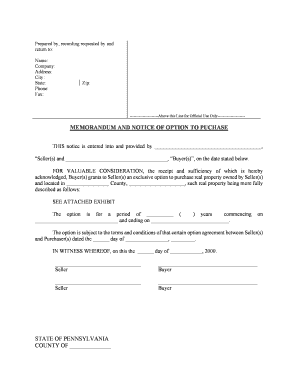

Pennsylvania Option Form

What is the Pennsylvania Option

The Pennsylvania Option refers to a specific provision that allows certain taxpayers in Pennsylvania to make choices regarding their tax liabilities. This option is particularly relevant for individuals and businesses seeking to optimize their tax situations while complying with state regulations. It is essential for taxpayers to understand the implications of this option, including how it may affect their overall tax burden and eligibility for various deductions.

How to use the Pennsylvania Option

Utilizing the Pennsylvania Option involves several steps that ensure compliance with state tax laws. Taxpayers must first determine their eligibility based on their specific financial situations. After confirming eligibility, they can select the appropriate option that aligns with their tax strategy. This may involve filling out specific forms, such as the PA memorandum, and submitting them through the designated channels. It is advisable to consult with a tax professional to navigate the complexities of this option effectively.

Steps to complete the Pennsylvania Option

Completing the Pennsylvania Option requires a systematic approach:

- Review eligibility criteria to ensure compliance with state requirements.

- Select the appropriate option based on your financial situation and tax objectives.

- Gather necessary documentation, including income statements and prior tax returns.

- Fill out the required forms accurately, ensuring all information is complete and correct.

- Submit the forms either online, by mail, or in person, depending on the submission methods available.

- Keep copies of all submitted documents for your records.

Legal use of the Pennsylvania Option

The legal use of the Pennsylvania Option is governed by state tax laws and regulations. Taxpayers must adhere to the guidelines set forth by the Pennsylvania Department of Revenue to ensure that their choices are valid and enforceable. Non-compliance with these regulations can lead to penalties or additional tax liabilities. It is crucial for individuals and businesses to stay informed about any changes in legislation that may impact their use of this option.

Key elements of the Pennsylvania Option

Several key elements define the Pennsylvania Option, including:

- Eligibility criteria that determine who can utilize the option.

- The specific forms required for submission, such as the PA memorandum.

- Deadlines for filing to avoid penalties.

- Potential tax benefits associated with choosing this option.

- Compliance requirements to ensure the option is legally binding.

Examples of using the Pennsylvania Option

Examples of using the Pennsylvania Option can vary widely based on individual circumstances. For instance, a self-employed individual may choose this option to maximize deductions related to business expenses. Alternatively, a retired taxpayer might utilize it to adjust their tax liabilities based on their fixed income. Each scenario highlights the flexibility of the Pennsylvania Option in addressing diverse financial situations while remaining compliant with state tax laws.

Quick guide on how to complete pennsylvania option

Complete Pennsylvania Option effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, alter, and eSign your documents quickly without delays. Manage Pennsylvania Option on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Pennsylvania Option with ease

- Obtain Pennsylvania Option and click Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Pennsylvania Option and ensure clear communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Pennsylvania option offered by airSlate SignNow?

The Pennsylvania option from airSlate SignNow allows businesses in Pennsylvania to efficiently sign and manage documents electronically. This service simplifies the signing process and ensures compliance with local regulations, making it an ideal choice for companies operating within the state.

-

How much does the Pennsylvania option cost?

Pricing for the Pennsylvania option varies based on the specific needs of your business. airSlate SignNow offers flexible plans tailored to different organizational sizes, ensuring that you find an affordable solution that meets your requirements for electronic signatures.

-

What features are included in the Pennsylvania option?

The Pennsylvania option includes a range of powerful features such as easy document customization, secure eSignature capabilities, and collaborative tools. These features ensure that your team can efficiently manage documents while maintaining a user-friendly experience.

-

Are there any benefits to using the Pennsylvania option?

Yes, the Pennsylvania option provides signNow benefits such as increased efficiency in document workflows, reduced paper usage, and enhanced security for sensitive information. By utilizing this option, businesses in Pennsylvania can streamline their processes and save valuable time.

-

Can the Pennsylvania option integrate with other tools?

Absolutely! The Pennsylvania option supports integrations with various third-party applications and services. This ensures a seamless experience by allowing you to connect airSlate SignNow with your existing workflows and tools.

-

Is the Pennsylvania option suitable for all business sizes?

Yes, the Pennsylvania option is designed to accommodate businesses of all sizes, from small startups to large enterprises. Regardless of your organization’s scale, airSlate SignNow provides features and pricing plans that can be tailored to your specific needs.

-

How secure is the Pennsylvania option for document signing?

The Pennsylvania option prioritizes security, utilizing advanced encryption technologies to protect your documents during the signing process. airSlate SignNow also complies with industry standards and regulations to ensure that your data remains private and secure.

Get more for Pennsylvania Option

- Reply date form

- You are directed to appear at the superior court in the criminal division form

- Chapter 217 emancipation of minors vermont laws form

- Hformsprobateformsoct1formsform 126wpd

- Asking for a relief from abuse ordervtlawhelporg form

- I understand my request for emergency relief has been denied form

- Criminal procedure rules committee agenda the florida bar form

- I request that this minor guardianship order issued by this court on form

Find out other Pennsylvania Option

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now