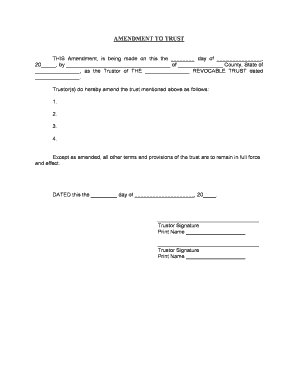

Utah Trust Form

What is the Utah Trust

The Utah Trust, often referred to as a living trust, is a legal arrangement that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after their death. This type of trust can help avoid probate, ensuring a smoother transition of assets to beneficiaries. The Utah Trust is designed to provide flexibility and control over one's estate, allowing for changes to be made as circumstances evolve.

How to use the Utah Trust

Utilizing the Utah Trust involves several key steps. First, individuals must identify and list their assets, including real estate, bank accounts, and personal property. Next, they should designate beneficiaries who will receive these assets upon their passing. It is essential to appoint a trustee, who will manage the trust and ensure that the terms are followed. Once these elements are established, the trust document must be created and signed, ideally with the assistance of a legal professional to ensure compliance with Utah laws.

Steps to complete the Utah Trust

Completing a Utah Trust involves a series of organized steps:

- Gather all relevant financial information and asset documentation.

- Choose a suitable trustee who will administer the trust.

- Draft the trust document, clearly outlining the terms and conditions.

- Sign the document in the presence of a notary to ensure its validity.

- Fund the trust by transferring ownership of assets into it.

Key elements of the Utah Trust

Several key elements define the Utah Trust, including:

- Revocability: Most Utah Trusts are revocable, allowing the grantor to modify or dissolve the trust at any time.

- Asset management: The trustee is responsible for managing the trust assets according to the grantor's wishes.

- Beneficiary designations: Clear instructions must be provided regarding who will receive the assets after the grantor's death.

- Tax considerations: The trust may have implications for estate and income taxes, which should be understood and planned for.

Legal use of the Utah Trust

The legal use of the Utah Trust is governed by state-specific laws that outline how trusts must be created and administered. It is crucial for individuals to ensure that their trust complies with Utah's legal requirements to be deemed valid. This includes proper execution of the trust document, adherence to state laws regarding asset transfers, and ongoing management by the appointed trustee. Legal advice is often recommended to navigate these complexities.

Required Documents

To establish a Utah Trust, several key documents are typically required:

- Trust agreement: The primary document outlining the terms of the trust.

- Asset documentation: Proof of ownership for all assets being transferred into the trust.

- Identification: Valid identification for the grantor and trustee.

- Notarization: A notarized signature may be necessary to validate the trust document.

Quick guide on how to complete utah trust

Finish Utah Trust effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to locate the necessary form and securely preserve it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Utah Trust on any platform using airSlate SignNow's Android or iOS apps and simplify any document-related task today.

The easiest way to edit and eSign Utah Trust without hassle

- Find Utah Trust and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Utah Trust and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an amendment living trust?

An amendment living trust is a legal document that modifies an existing living trust. This allows you to make changes to the trust's terms, beneficiaries, or assets without revoking the entire trust. It's an essential tool for estate planning, ensuring your wishes are carried out effectively.

-

Why should I use airSlate SignNow for my amendment living trust?

airSlate SignNow provides a user-friendly platform for creating, signing, and managing your amendment living trust. With features like electronic signatures and secure storage, you can ensure your documents are both accessible and protected. This makes the process of managing your trust quick and efficient.

-

How much does it cost to create an amendment living trust with airSlate SignNow?

The cost to create an amendment living trust with airSlate SignNow is competitive and tailored to fit different budgets. We offer flexible pricing plans that cater to both individual users and businesses. To get a precise quote, visit our pricing page or contact our sales team.

-

Can I integrate airSlate SignNow with other software for my amendment living trust?

Yes, airSlate SignNow can seamlessly integrate with various software applications you may be using, such as CRM systems and document management platforms. This integration enhances your workflow and allows for more efficient management of your amendment living trust. Check our integrations list to see the supported platforms.

-

Is it safe to sign my amendment living trust documents online?

Absolutely! airSlate SignNow uses advanced encryption and security protocols to ensure that your amendment living trust documents are protected. Our platform complies with industry standards, ensuring your information remains confidential and secure throughout the signing process.

-

Can I make multiple amendments to my living trust using airSlate SignNow?

Yes, you can make multiple amendments to your living trust using airSlate SignNow easily. Our platform allows you to update any aspect of your amendment living trust as needed, with a simple and intuitive interface. This flexibility ensures that your trust can adapt to changes in your circumstances or preferences.

-

What if I need legal assistance with my amendment living trust?

While airSlate SignNow provides the tools for creating and signing an amendment living trust, we always recommend consulting with a legal professional for personalized advice. They can help you navigate any complexities and ensure that your trust complies with local laws. Our platform is designed to work alongside legal experts if needed.

Get more for Utah Trust

- Request for subpoena duces tecum form

- Fillable online the undersigned applicant states under oath form

- Notice to patientsubpoena duces tecum for form

- Code 18 form

- Courts and legaltopics fairfax county form

- Circuit court local procedures civilcity of alexandria va form

- Code 27 32 form

- Emotional support dogs for witnesses in court form

Find out other Utah Trust

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile