Show Examples and Samples of Balance Sheet 2008-2026

Understanding the balance sheet model

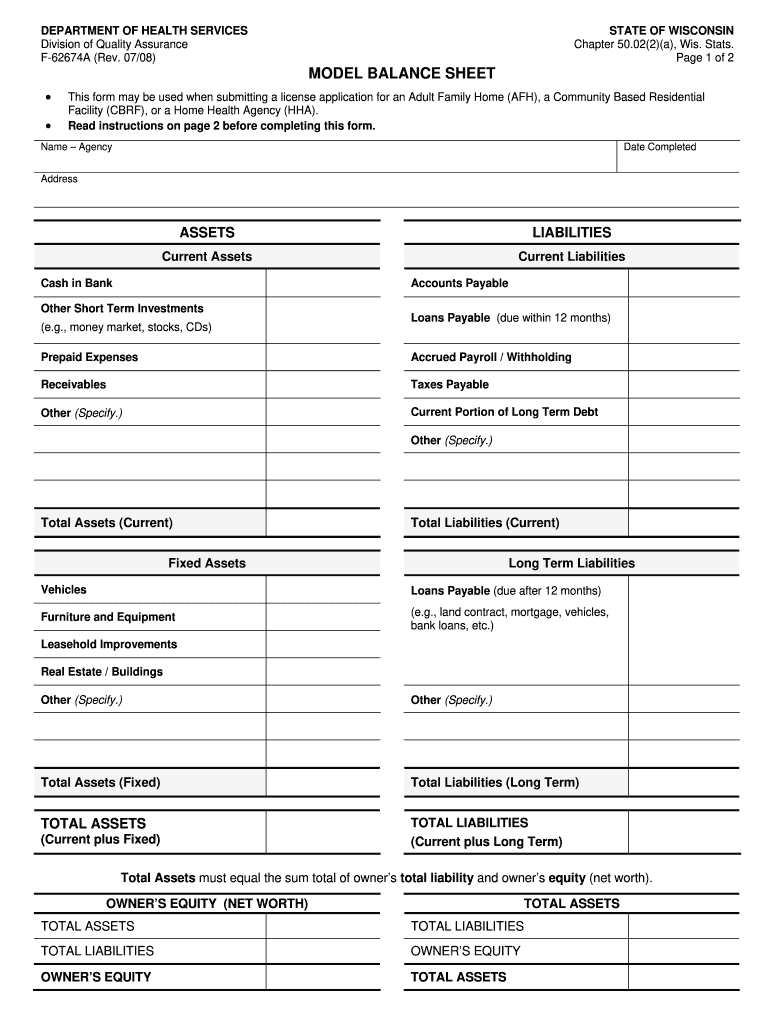

The balance sheet model serves as a financial statement that provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. This model is essential for businesses to assess their financial health and make informed decisions. It typically includes three main components: assets, which are what the company owns; liabilities, which are what the company owes; and equity, representing the owner's stake in the company. Understanding these elements is crucial for stakeholders, including investors, creditors, and management.

Key elements of the balance sheet model

When creating a balance sheet model, it is important to include specific key elements:

- Assets: These are divided into current and non-current assets. Current assets include cash, accounts receivable, and inventory, while non-current assets encompass property, plant, and equipment.

- Liabilities: Like assets, liabilities are categorized into current and long-term. Current liabilities include accounts payable and short-term debt, whereas long-term liabilities consist of loans and bonds payable.

- Equity: This section reflects the owner's investment in the business and includes retained earnings and common stock.

Steps to complete the balance sheet model

Completing a balance sheet model involves several key steps:

- Gather financial data: Collect all relevant financial information, including transactions, bank statements, and invoices.

- Organize assets: List all assets, ensuring to categorize them into current and non-current.

- List liabilities: Document all liabilities, separating them into current and long-term categories.

- Calculate equity: Determine the equity by subtracting total liabilities from total assets.

- Review and finalize: Ensure that the balance sheet is accurate and that the accounting equation (Assets = Liabilities + Equity) holds true.

