Trusts Issue Form

Understanding the Trusts Issue

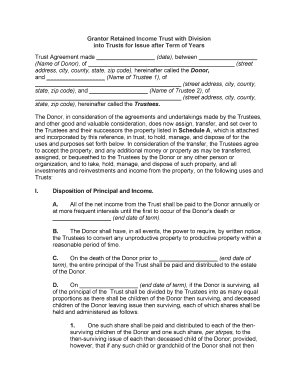

The trusts issue refers to the complexities and considerations involved in establishing and managing various types of trusts, particularly grantor retained unitrusts. These legal entities allow a grantor to retain certain rights while transferring assets to beneficiaries. Understanding the nuances of this issue is essential for effective estate planning and tax management.

Trusts can serve multiple purposes, such as minimizing estate taxes, providing for beneficiaries, or managing assets during incapacity. Each trust type has distinct characteristics, and the grantor retained unitrust is no exception. It typically allows the grantor to receive income from the trust for a specified period, after which the principal passes to the beneficiaries.

Key Elements of the Trusts Issue

Several key elements define the trusts issue, particularly in relation to grantor retained income trusts. These include:

- Income Distribution: The grantor receives income from the trust during its term, which can impact tax liabilities.

- Beneficiary Designation: Clear identification of beneficiaries is crucial to ensure proper asset distribution.

- Duration: Trusts can be established for a fixed term or until a specific event occurs, affecting both income and principal distribution.

- Tax Implications: Understanding how grantor trusts are taxed is vital, as income may be reported on the grantor's personal tax return.

Steps to Complete the Trusts Issue

Completing the trusts issue involves several important steps to ensure compliance and effectiveness. These steps typically include:

- Drafting the Trust Document: This legal document outlines the terms, conditions, and structure of the trust.

- Funding the Trust: Assets must be transferred into the trust to make it operational.

- Designating Trustees: Appointing a reliable trustee to manage the trust according to its terms is essential.

- Reviewing State-Specific Laws: Each state may have unique regulations regarding trusts that must be adhered to.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the taxation and reporting of grantor retained unitrusts. Understanding these guidelines is crucial for compliance and effective tax planning. Key considerations include:

- Tax Reporting: Income generated by the trust typically must be reported on the grantor's tax return.

- Gift Tax Implications: Transferring assets into the trust may trigger gift tax considerations.

- Annual Reporting Requirements: Certain trusts may require annual filings, depending on their structure and income levels.

Required Documents

Establishing a grantor retained unitrust requires specific documentation to ensure legal validity and compliance. Essential documents include:

- Trust Agreement: This foundational document outlines the trust's terms and conditions.

- Asset Transfer Documents: These documents facilitate the transfer of assets into the trust.

- Tax Identification Number: Obtaining an EIN may be necessary for tax purposes.

- Beneficiary Designation Forms: These forms clarify who will benefit from the trust upon its termination.

Form Submission Methods

Submitting the necessary forms related to grantor retained unitrusts can be done through various methods, depending on the requirements of the state or financial institution involved. Common submission methods include:

- Online Submission: Many institutions offer digital platforms for submitting trust documents.

- Mail: Traditional mail remains a viable option for submitting physical documents.

- In-Person Submission: Some situations may require or benefit from in-person submission, particularly for notarization or verification.

Quick guide on how to complete trusts issue

Prepare Trusts Issue effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Trusts Issue on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Trusts Issue with ease

- Find Trusts Issue and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Trusts Issue and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a grantor retained unitrust?

A grantor retained unitrust (GRUT) is a type of trust that allows the grantor to receive income for a specified period, after which the remaining assets pass to beneficiaries. This structure provides potential tax benefits and allows for greater control over the distribution of assets. Understanding the implications of a GRUT can help you make informed decisions for estate planning.

-

How can airSlate SignNow help with grantor retained unitrust documentation?

airSlate SignNow simplifies the documentation process for a grantor retained unitrust by providing an intuitive platform for eSigning and managing legal documents. With user-friendly features, you can easily customize trust agreements and securely store them for future access. This ensures that managing your GRUT is efficient and convenient.

-

What are the benefits of using a grantor retained unitrust?

Using a grantor retained unitrust can offer several benefits, including potential income tax deductions and the ability to pass wealth to heirs while reducing estate taxes. Additionally, it allows the grantor to retain some income while still benefiting loved ones in the future. This dual benefit structure makes GRUTs a strategic option for savvy estate planners.

-

What features does airSlate SignNow offer for grantor retained unitrust management?

airSlate SignNow offers features like customizable templates, secure electronic signatures, and easy document sharing specifically designed for managing grantor retained unitrusts. These functionalities help streamline the process of creating and maintaining trust documents, ensuring compliance and enhancing efficiency. The platform’s versatility supports varied estate planning needs.

-

Is there a cost associated with using airSlate SignNow for grantor retained unitrust eSigning?

airSlate SignNow offers affordable pricing plans, making it cost-effective for individuals managing a grantor retained unitrust or any other legal documents. Plans vary based on features and user needs, providing flexibility while still delivering robust eSigning tools. You can choose a plan that suits your estate planning requirements without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for managing grantor retained unitrusts?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms aimed at enhancing the management of grantor retained unitrusts. Integration with CRM systems, cloud storage, or financial software allows for a streamlined workflow and better data management. This connectivity helps keep all relevant information organized and easily accessible.

-

What should I consider before establishing a grantor retained unitrust?

Before establishing a grantor retained unitrust, consider your financial goals, the assets you want to transfer, and the implications for inheritance. Consulting with a financial advisor or estate planner is crucial to understanding the nuances of a GRUT and ensuring it aligns with your overall estate planning strategy. This proactive approach can lead to more advantageous outcomes.

Get more for Trusts Issue

- Agreement to remove house form

- Enclosed please find a copy of the cancellation which you recently forwarded to our office form

- Letters for providing child support example fill online form

- Enclosed please find the original and two copies of the complaint to reform title in deed

- Intake form for hcg diet injections with hcg diet miami

- Enclosed please find the original and a copy of the complaint to reform title in deed of

- Enclosed please find the original assignment from n a m e to n a m e to be recorded form

- Chancery court no form

Find out other Trusts Issue

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form