Form

What is the Pennsylvania Assignment of Mortgage by Individual Mortgage Holder?

The Pennsylvania Assignment of Mortgage by Individual Mortgage Holder is a legal document used to transfer the rights and obligations of a mortgage from one party to another. This form is essential in situations where the original mortgage holder wishes to assign their interest in the mortgage to a new lender or buyer. The assignment must be executed properly to ensure that it is legally binding and enforceable in a court of law.

This document typically includes details such as the names of the parties involved, the original mortgage information, and the specific terms of the assignment. Understanding this form is crucial for both individual mortgage holders and potential assignees to ensure compliance with state laws and regulations.

Steps to Complete the Pennsylvania Assignment of Mortgage by Individual Mortgage Holder

Completing the Pennsylvania Assignment of Mortgage involves several key steps to ensure its validity and legal acceptance. Here is a straightforward guide:

- Gather necessary information: Collect details about the original mortgage, including the mortgage number, property address, and names of all parties involved.

- Fill out the form: Carefully complete the assignment form, ensuring all fields are accurately filled in. This includes specifying the new mortgage holder's details.

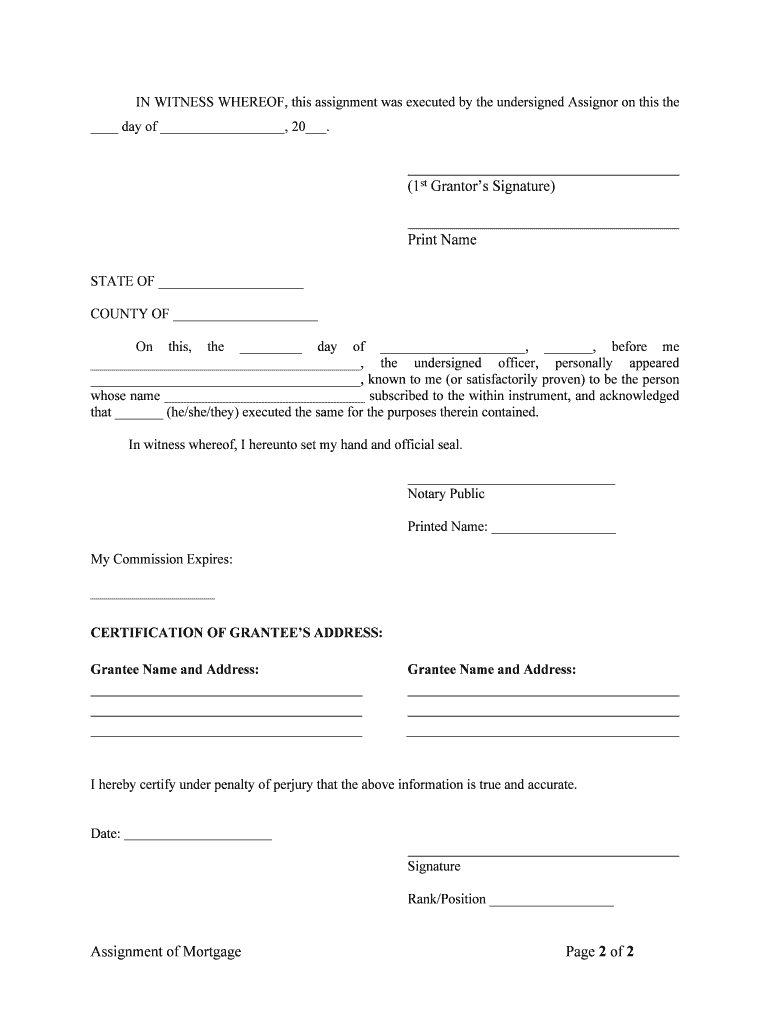

- Sign the document: All parties involved must sign the form. It is advisable to have the signatures notarized to add an extra layer of authenticity.

- File the assignment: Submit the completed assignment to the appropriate county office where the original mortgage was recorded. This step is crucial for public record purposes.

By following these steps, individuals can ensure that their assignment of mortgage is processed correctly and remains legally enforceable.

Legal Use of the Pennsylvania Assignment of Mortgage by Individual Mortgage Holder

The legal use of the Pennsylvania Assignment of Mortgage is governed by state laws that dictate how mortgages can be assigned. This form is legally binding when executed in accordance with Pennsylvania statutes. It is essential to ensure that the assignment is recorded with the county recorder of deeds to protect the rights of the new mortgage holder.

Failure to adhere to these legal requirements may result in complications regarding the enforceability of the mortgage. Therefore, understanding the legal framework surrounding this assignment is vital for all parties involved.

Key Elements of the Pennsylvania Assignment of Mortgage by Individual Mortgage Holder

Several key elements must be included in the Pennsylvania Assignment of Mortgage to ensure its validity:

- Names of the parties: Clearly state the names of the assignor (original mortgage holder) and the assignee (new mortgage holder).

