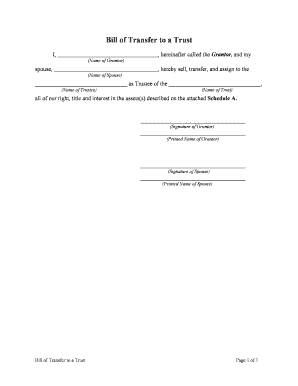

Transfer Trust Form

What is the Transfer Trust?

The transfer trust is a legal arrangement that allows individuals to transfer assets into a trust for the benefit of designated beneficiaries. This mechanism helps manage and protect assets while providing clear instructions on their distribution. Trusts can be used for various purposes, including estate planning, tax management, and asset protection. By utilizing a transfer trust, individuals can ensure that their assets are handled according to their wishes, potentially avoiding probate and minimizing estate taxes.

Steps to Complete the Transfer Trust

Completing a transfer trust involves several key steps to ensure the process is legally sound and effective. Here are the essential steps:

- Identify the assets: Determine which assets you wish to transfer into the trust, such as real estate, bank accounts, or investments.

- Choose a trustee: Select a trustworthy individual or institution to manage the trust and ensure it operates according to your wishes.

- Draft the trust document: Create a formal document outlining the terms of the trust, including the beneficiaries and the distribution of assets.

- Fund the trust: Transfer the identified assets into the trust, which may involve changing titles or account ownership.

- Review and update: Periodically review the trust to ensure it aligns with your current wishes and any changes in laws.

Legal Use of the Transfer Trust

The legal use of a transfer trust is governed by state laws, which can vary significantly. Generally, a transfer trust must comply with specific legal requirements to be valid. This includes proper drafting, execution, and funding of the trust. It is essential to ensure that the trust document is clear and unambiguous to avoid disputes among beneficiaries. Additionally, the trust must be funded appropriately to be effective in asset protection and management.

Required Documents

To establish a transfer trust, certain documents are typically required. These may include:

- Trust agreement: The primary document that outlines the terms and conditions of the trust.

- Asset documentation: Proof of ownership for assets being transferred, such as deeds for real estate or account statements for financial assets.

- Identification: Personal identification for the grantor, trustee, and beneficiaries to verify their identities.

Examples of Using the Transfer Trust

Transfer trusts can be utilized in various scenarios to achieve specific goals. Some common examples include:

- Estate planning: Individuals can use a transfer trust to ensure their assets are distributed according to their wishes after their passing.

- Tax planning: Transferring assets into a trust may help reduce estate taxes and provide tax benefits for beneficiaries.

- Asset protection: A transfer trust can shield assets from creditors, ensuring that they remain available for intended beneficiaries.

Eligibility Criteria

Eligibility to create a transfer trust typically requires the grantor to be of legal age and mentally competent. Additionally, the assets intended for transfer must be legally owned by the grantor. Understanding the specific eligibility criteria in your state is crucial, as laws may differ. Consulting with a legal professional can help clarify any requirements and ensure compliance with local regulations.

Quick guide on how to complete transfer trust

Effortlessly prepare Transfer Trust on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Manage Transfer Trust across any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Transfer Trust with ease

- Locate Transfer Trust and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or obscure sensitive information using the tools specifically designed for this purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Verify all details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searching for forms, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Transfer Trust, ensuring superb communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to transfer trust online using airSlate SignNow?

Transferring trust online with airSlate SignNow is a streamlined process. You simply create your trust documents, send them to relevant parties for eSignature, and track the entire process online. This solution ensures that all parties can complete the required actions efficiently, allowing you to transfer trust without hassle.

-

Is there a cost associated with transferring trust online through airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective while providing comprehensive features for transferring trust online. You can choose a plan that fits your budget and business requirements, ensuring accessibility to all.

-

What features does airSlate SignNow offer for transferring trust online?

airSlate SignNow provides a suite of features specifically designed to enhance the process of transferring trust online. Key features include customizable templates, secure cloud storage, and real-time tracking of document status. These tools ensure a smooth and efficient experience, making it easier to manage trust transfers.

-

How can I ensure the security of my documents when I transfer trust online?

Security is a top priority when you transfer trust online with airSlate SignNow. The platform employs robust encryption protocols to protect your documents and data. Additionally, you can manage access permissions to ensure that only authorized users can view or sign the trust documents.

-

Can I integrate airSlate SignNow with other software for transferring trust online?

Yes, airSlate SignNow seamlessly integrates with various third-party applications to enhance your workflow when transferring trust online. Popular integrations include Google Drive, Dropbox, and Salesforce. These integrations help streamline the document management process, making it easier to handle trust transfers.

-

What are the benefits of transferring trust online with airSlate SignNow compared to traditional methods?

Transferring trust online with airSlate SignNow offers multiple benefits over traditional methods. It signNowly reduces the time taken to complete transactions and minimizes paperwork. Additionally, the electronic signature feature accelerates the process, while ensuring that documents are legally binding and secure.

-

Is airSlate SignNow user-friendly for those unfamiliar with digital document signing?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for everyone, even those unfamiliar with digital document signing. The intuitive interface simplifies the process of transferring trust online, guiding users through each step clearly. Comprehensive support resources are also available to assist new users.

Get more for Transfer Trust

- Amendment to easement form

- Dont get ripped off how to fight a bad contractorangies form

- Assignors does hereby sell assign transfer and boem form

- Maps texas general land office texasgov form

- General assignment conveyance and bill of sale hawaii form

- This assignment bill of sale and conveyance ampquotassignment form

- Billboard attachment sublease agreement form

- Sample lease unsworth properties form

Find out other Transfer Trust

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now