Legal use of the balance sheet model

The balance sheet model must comply with various legal standards and regulations. In the United States, businesses are required to follow Generally Accepted Accounting Principles (GAAP) when preparing financial statements. This ensures consistency and transparency in financial reporting. Additionally, public companies must adhere to the Securities and Exchange Commission (SEC) regulations, which mandate the disclosure of financial information to protect investors.

Examples of using the balance sheet model

Practical examples of the balance sheet model can help illustrate its application:

- A small business may use a balance sheet to secure a loan by demonstrating its financial stability to a lender.

- Investors often analyze a company's balance sheet to assess its liquidity and financial leverage before making investment decisions.

- Non-profit organizations utilize balance sheets to provide transparency to donors regarding their financial health.

Digital vs. paper version of the balance sheet model

With advancements in technology, businesses can choose between digital and paper versions of the balance sheet model. Digital formats offer advantages such as easier updates, enhanced security, and improved accessibility. Electronic documents can be stored in the cloud, allowing for quick retrieval and sharing among stakeholders. Conversely, paper versions may still be used for traditional record-keeping but can be less efficient in terms of organization and accessibility.

Quick guide on how to complete model balance sheet form

Explore the simpler method to manage your Show Examples And Samples Of Balance Sheet

The traditional approach to finishing and authorizing documents requires an excessive amount of time compared to contemporary document management tools. In the past, you had to look for appropriate forms, print them, fill in all the information, and mail them. Now, you can discover, complete, and sign your Show Examples And Samples Of Balance Sheet all in one browser tab with airSlate SignNow. Creating your Show Examples And Samples Of Balance Sheet has never been easier.

Steps to finalize your Show Examples And Samples Of Balance Sheet with airSlate SignNow

- Access the category page needed and find your state-specific Show Examples And Samples Of Balance Sheet. Alternatively, utilize the search box.

- Ensure the version of the form is correct by reviewing it.

- Click Get form to enter editing mode.

- Fill your document with the necessary information using the editing tools.

- Review the entered information and click the Sign feature to validate your form.

- Select the most suitable method to create your signature: generate it, draw your signature, or upload an image of it.

- Click DONE to apply changes.

- Download the document to your device or move to Sharing settings to send it digitally.

Efficient online solutions like airSlate SignNow make completing and submitting your forms straightforward. Utilize it to discover how long document management and approval procedures are truly meant to be. You will save a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

How are Square and Stripe able to accept payments on merchants' behalf without requiring them to hold their own merchant accounts with a banking/financial institution?

This answer still gets a lot of attention, so I want to point out that it was written in 2011. A lot has changed in the payments industry since then.Square is what is known as an "aggregator", meaning they are the Merchant of Record (MOR) for the transactions they process. They are essentially allowing their customers to use their merchant account for the purposes of collecting credit card payments. PayPal employs essentially the same model.Stripe may also be acting as an aggregator, but appear to be going about it in a different way. Their terms of service state "Stripe may use your information to apply for card merchant acquiring accounts on your behalf…" (https://stripe.com/terms). Also, Ross Boucher from Stripe has said "Stripe is not the merchant of record" in For payment processing, how do Stripe and Samurai (FeeFighters) compare?.As the original question points out, the advantage to the above payment models is the somewhat faster sign-up process. Merchants can begin accepting credit cards right after they fill out the form. The downside for payments companies like Square, PayPal and presumably Stripe (and others who would embrace the aggregator model) is that they take on substantial risk from their merchants, which creates some side effects. In particular, they wind up with an unusually high burden of loss prevention.Due to the lightweight due diligence that facilitated the abbreviated sign-up process, the aggregator fundamentally knows less about the merchants they are working with, but they have a strong financial incentive to err on the side of their own safety. So if the aggregator sees something that they think could present an increased risk to them (e.g. a change in the merchant’s business model, larger than expected transactions, higher than expected sales volumes, international sales, or chargebacks) they may be compelled to immediately mitigate the risk by changing conditions for the merchant. This can put the aggregator in an adversarial relationship with the merchant, as they put into place reserves or limits, withhold payout, or even shut down a merchant’s ability to collect payments, all without negotiation or warning.PayPal has earned a particularly negative reputation in this regard - try googling for "PayPal shut me down" or "PayPal steals Christmas". To be clear, I have not heard any stories of Square or Stripe behaving in this manner toward merchants, I'm just pointing out that their model appears to have the same incentives built-in as PayPal's.As the risk falls to the aggregator, to become one is a bit difficult. The banks are very careful about who they would work with in this type of model. They would probably look for a company with both risk management experience and a strong balance sheet (i.e. a lot of cash). For a startup, that would almost certainly mean backing from a major institutional investor. It's worth noting that PayPal, Square, and Stripe all had early backing from investors with deep pockets.The alternate approach is for a payment company to help merchants get their own merchant account, so they can be their own MOR. This is the approach that Braintree takes (DISCLOSURE: I work at Braintree). While this approach requires a little more effort from the merchant during the application process, it enables Braintree to have a much better understanding of our customers, which greatly reduces the chance that a merchant will encounter problems processing payments as their business grows.