- Property description: Provide a detailed description of the property associated with the mortgage, including its address and any relevant identifiers.

- Mortgage details: Include information about the original mortgage, such as the mortgage number and date of execution.

- Signatures: Ensure that all parties sign the document, preferably in the presence of a notary public.

Incorporating these elements will help ensure that the assignment is recognized and enforceable under Pennsylvania law.

How to Obtain the Pennsylvania Assignment of Mortgage by Individual Mortgage Holder

Obtaining the Pennsylvania Assignment of Mortgage is a straightforward process. Individuals can typically access the form through several channels:

- Online resources: Many legal websites provide downloadable templates for the assignment of mortgage.

- County recorder's office: Visit or contact the local county recorder's office to request a copy of the form.

- Legal professionals: Consulting with a real estate attorney can provide guidance and ensure that the form is completed correctly.

By utilizing these resources, individuals can easily obtain the necessary form to facilitate the assignment of their mortgage.

Examples of Using the Pennsylvania Assignment of Mortgage by Individual Mortgage Holder

There are various scenarios in which the Pennsylvania Assignment of Mortgage may be utilized:

- Transfer of ownership: When a property is sold, the seller may assign the existing mortgage to the buyer as part of the sale agreement.

- Refinancing: A homeowner may choose to refinance their mortgage with a new lender, requiring the assignment of the original mortgage to the new lender.

- Inheritance situations: If a property owner passes away, heirs may need to assign the mortgage to themselves or to a new lender as part of settling the estate.

These examples illustrate the practical applications of the assignment of mortgage form in various real estate transactions.

Quick guide on how to complete pennsylvania assignment of mortgage by individual mortgage holder

Effortlessly Complete Pennsylvania Assignment Of Mortgage By Individual Mortgage Holder on Any Device

Digital document management has become increasingly favored among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Pennsylvania Assignment Of Mortgage By Individual Mortgage Holder on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

Steps to Edit and Electronically Sign Pennsylvania Assignment Of Mortgage By Individual Mortgage Holder Seamlessly

- Obtain Pennsylvania Assignment Of Mortgage By Individual Mortgage Holder and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Decide how you would like to send your form, via email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about missing or misfiled documents, tedious form searches, or inaccuracies that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Pennsylvania Assignment Of Mortgage By Individual Mortgage Holder and ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an assignment of mortgage pdf?

An assignment of mortgage PDF is a legal document that officially transfers mortgage rights from one party to another. It is essential for ensuring the new mortgage holder has the necessary authority to manage the mortgage. airSlate SignNow simplifies the process of creating and signing these documents, making it easy for users to generate their assignment of mortgage PDFs.

-

How can airSlate SignNow help with assignment of mortgage PDFs?

airSlate SignNow streamlines the creation, signing, and sharing of assignment of mortgage PDFs, helping businesses save time and reduce paperwork. With its user-friendly interface, you can easily fill out your document and send it for electronic signatures. This enhances the efficiency of your mortgage management process.

-

Is there a cost to using airSlate SignNow for assignment of mortgage PDFs?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs, including plans that are specifically beneficial for managing assignment of mortgage PDFs. Our competitive pricing ensures that you receive a cost-effective solution without compromising on features or functionality. You can choose the plan that best suits your requirements and budget.

-

What features are available for creating assignment of mortgage PDFs?

airSlate SignNow provides a range of features for creating assignment of mortgage PDFs, including customizable templates, electronic signatures, and document tracking. Users can edit content within the PDF, set signing order, and even add secure fields for sensitive information. These features help ensure that your documents are not only well-prepared but also legally binding.

-

Can I integrate airSlate SignNow with other software for assignment of mortgage PDFs?

Absolutely! airSlate SignNow offers integration with popular CRM and management software, allowing you to streamline your workflow involving assignment of mortgage PDFs. By connecting with tools like Salesforce, Google Drive, or Microsoft Office, you can enhance productivity and ensure all your documents are seamlessly managed in one place.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for document signing, including assignment of mortgage PDFs, offers numerous benefits. It allows for faster turnaround times with electronic signatures, reduces the likelihood of errors, and eliminates the need for printing and faxing. These advantages contribute to a more efficient and eco-friendly approach to document management.

-

How secure is the assignment of mortgage PDF process with airSlate SignNow?

The security of your assignment of mortgage PDF documents is a top priority for airSlate SignNow. We utilize industry-leading encryption methods to protect your data, ensuring that your documents are safe from unauthorized access. Additionally, our platform complies with regulatory standards to provide peace of mind during the signing process.

Get more for Pennsylvania Assignment Of Mortgage By Individual Mortgage Holder

- Independent contractor journalistreporter agreement form

- Vinylaluminum siding installation contract form

- Attorney services agreement this agreement form

- Exterminator services contract form

- Awning services contract form

- Bath remodeling services contract form

- Pre cast concrete contract form

- Table of contents city of folsom form

Find out other Pennsylvania Assignment Of Mortgage By Individual Mortgage Holder

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple