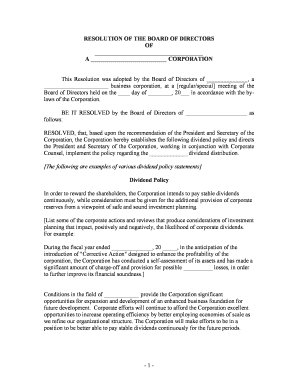

Dividend Policy Form

Understanding the Dividend Policy

The dividend policy outlines how a corporation decides to distribute profits to its shareholders. This policy can significantly impact the financial health of a company and the satisfaction of its investors. A well-defined dividend policy provides clarity on the frequency and amount of dividends, which can enhance investor confidence and attract potential shareholders. Companies typically adopt one of several approaches, including stable, residual, or hybrid dividend policies, each of which reflects different strategies for managing earnings and shareholder expectations.

Key Elements of the Dividend Policy

Several critical components define a robust dividend policy. These include:

- Dividend Payout Ratio: This ratio indicates the percentage of earnings distributed as dividends, guiding how much profit is retained for reinvestment.

- Dividend Stability: Companies often aim for consistent dividend payments to build trust with investors, which can influence stock prices positively.

- Growth Prospects: The policy should align with the company’s growth strategy, balancing between reinvesting in the business and returning value to shareholders.

- Market Conditions: External economic factors can impact dividend decisions, requiring flexibility in the policy to adapt to changing market conditions.

Steps to Complete the Dividend Policy

Creating a dividend policy involves several key steps:

- Assess Financial Health: Review financial statements to determine profitability and cash flow.

- Define Objectives: Establish clear goals for the dividend policy, considering shareholder expectations and company growth.

- Choose a Dividend Model: Select a model that aligns with the company’s financial situation and market position.

- Communicate the Policy: Clearly communicate the dividend policy to shareholders and stakeholders to ensure transparency.

- Review Regularly: Periodically evaluate the policy to ensure it remains relevant to the company’s financial condition and market environment.

Legal Use of the Dividend Policy

Adhering to legal requirements is crucial when implementing a dividend policy. Corporations must comply with state laws regarding dividend distributions, which often dictate the conditions under which dividends can be paid. These laws typically require that dividends are paid from retained earnings and that the company remains solvent after the distribution. Understanding these legal frameworks helps prevent potential disputes and ensures that the company operates within the law.

Examples of Using the Dividend Policy

Real-world examples can illustrate how companies implement dividend policies. For instance, a mature company may adopt a stable dividend policy, providing regular, predictable dividends to attract income-focused investors. In contrast, a growth-oriented company might choose a residual dividend policy, paying dividends only after funding all profitable investment opportunities. These examples highlight the diversity of approaches and the importance of aligning the dividend policy with overall business strategy.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines that impact dividend distributions, particularly regarding taxation. Dividends are generally considered taxable income for shareholders, and understanding these tax implications is essential for both the company and its investors. Companies must ensure compliance with IRS regulations when declaring dividends to avoid penalties and ensure proper reporting on tax documents.

Quick guide on how to complete dividend policy

Complete Dividend Policy effortlessly on any device

Digital document management has become favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Handle Dividend Policy on any platform using airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The easiest way to alter and eSign Dividend Policy with minimal effort

- Find Dividend Policy and then click Get Form to begin.

- Use the tools provided to fill in your document.

- Highlight important sections of your documents or conceal sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors requiring new document prints. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Modify and eSign Dividend Policy to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the best suggestions on dividend distribution policy for small businesses?

Small businesses should consider several suggestions on dividend distribution policy, including retaining a portion of earnings for reinvestment, ensuring consistent dividends, and aligning distributions with business performance. Consulting with financial advisors can also help tailor a policy suitable for specific business contexts.

-

How can airSlate SignNow help manage documents related to dividend distribution policy?

airSlate SignNow simplifies the management of documents related to suggestions on dividend distribution policy by allowing users to create, send, and eSign financial agreements effortlessly. The platform's robust document management features enhance collaboration and ensure compliance with policy implementation.

-

What pricing plans are available for airSlate SignNow, and how do they support dividend distribution policy management?

airSlate SignNow offers various pricing plans designed to meet different business needs, including features that efficiently manage documents related to suggestions on dividend distribution policy. Each plan provides the essential tools for creating secure and legally binding documents critical to financial operations.

-

Can airSlate SignNow integrate with other financial tools to enhance dividend distribution policy management?

Yes, airSlate SignNow integrates seamlessly with various financial tools and software, providing a comprehensive solution for managing suggestions on dividend distribution policy. This integration enhances data flow and simplifies the documentation process, ensuring that all financial decisions are well-documented.

-

What are the benefits of using airSlate SignNow for dividend distribution policy documentation?

Using airSlate SignNow for your dividend distribution policy documentation offers numerous benefits, including increased efficiency, streamlined workflows, and the ability to track document status in real-time. These advantages ensure that businesses can adhere to their suggested policies effectively and minimize delays.

-

How does airSlate SignNow ensure the security of documents related to dividend distribution policies?

airSlate SignNow prioritizes security by implementing encryption and stringent access controls for all documents, including those related to suggestions on dividend distribution policy. This added level of security instills confidence among users that their sensitive financial documents are protected against unauthorized access.

-

What user support options are available for questions regarding dividend distribution policy on airSlate SignNow?

airSlate SignNow offers comprehensive user support including tutorials, FAQs, and direct customer service to assist with any questions regarding suggestions on dividend distribution policy. This commitment to support ensures that users can effectively utilize the platform to meet their specific business needs.

Get more for Dividend Policy

- Property owner rights ampampamp electric power easementhome form

- State of south carolina real property deed of county of form

- Partial release of oil and gas lease form

- Multiple lessees form

- Where lease grants lessee the right to release form

- How to negotiate an oil ampampamp gas lease attorney blog form

- Oil and gas lease between westland and sun valley energy corp form

- Legal aspects of real estate flashcardsquizlet form

Find out other Dividend Policy

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online