-

How do you fill out a balance sheet for a business plan?

You can't just fill out a business plan as you need to construct it from the whole set of information that includes the profit and loss account and other items. A layman will not be able to do this properly so seek out a friend who can give you the advice on how to prepare a proper plan. Doing it in an amateur way will not impressed anyone.

-

How do I balance a pro forma/forecasted balance sheet in an LBO model?

When cross-checking a 3-statement model, these are the basic adjustments on the balance sheet:Add depreciation expense to the accumulated depreciation. Be sure to add that non-cash expense to your cash as well. Adjust your cash balances with you accounts receivables and payables agings. Assuming you have added a A/R, A/P analysis to your model. Add to your fixed assets. Be sure to include this in your depreciation model. Reduce Amortization of any liabilities. Add any additional funding to your equity if capital or liability if debt. Add to cash accounts, accordingly.Finally, make sure your retained earnings are added from the Net Income section (and not Net Cash Flow). Then, subtract any dividend payments to the shareholders. A good way to understand your model is to create a Cash Flow Statement. I prefer to use the Indirect Method. Hope this helps.

-

How can I learn to create balance sheets, revenue model, term sheet?

The only confident way of creating balance sheets is if you become a qualified accountant, as alluded to by the other answers. If you simply want to understand balance sheets, you can attend a course for non-financial people, if such courses are available in your area. Term sheets require more than number manipulation to create. If you go ahead and try to create balance sheets with insufficient skill, the consequences will depend on how you use the balance sheets, or term sheets, or revenue models.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

Does the IRS require unused sheets of a form to be submitted? Can I just leave out the section of a form whose lines are not filled out?

This is what a schedule C I submitted earlier looks like :http://onemoredime.com/wp-conten... So I did not submit page 2 of the schedule C - all the lines on page 2 (33 through 48) were blank.

-

How is it possible for Amazon to pay $0 in Federal Taxes for its 11.2 billion profits?

