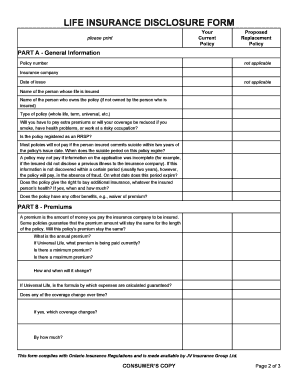

LIFE INSURANCE DISCLOSURE FORM

What is the LIFE INSURANCE DISCLOSURE FORM

The LIFE INSURANCE DISCLOSURE FORM is a crucial document that provides essential information about life insurance policies. This form is designed to ensure that policyholders understand the terms, benefits, and limitations of their insurance coverage. It typically includes details such as premium amounts, coverage limits, and the rights of the policyholder. By filling out this form, individuals can make informed decisions regarding their life insurance options, ensuring they select a policy that aligns with their financial goals and family needs.

Key elements of the LIFE INSURANCE DISCLOSURE FORM

Understanding the key elements of the LIFE INSURANCE DISCLOSURE FORM can enhance your comprehension of your life insurance policy. Important components often include:

- Policyholder Information: Details about the individual who owns the policy.

- Insured Individual: Information regarding the person whose life is covered by the policy.

- Coverage Amount: The total value that will be paid out upon the insured's death.

- Premiums: The cost of maintaining the policy, typically paid monthly or annually.

- Beneficiaries: Individuals or entities designated to receive the death benefit.

- Exclusions: Specific circumstances under which the policy may not pay out.

Steps to complete the LIFE INSURANCE DISCLOSURE FORM

Completing the LIFE INSURANCE DISCLOSURE FORM involves several straightforward steps. These steps ensure that all necessary information is accurately provided:

- Gather Information: Collect personal and financial information, including details about the insured and beneficiaries.

- Review Policy Details: Carefully read through the life insurance policy to understand coverage and terms.

- Fill Out the Form: Enter the required information into the form, ensuring accuracy to prevent issues later.

- Sign and Date: After completing the form, sign and date it to validate the information provided.

- Submit the Form: Send the completed form to the insurance company via the specified method, whether online, by mail, or in person.

Legal use of the LIFE INSURANCE DISCLOSURE FORM

The LIFE INSURANCE DISCLOSURE FORM serves a legal purpose, ensuring that both the policyholder and the insurance provider are clear on the terms of the policy. Legally, it protects the rights of the policyholder by documenting the agreed-upon terms, which can be referenced in case of disputes. It is essential for policyholders to retain a copy of this form for their records, as it may be needed for future claims or legal matters.

How to obtain the LIFE INSURANCE DISCLOSURE FORM

Obtaining the LIFE INSURANCE DISCLOSURE FORM is a straightforward process. Typically, you can acquire this form through the following methods:

- Insurance Provider: Request the form directly from your life insurance company, either through their website or customer service.

- Agent or Broker: If you purchased your policy through an agent or broker, they can provide you with the necessary form.

- Online Resources: Some insurance companies may offer downloadable versions of the form on their websites.

Disclosure Requirements

The disclosure requirements associated with the LIFE INSURANCE DISCLOSURE FORM are vital to ensure transparency between the insurer and the insured. These requirements typically mandate that the insurance provider disclose all relevant information regarding the policy, including:

- Details about premiums and payment schedules.

- Information on any exclusions or limitations of coverage.

- Rights of the policyholder regarding policy changes or cancellations.

- Information about the claims process and how benefits are paid out.

Quick guide on how to complete life insurance disclosure form

Prepare [SKS] effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the resources we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Produce your electronic signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to deliver your form, via email, SMS, or invite link, or download it to your computer.

Leave behind issues of lost or misplaced files, tiring document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to LIFE INSURANCE DISCLOSURE FORM

Create this form in 5 minutes!

How to create an eSignature for the life insurance disclosure form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a LIFE INSURANCE DISCLOSURE FORM?

A LIFE INSURANCE DISCLOSURE FORM is a document that outlines the critical information regarding a life insurance policy. This form typically includes details about coverage, premiums, and benefits, ensuring that policyholders and beneficiaries are fully informed. Understanding this form is essential for effective financial planning.

-

How can airSlate SignNow help with the LIFE INSURANCE DISCLOSURE FORM?

airSlate SignNow offers a streamlined process for creating, sending, and eSigning your LIFE INSURANCE DISCLOSURE FORM. With our platform, you can easily manage your documents, ensuring quick and secure transactions. This saves time and enhances the overall experience for both providers and clients.

-

Is there a cost associated with using the LIFE INSURANCE DISCLOSURE FORM on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans depending on the features you need for managing LIFE INSURANCE DISCLOSURE FORM documents. Our solutions are designed to be cost-effective, making it accessible for businesses of all sizes. You can choose the plan that best fits your requirements and budget.

-

What features does airSlate SignNow provide for managing the LIFE INSURANCE DISCLOSURE FORM?

airSlate SignNow provides numerous features for managing your LIFE INSURANCE DISCLOSURE FORM, including template creation, automated workflows, and real-time tracking. These features simplify the documentation process, making it easier to stay organized and compliant. Additionally, you can store and retrieve documents effortlessly.

-

How secure is the LIFE INSURANCE DISCLOSURE FORM when using airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption tactics and secure cloud storage to protect your LIFE INSURANCE DISCLOSURE FORM and other documents. This ensures that sensitive information remains confidential while enhancing compliance with regulatory standards.

-

Can I integrate airSlate SignNow with other software for managing LIFE INSURANCE DISCLOSURE FORMs?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing for efficient management of your LIFE INSURANCE DISCLOSURE FORM. This integration capability enhances your workflow by connecting with CRM, storage, and other essential business tools, providing a comprehensive solution.

-

What are the benefits of using airSlate SignNow for the LIFE INSURANCE DISCLOSURE FORM?

Using airSlate SignNow for your LIFE INSURANCE DISCLOSURE FORM offers numerous benefits, including simplified eSigning, enhanced document tracking, and improved collaboration. These features not only improve efficiency but also enhance customer satisfaction by making the process faster and more transparent.

Get more for LIFE INSURANCE DISCLOSURE FORM

- 22 internal revenue service department of the treasury irs tax forms

- What is form 8867earned income tax credit irs tax forms

- Form 8554 rev 11 2022 application for renewal of enrollment to practice before the internal revenue service as an enrolled

- Form 1040 nr department of the treasuryinternal revenue service us

- Federal 8865 schedule k 1 partners share of incomefederal 8865 schedule k 1 partners share of incomeabout form 8865 return of

- Indiana form 103 short business tangible personal property returnpersonal property dlgfdlgf personal property forms montgomery

- 2022 schedule i form 990 grants and other assistance to organizations governments and individuals in the united states

- 2022 schedule d form 990 supplemental financial statements

Find out other LIFE INSURANCE DISCLOSURE FORM

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form