Pennsylvania Inventory Form

What is the Pennsylvania Inventory Form

The Pennsylvania Inventory Form is a legal document used primarily in estate administration. It serves to provide a comprehensive list of all assets owned by a decedent at the time of their death. This form is essential for ensuring that the estate is properly managed and that all assets are accounted for during the probate process. The inventory typically includes real estate, personal property, bank accounts, and other financial assets.

How to use the Pennsylvania Inventory Form

Using the Pennsylvania Inventory Form involves several key steps. First, gather all necessary information about the decedent's assets, including their value and location. Next, accurately fill out the form with detailed descriptions of each asset. Once completed, the form must be filed with the appropriate probate court within the specified timeframe. This ensures compliance with state laws and helps facilitate the distribution of the estate to beneficiaries.

Steps to complete the Pennsylvania Inventory Form

Completing the Pennsylvania Inventory Form requires careful attention to detail. Begin by listing all assets in the designated sections of the form. Include the type of asset, its description, and its estimated value. Ensure that all information is accurate and up-to-date. After filling out the form, review it for completeness and correctness before submitting it to the probate court. Consider consulting with a legal professional if you have questions about specific assets or legal requirements.

Legal use of the Pennsylvania Inventory Form

The Pennsylvania Inventory Form is legally binding when completed correctly and submitted to the court. It must adhere to state laws regarding estate administration, including the requirement to list all assets and provide accurate valuations. Failure to comply with these legal standards can result in penalties or delays in the probate process. Therefore, understanding the legal implications of this form is crucial for executors and administrators of estates.

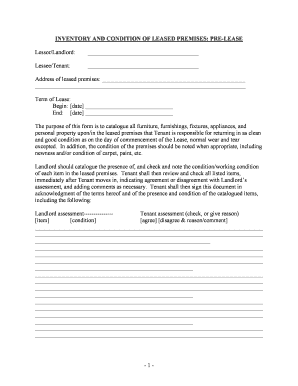

Key elements of the Pennsylvania Inventory Form

Key elements of the Pennsylvania Inventory Form include sections for personal property, real estate, financial accounts, and other significant assets. Each section requires specific details, such as asset descriptions and estimated values. Additionally, the form must include the decedent's information and the executor's signature. Ensuring that all key elements are addressed will help avoid issues during the probate process.

Who Issues the Form

The Pennsylvania Inventory Form is issued by the Pennsylvania court system, specifically through the probate court where the estate is being administered. Executors or administrators of estates must obtain the form from the court or its official website. It is important to use the most current version of the form to ensure compliance with state regulations.

Quick guide on how to complete pennsylvania inventory form

Manage Pennsylvania Inventory Form effortlessly on any device

Web-based document organization has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your files swiftly without any delays. Handle Pennsylvania Inventory Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Pennsylvania Inventory Form with ease

- Obtain Pennsylvania Inventory Form and click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or an invitation link, or download it to your computer.

Forget about missing or misplaced documents, laborious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Alter and eSign Pennsylvania Inventory Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to Pennsylvania post?

airSlate SignNow is an intuitive platform designed to empower businesses to send and eSign documents seamlessly. Specifically for users in Pennsylvania post, this service provides an efficient and cost-effective solution for managing document workflows, helping organizations streamline their operations and enhance productivity.

-

How does airSlate SignNow's pricing structure work for Pennsylvania post users?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses in Pennsylvania post. Each plan is designed for different levels of usage and features, ensuring that every organization can find anoption that suits their budget while maximizing their efficiency in document management.

-

What features does airSlate SignNow provide for users in Pennsylvania post?

airSlate SignNow includes a variety of features designed to simplify document handling for Pennsylvania post users. Key functionalities such as customizable templates, automated workflows, and secure eSigning options ensure that businesses can effectively manage their documents while maintaining compliance and security.

-

What are the benefits of using airSlate SignNow for businesses in Pennsylvania post?

Using airSlate SignNow provides numerous benefits for Pennsylvania post businesses, including enhanced efficiency, reduced turnaround times for document signing, and improved collaboration among teams. These advantages promote a more agile work environment, allowing companies to focus on growth and customer satisfaction.

-

Can airSlate SignNow integrate with other software commonly used in Pennsylvania post?

Yes, airSlate SignNow integrates seamlessly with various software applications that Pennsylvania post businesses often use. This compatibility allows for streamlined workflows, enabling users to manage their document signing processes alongside their existing tools like CRMs and project management software.

-

Is airSlate SignNow compliant with Pennsylvania post regulations?

Absolutely, airSlate SignNow adheres to all necessary regulations and standards applicable to Pennsylvania post businesses. This commitment to compliance ensures that all eSigned documents hold legal validity, reducing worries about regulatory risks for users in the region.

-

How can I get support for airSlate SignNow in Pennsylvania post?

Pennsylvania post users can access dedicated support for airSlate SignNow through various channels including live chat, email, and an extensive knowledge base. This multi-faceted support system ensures that businesses can receive timely assistance, making their experience with the platform hassle-free.

Get more for Pennsylvania Inventory Form

- Summary hearing findings and order continuing order form

- Windsor family divisionvermont judiciary form

- In support of the claims made in my complaint i state the following facts to be true and correct to the best of form

- Affidavit in support of relief from abuse complaint for child notary form

- Affidavit in support of request for emergency relief form

- Relief from abuse neglect and exploitation of a vermont judiciary form

- Section 6936b form

- Vermont family law practice manual vermont bar association form

Find out other Pennsylvania Inventory Form

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document