To start, for the sake of accuracy, let’s make some clarifications.Amazon recorded a provision for income taxes in 2018 of $1.2 billion. Of this amount, $436 million was provisioned for U.S. Federal Taxes, $327 million for U.S. State Taxes and $434 million for International Taxes.Out of the U.S. Federal Tax amount, $565 million was deferred and negative $129 million (i.e. “less than zero”) was provisioned for current-year obligations:Source: Amazon 10-K (2018) (Note 9, p. 62)In accounting-speak, “provision” is a fancy way of saying “estimate”. For example, in 2018, the tax provision includes a “one-time provisional tax benefit of the U.S. Tax Act recognized in 2017”. The Tax Cuts and Jobs Act of 2017[1] reduced the corporate tax rate from 35% to 21%, and this shows up as a benefit for profit-generating corporations like Amazon. Translation: what happened here is that the previously estimated figure was re-estimated based on recent changes in tax laws.Actual taxes paid are another matter, although it just so happens that for 2018 they were pretty much the same (also $1.2 billion). Normally, these numbers are different. Amazon’s 10-K does not provide a breakdown of this amount between U.S. Federal, U.S. State and International.With this out of the way, let’s look at how Amazon managed to reduce its current-year U.S. Federal taxable income to the point where it could record a negative provision in 2018. Our tax code is complicated, and this means there are a lot of tricks that you can do to legally reduce taxes or push them out as far into the future as possible.Aggressive re-investment. Amazon plays in a number of sectors that (i) feature signNow long-term growth opportunities and (ii) require signNow capital or technology investment to capture. Historically, the company has re-invested nearly all of its growth back into the business, including the creation of entirely new market segments from scratch — e.g. how it parlayed internal technology services into a third-party business (Amazon Web Services) that is now the largest contributor to consolidated group operating profit. Heavy re-investment, whether through capital assets (more on this below) or hiring of high-salaried technology workers, will serve to reduce taxable income.It took a long time before Amazon started generating GAAP[2] profits. Even after it started generating GAAP profits, the company still had to burn through all of the tax losses accumulated in the earlier, ramp-up years. It wasn’t until 2009 that Amazon’s retained earnings account on the balance sheet turned positive. And it has only been the last couple years where the company has really started to see its profits increase to substantial levels relative to its market cap.On top of this, remember that U.S. companies keep two sets of books, one for GAAP accounting and the other for taxes. This is perfectly legal, as the rules for tax treatment are often very different than GAAP treatment. This means that even as its accumulated GAAP earnings finally caught up in 2009, accumulated losses for tax purposes would take much longer to burn up.One of the key GAAP vs. tax accounting differences that Amazon takes advantage of is accelerated depreciation.Accelerated depreciation. Amazon is a capital-intensive business that requires signNow capital to grow, both for its core e-commerce operation (logistics and fulfillment) as well as its technology services (Amazon Web Services). For e-commerce, it invests in warehouses and the equipment and machinery within the warehouses. For cloud/technology services, it invests in servers, networking equipment and some capitalized software development to expand capacity to meet both internal needs and that of third-party customers.These investments are typically made via something called a “capital lease”. Capital leases allow companies to finance the purchase of long-lived assets, but for tax purposes treat them like normal capital assets. As a capital asset, the company can take a depreciation charge for tax accounting purposes. Companies typically try to “accelerate” as much of the depreciation as possible, which has the net effect reducing current-year taxable income by pushing profits farther out into the future.This accelerated depreciation shows up in something called “deferred taxes”. When a company pushes taxable income into the future, this shows up as a future liability on the balance sheet through the deferred tax liability account. To the extent tax laws stay the same, at some point the company will need to pay those taxes. Of course, most companies, Amazon included, try their best to push the actual bill as far out into the future as possible.Other cool tricks. Interestingly, the largest adjustment to Amazon’s 2018 income tax provision was an adjustment made for stock-based compensation.Stock-based compensation arises when companies like Amazon issue stock options to employees. When equity is awarded to employees, a complicated calculation is performed — typically by the HR department — to calculate the value of the equity, using models with fancy-sounding names (e.g. the “Black-Scholes”[3] formula).However, in the time from when the equity award was issued to when it was exercised, the share price invariably changes. In the case of Amazon, the direction has historically been upwards, often at a very steep slope!When this happens, tax accounting rules[4] allow the company to calculate how much higher the realized equity award was compared to the original estimate. The difference between these two numbers gives rise to something called “excess tax benefits from stock-based compensation” and has the effective of lowering current-year income tax provisions.This is one reason why companies love to issue options!Profit-shifting. Another common practice is maximizing the allocation profits to overseas entities in jurisdictions where tax rates are lower. The most profitable segment within Amazon is its cloud/technology services division, and a not-insignNow proportion of these revenues are generated overseas. As I discuss here[5], because of the intangible nature of technology and software services, it is quite easy to structure things so that a big chunk of these profits are recognized offshore to lower the overall tax bill.In my view, Amazon is actually not as aggressive compared to some other technology companies at shifting profits overseas. A big part of this is, as described earlier, Amazon does not generate signNow profits to begin with (again, relative to its market cap). The other reason is that a signNow amount of its profit is actually generated onshore vs. offshore. For example, its International operations are barely profitable (as you can see in the first table above).However, as the company’s profits start to signNowly ramp up, expect more of an effort to use international tax havens like Ireland and the British Virgin Islands to minimize its overall tax bill.As it states in its 10-K (p. 63) , “we intend to invest substantially all of our foreign subsidiary earnings, as well as our capital in our foreign subsidiaries, indefinitely outside of the U.S. in those jurisdictions in which we would incur signNow, additional costs upon repatriation of such amounts.”I just want to add that even though Amazon’s corporate tax bill is relatively low (or even non-existent) at the federal level, the company is still responsible for generating signNow tax revenue when you analyze things holistically. Amazon pays tens of billions of dollars in wage and compensation income to its employees, the majority of whom are based in the United States. A signNow portion of the wages will fill government coffers in the form of federal and state-level income taxes.Its spending (on capital leases and other non-compensation related expenses) also indirectly generates taxable income for other companies in its eco-system.Finally, unlike many other multinational corporations, Amazon is actually heavily investing back into the United States, both in terms of hiring workers and investing in next-generation warehouse and datacenter operations.Footnotes[1] https://www.govinfo.gov/content/...[2] Generally Accepted Accounting Principles (United States) - Wikipedia[3] Black Scholes Model[4] Proposed ASUâCompensationâStock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting[5] Glenn Luk's answer to Where does the money I pay for an iPhone go?

