Independent Contractor Payment Form

What is the Independent Contractor Payment

The independent contractor payment refers to the compensation that businesses provide to individuals who are not classified as employees but perform work or services on a contractual basis. This payment can include various forms of remuneration, such as hourly wages, project fees, or commission-based earnings. Understanding the nature of these payments is crucial for both contractors and businesses, as it affects tax obligations and compliance with legal regulations.

How to Use the Independent Contractor Payment

Utilizing the independent contractor payment involves several key steps. First, businesses must establish a clear agreement outlining the terms of payment, including the amount, frequency, and method of payment. This agreement should be documented in a contract, which both parties sign. Next, the contractor must submit an invoice detailing the services provided and the payment due. Finally, the business processes the payment, ensuring that all necessary tax documentation, such as a W-9 form, is completed to comply with IRS regulations.

Steps to Complete the Independent Contractor Payment

Completing the independent contractor payment involves a systematic approach:

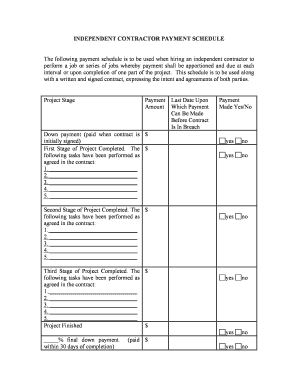

- Draft a contract that specifies the payment terms and conditions.

- Have the contractor complete a W-9 form to provide their taxpayer identification information.

- Request an invoice from the contractor after the work is completed.

- Review the invoice for accuracy and ensure it aligns with the contract.

- Process the payment using the agreed-upon method, such as direct deposit or check.

- Maintain records of the transaction for tax purposes.

Legal Use of the Independent Contractor Payment

The legal use of independent contractor payments is governed by various federal and state regulations. It is essential for businesses to classify workers correctly to avoid misclassification penalties. Proper documentation, including contracts and invoices, helps establish the legal framework for these payments. Additionally, compliance with tax regulations, such as issuing a 1099 form to contractors who earn more than a specified threshold, is necessary to ensure adherence to IRS guidelines.

Required Documents

When processing independent contractor payments, several documents are essential:

- Contract: A formal agreement outlining the scope of work and payment terms.

- W-9 Form: Completed by the contractor to provide tax identification information.

- Invoice: Submitted by the contractor to request payment for services rendered.

- 1099 Form: Issued by the business at the end of the year to report payments made to contractors.

IRS Guidelines

The IRS provides specific guidelines regarding independent contractor payments. These include the requirement to report payments made to contractors using Form 1099-NEC for amounts exceeding $600 in a calendar year. Businesses must also ensure that they are not withholding taxes from these payments, as independent contractors are responsible for their own tax obligations. Understanding these guidelines helps businesses maintain compliance and avoid potential penalties.

Quick guide on how to complete independent contractor payment

Complete Independent Contractor Payment effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle Independent Contractor Payment on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign Independent Contractor Payment with ease

- Find Independent Contractor Payment and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign Independent Contractor Payment to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's approach to independent contractor payment?

airSlate SignNow provides a seamless platform that simplifies the independent contractor payment process. By enabling businesses to send, sign, and manage payment agreements electronically, it enhances efficiency and reduces paperwork.

-

How does airSlate SignNow streamline independent contractor payment?

With airSlate SignNow, businesses can quickly create, send, and sign payment agreements for independent contractors. This automation reduces time spent on administrative tasks, allowing you to focus on your core business activities.

-

What features does airSlate SignNow offer for independent contractor payment?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure signing for independent contractor payment agreements. These features ensure that all parties can complete the payment process quickly and efficiently.

-

Is airSlate SignNow cost-effective for managing independent contractor payment?

Yes, airSlate SignNow is designed to be a cost-effective solution for independent contractor payment management. With various pricing plans, it allows businesses of all sizes to choose a plan that fits their budget and payment needs.

-

Can airSlate SignNow integrate with other payment systems for independent contractors?

Absolutely! airSlate SignNow integrates seamlessly with various payment systems, allowing you to manage independent contractor payment alongside your existing workflows. This integration helps streamline your overall process and minimizes manual data entry.

-

How secure is the independent contractor payment process with airSlate SignNow?

Security is a priority at airSlate SignNow. The independent contractor payment process is protected with robust encryption methods, ensuring that all documents and payment agreements are safe and secure from unauthorized access.

-

Can I customize my independent contractor payment agreements on airSlate SignNow?

Yes, airSlate SignNow allows you to customize independent contractor payment agreements to meet your specific requirements. You can modify templates to reflect your branding and include any relevant terms related to payment schedules.

Get more for Independent Contractor Payment

- Service of process information for petition for order of protection from

- Request for order to omit petitioners address and telephone form

- Response to petition for order of protection from domestic form

- Faqs domestic abuse under new mexico family violence form

- New mexico protective orders laws state laws findlaw form

- Domestic violence orders of protection under new mexicos form

- New mexico order of protection mutual or non mutualus form

- Custody support and division of property order attachment 4 form

Find out other Independent Contractor Payment

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple