Citizen Complaint Report City of Pinole Form

What is the Citizen Complaint Report for the City of Pinole?

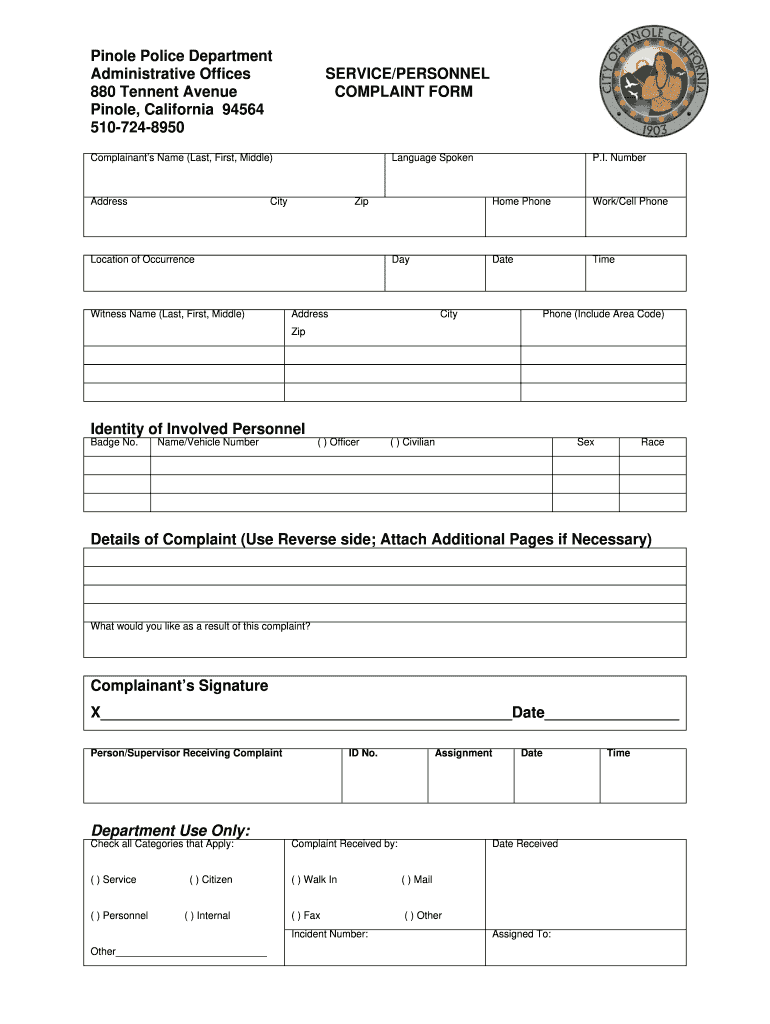

The Citizen Complaint Report is a formal document used by residents of Pinole to report grievances or concerns regarding the conduct of law enforcement officers. This report serves as a crucial tool for accountability within the Pinole Police Department, allowing citizens to voice their experiences and seek resolution. It is essential for maintaining transparency and trust between the community and law enforcement agencies.

How to Use the Citizen Complaint Report for the City of Pinole

To effectively use the Citizen Complaint Report, individuals should first gather all relevant information regarding the incident, including dates, times, locations, and any witnesses. Once this information is compiled, residents can fill out the complaint report form, detailing their concerns clearly and concisely. It is important to provide as much context as possible to ensure that the complaint is thoroughly understood and investigated.

Steps to Complete the Citizen Complaint Report for the City of Pinole

Completing the Citizen Complaint Report involves several key steps:

- Obtain the complaint report form from the Pinole Police Department or their official website.

- Fill out personal information, including your name, address, and contact details.

- Describe the incident in detail, including the officer's name, badge number, and the nature of the complaint.

- List any witnesses or evidence that supports your complaint.

- Sign and date the report to validate your submission.

Legal Use of the Citizen Complaint Report for the City of Pinole

The Citizen Complaint Report is legally recognized as a formal means of addressing grievances against law enforcement. When submitted, it initiates an internal review process within the Pinole Police Department. The findings from this review can lead to various outcomes, including policy changes, officer training, or disciplinary actions, depending on the nature of the complaint. Proper use of this report ensures that citizens' rights are upheld and that law enforcement agencies remain accountable.

Key Elements of the Citizen Complaint Report for the City of Pinole

Key elements of the Citizen Complaint Report include:

- Complainant Information: Details about the individual filing the complaint.

- Incident Description: A thorough account of what occurred, including specific actions taken by the officer.

- Witness Information: Names and contact details of any witnesses present during the incident.

- Evidence: Any supporting documents or materials that can substantiate the complaint.

- Signature: The complainant's signature is required to validate the report.

State-Specific Rules for the Citizen Complaint Report for the City of Pinole

In California, the handling of citizen complaints against law enforcement is governed by specific state laws and regulations. These laws ensure that complaints are taken seriously and investigated thoroughly. Additionally, the California Department of Justice provides guidelines on how police departments should manage and respond to citizen complaints, promoting transparency and accountability in law enforcement practices.

Quick guide on how to complete citizen complaint report city of pinole

Effortlessly Prepare Citizen Complaint Report City Of Pinole on Any Device

The management of online documents has become increasingly favored among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and electronically sign your documents promptly without any hold-ups. Manage Citizen Complaint Report City Of Pinole on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The simplest method to edit and electronically sign Citizen Complaint Report City Of Pinole with ease

- Locate Citizen Complaint Report City Of Pinole and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes just a few seconds and holds the same legal standing as an ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Citizen Complaint Report City Of Pinole and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I’m being sued and I’m representing myself in court. How do I fill out the form called “answer to complaint”?