Create this form in 5 minutes!

How to create an eSignature for the model balance sheet form

How to create an electronic signature for your Model Balance Sheet Form online

How to make an electronic signature for the Model Balance Sheet Form in Google Chrome

How to make an eSignature for putting it on the Model Balance Sheet Form in Gmail

How to create an electronic signature for the Model Balance Sheet Form from your mobile device

How to make an electronic signature for the Model Balance Sheet Form on iOS devices

How to generate an eSignature for the Model Balance Sheet Form on Android

People also ask

-

What is a balance sheet and why is it important for businesses?

A balance sheet is a financial statement that provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. It is crucial for businesses as it helps stakeholders assess financial health and stability. To better understand this, you can find resources that show examples and samples of balance sheets.

-

How can airSlate SignNow help me manage my balance sheet documents?

airSlate SignNow offers a streamlined platform for creating, signing, and managing your balance sheet documents efficiently. With its user-friendly interface, you can easily edit and store balance sheets securely. This ensures that you can quickly access and show examples and samples of balance sheets whenever needed.

-

Are there templates available for balance sheets in airSlate SignNow?

Yes, airSlate SignNow provides a variety of templates that can help you create professional balance sheets quickly. These templates are designed to be customizable, allowing you to tailor them to your specific business needs. You can also show examples and samples of balance sheets to guide your customization process.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to suit different business sizes and needs. Whether you're a small startup or a large corporation, you can find a plan that fits your budget. As part of your plan, you'll have access to tools that allow you to show examples and samples of balance sheets easily.

-

Can I integrate airSlate SignNow with other financial software?

Absolutely! airSlate SignNow seamlessly integrates with various financial software applications, making it easy to manage your balance sheets and other documents. This integration allows you to pull in data and show examples and samples of balance sheets directly from your accounting software.

-

Is it easy to share balance sheets with stakeholders using airSlate SignNow?

Yes, sharing balance sheets with stakeholders is straightforward using airSlate SignNow. You can send documents for eSignature or share links securely, ensuring that everyone has access to the most current information. This feature is particularly useful when you want to quickly show examples and samples of balance sheets to interested parties.

-

How does airSlate SignNow ensure the security of my balance sheet documents?

airSlate SignNow prioritizes security with advanced encryption and compliance measures to protect your sensitive financial information. Your balance sheet documents are stored securely in the cloud, ensuring that only authorized users can access them. This security allows you to confidently show examples and samples of balance sheets without concerns about data bsignNowes.

Get more for Show Examples And Samples Of Balance Sheet

- Hendrix college transcript form

- Howard university ferpa form

- Miles college transcript form

- Off campus living request form milligan college milligan

- Meningitis waiver form molloy college molloy

- Macbride principles certification nj form

- Numass form

- Request for supplemental certificate alabama g i form

Find out other Show Examples And Samples Of Balance Sheet

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself