Sc Satisfaction Mortgage Form

What is the SC Satisfaction Mortgage?

The South Carolina satisfaction mortgage is a legal document that serves to release a mortgage lien on a property once the debt has been fully paid. This form is essential for homeowners who have completed their mortgage payments, as it officially clears the mortgage from public records. The satisfaction release mortgage form ensures that the lender relinquishes all claims to the property, providing peace of mind to the homeowner. It is a critical step in the homeownership process and is recognized under South Carolina law.

How to Use the SC Satisfaction Mortgage

Using the South Carolina satisfaction mortgage involves several steps to ensure that the document is properly executed and recorded. First, the lender must prepare the satisfaction release mortgage form, which includes details such as the borrower’s name, property address, and mortgage information. Once completed, the form must be signed by an authorized representative of the lending institution. The next step is to file the document with the local county clerk's office to make the release official. This process is crucial for maintaining accurate property records and protecting the homeowner's rights.

Steps to Complete the SC Satisfaction Mortgage

Completing the South Carolina satisfaction mortgage requires careful attention to detail. Here are the essential steps:

- Obtain the satisfaction release mortgage form from your lender.

- Fill in the necessary information, including the borrower's details and mortgage specifics.

- Ensure the form is signed by the lender’s authorized representative.

- Submit the completed form to the county clerk’s office where the property is located.

- Request a copy of the recorded document for your records.

Following these steps will help ensure that your mortgage is officially released and that you receive the necessary documentation for your records.

Legal Use of the SC Satisfaction Mortgage

The South Carolina satisfaction mortgage is governed by state laws that dictate its legal use. It is essential for the form to meet specific requirements to be considered valid. This includes proper execution by the lender and adherence to filing procedures. The satisfaction release mortgage form must be filed with the appropriate county office to ensure that it is recognized legally. Failure to comply with these regulations may result in complications regarding property ownership and title clarity.

Key Elements of the SC Satisfaction Mortgage

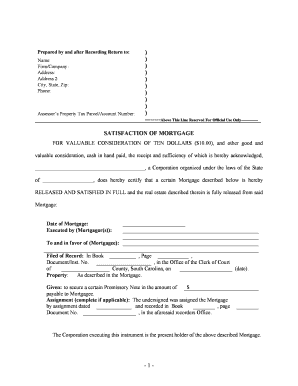

The key elements of the South Carolina satisfaction mortgage include:

- Borrower Information: Full name and address of the borrower.

- Lender Information: Name and contact details of the lending institution.

- Property Description: Complete address and legal description of the property.

- Mortgage Details: Original loan amount, date of the mortgage, and loan number.

- Signatures: Required signatures from the lender's authorized representative.

These elements ensure that the document is complete and legally binding, facilitating a smooth release of the mortgage lien.

State-Specific Rules for the SC Satisfaction Mortgage

In South Carolina, specific rules govern the use of the satisfaction mortgage form. The state requires that the form be filed within a certain timeframe after the mortgage has been paid off, typically within thirty days. Additionally, the form must be notarized to ensure its authenticity. Homeowners should also be aware of any local regulations that may affect the filing process, as these can vary by county. Understanding these state-specific rules is vital for ensuring compliance and protecting property rights.

Quick guide on how to complete sc satisfaction mortgage

Effortlessly Prepare Sc Satisfaction Mortgage on Any Device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Sc Satisfaction Mortgage on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and electronically sign Sc Satisfaction Mortgage without hassle

- Locate Sc Satisfaction Mortgage and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Select important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in a few clicks from any device you prefer. Modify and electronically sign Sc Satisfaction Mortgage and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is SC satisfaction mortgage and how does airSlate SignNow assist with it?

SC satisfaction mortgage refers to the process of documenting the full repayment of a mortgage loan. airSlate SignNow simplifies this process by providing businesses with the tools to easily send and eSign the necessary satisfaction documents, ensuring compliance and efficiency.

-

How does airSlate SignNow enhance the mortgage satisfaction process?

By using airSlate SignNow, businesses can streamline the SC satisfaction mortgage process with automated workflows and electronic signatures. This not only accelerates document handling but also reduces the risk of errors, helping companies save time and resources.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers various pricing plans to fit different needs, including options for small businesses and larger enterprises. Each plan is designed to provide essential features for managing SC satisfaction mortgage documents efficiently, all at competitive rates.

-

Can I integrate airSlate SignNow with my existing systems for SC satisfaction mortgage processes?

Yes, airSlate SignNow offers seamless integrations with many popular applications, ensuring your SC satisfaction mortgage processes can be linked with your existing systems. This capability enhances workflow automation and improves overall productivity.

-

What features does airSlate SignNow provide for managing mortgage documents?

Key features of airSlate SignNow for SC satisfaction mortgage management include customizable templates, secure eSigning, and detailed audit trails. These tools help ensure that all documents are correctly executed and can be easily tracked throughout the process.

-

Is airSlate SignNow compliant with legal standards for mortgage documents?

Absolutely! airSlate SignNow is designed to meet legal compliance requirements for SC satisfaction mortgage documents, including eSignature laws. This provides assurance that your business can operate within the legal framework while streamlining document processes.

-

What are the benefits of using airSlate SignNow for SC satisfaction mortgage?

Using airSlate SignNow for SC satisfaction mortgage offers numerous benefits, including quick turnaround times, reduced paperwork, and enhanced security. These advantages lead to improved customer satisfaction and operational efficiency for businesses.

Get more for Sc Satisfaction Mortgage

- Full text of ampquotreport on human artificial reproduction and form

- Poli ies ampampamp proedures manual form

- Form retail internet site agreement

- Template talkattached kmlarchive 1 wikipedia form

- Privacy policy official us mint store form

- This is a sample personal protective equipment program of form

- 4204 installment agreementsinternal revenue service form

- Subscription video on demand license agreement germany form

Find out other Sc Satisfaction Mortgage

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document