You can represent yourself. Each form is different per state or county but generally an answer is simply a written document which presents a synopsis of your story to the court. The answer is not your defense, just written notice to the court that you intend to contest the suit. The blank forms are available at the court clerk’s office and are pretty much self explanatoryThere will be a space calling for the signature of an attorney. You should sign your name on the space and write the words “Pro se” after your signature. This lets the court know you are acting as your own attorney.

-

How do I fill out a W4 form if am I a dependent of my father -who is a non US citizen living abroad, but pays for most of my living expenses?

You can be claimed as a dependent for tax purposes by a parent if:1. You are under age 19 at the end of the year, or under age 24 and a full-time student, or permanently and totally disabled; and2. You lived with that parent for at least half of the year (counting time spent temporarily absent from the home, i.e. at school); and3. You did not provide more than half of your own support.I bring that up just in case your mother - who you did not mention - meets all of those requirements. Note that the support requirement is only that you don't provide more than half of your own support - and not that the claiming parent does, so it's possible that you may still be your mother's dependent.Assuming that's not the case, then yor father, as a nonresident alien, would not generally be allowed to claim any exemption for dependents (assuming he has a US tax obligation). He might be able to do so if you qualify as his dependent otherwise and he is a resident of Canada or Mexico, but that's an unusual circumstance.On the W4 it doesn't really matter that much; claiming 1 instead of zero only means that the employer will withhold less in taxes, and many people report a different number than the allowance calculator (which the IRS doesn't see) computes. What does matter is that you know your dependency status for the year when it comes time to actually file your return. If you can be claimed as a dependent on someone else's return, you cannot claim your own exemption - even if that other person does not claim you.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

What is the total number of federal applications, documents, or forms from all the departments of government that US citizens are required by law to fill out?

I am not an American. But it would depend on the person's circumstances. How much do they earn? If you earn little then you don't need to file a tax return. How do they earn it? Self employed or employed?Do they travel? You need a passport.How long do they live? - if they die after birth then it is very little. Do they live in the USA?What entitlements do they have?Do they have dialysis? This is federally funded.Are they on medicaid/medicare?.Are they in jail or been charged with a crime?Then how do you count it? Do you count forms filled in by the parents?Then there is the census the Constitution which held every ten years.

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

Create this form in 5 minutes!

How to create an eSignature for the citizen complaint report city of pinole

How to create an electronic signature for the Citizen Complaint Report City Of Pinole online

How to make an electronic signature for the Citizen Complaint Report City Of Pinole in Google Chrome

How to create an eSignature for signing the Citizen Complaint Report City Of Pinole in Gmail

How to generate an eSignature for the Citizen Complaint Report City Of Pinole from your mobile device

How to create an eSignature for the Citizen Complaint Report City Of Pinole on iOS

How to create an electronic signature for the Citizen Complaint Report City Of Pinole on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to internet law in Pinole?

airSlate SignNow is a digital solution that allows businesses to send and eSign documents efficiently. Understanding internet law in Pinole is crucial for businesses to ensure compliance with local regulations while utilizing eSignature solutions like SignNow.

-

How can airSlate SignNow assist with compliance under internet law in Pinole?

By using airSlate SignNow, you can create legally binding agreements that comply with internet law in Pinole. The platform provides a secure environment for document handling, ensuring that your signatures and data meet local legal standards.

-

What pricing plans does airSlate SignNow offer for businesses focused on internet law in Pinole?

airSlate SignNow offers a variety of pricing plans to suit different business needs, including options that align with the requirements of internet law in Pinole. You can choose from monthly or annual subscriptions, with features scaled to help keep your costs effective.

-

What are the key features of airSlate SignNow relevant to internet law in Pinole?

Key features of airSlate SignNow include document templates, real-time tracking, and secure signing, all of which are beneficial under internet law in Pinole. These features ensure that your documents are managed efficiently and comply with applicable laws.

-

How can airSlate SignNow benefit my business in terms of internet law in Pinole?

By adopting airSlate SignNow, your business can streamline document workflows while adhering to internet law in Pinole. This not only enhances productivity but also mitigates legal risks associated with eSignature processes.

-

Can airSlate SignNow integrate with other software to align with internet law in Pinole?

Yes, airSlate SignNow integrates with various software applications that many businesses in Pinole use. This capability allows you to maintain compliance with internet law in Pinole while improving the overall efficiency of your operations.

-

Is airSlate SignNow secure and compliant with internet law in Pinole?

Absolutely, airSlate SignNow prioritizes security and compliance to ensure adherence to internet law in Pinole. The platform uses advanced encryption and authentication measures to protect your documents and personal data.

Get more for Citizen Complaint Report City Of Pinole

- How to complete an income withholding for support order form

- Landlord shall make any payment called for under paragraph 5 by form

- Non custodial parent form

- Sample testimony for divorce fill online printable fillable form

- Name address phone form

- But not limited to unpaid rent caused by assignee form

- Agreed suit affecting the parent child relationship filed by form

- Tx pretrial chapter 4 the special appearance flashcards form

Find out other Citizen Complaint Report City Of Pinole

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template