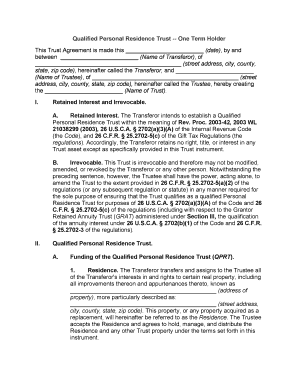

Qualified Personal Residence Form

What is the Qualified Personal Residence

The qualified personal residence trust (QPRT) is a legal estate planning tool designed to help individuals transfer their homes or other real estate assets to beneficiaries while minimizing gift and estate taxes. This type of trust allows the property owner to retain the right to live in the home for a specified period, after which the property is transferred to the beneficiaries. This strategy is particularly useful for high-net-worth individuals looking to reduce their taxable estate while still enjoying their property during their lifetime.

Steps to Complete the Qualified Personal Residence

Completing the qualified personal residence trust form involves several key steps to ensure that the trust is established correctly and complies with legal requirements. Here’s a simplified process:

- Determine the property to be placed in the trust.

- Decide on the term of the trust, which is the duration the grantor will retain the right to live in the property.

- Draft the trust document, including details about the property, beneficiaries, and terms of the trust.

- Sign the trust document in the presence of a notary public to ensure its legal validity.

- Transfer the property title into the trust, which may require filing documents with the local county recorder’s office.

Legal Use of the Qualified Personal Residence

The legal framework surrounding a qualified personal residence trust is governed by federal and state laws. The trust must be structured to meet specific IRS guidelines to qualify for favorable tax treatment. This includes ensuring that the grantor retains the right to live in the property for a defined term and that the transfer of the property is completed according to legal standards. Proper legal counsel is advisable to navigate these requirements and ensure compliance.

Required Documents

Establishing a qualified personal residence trust requires several key documents to be prepared and submitted. These typically include:

- The trust agreement, outlining the terms and conditions of the trust.

- Property deed, which must be updated to reflect the trust as the new owner.

- IRS Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return, if applicable.

- Any additional documents required by state law for trust establishment.

Eligibility Criteria

To establish a qualified personal residence trust, the grantor must meet certain eligibility criteria. These criteria include:

- The grantor must be the owner of the property intended to be placed in the trust.

- The property must be a personal residence, such as a primary home or vacation home.

- The grantor must be willing to relinquish ownership of the property after the term of the trust expires.

IRS Guidelines

The Internal Revenue Service provides specific guidelines regarding the establishment and operation of a qualified personal residence trust. Key points include:

- The trust must be irrevocable, meaning the grantor cannot alter the terms once established.

- The grantor must retain the right to live in the property for a specified number of years.

- The value of the property transferred to the trust is considered a gift, and the grantor must file a gift tax return if the value exceeds the annual exclusion limit.

Quick guide on how to complete qualified personal residence

Effortlessly Prepare Qualified Personal Residence on Any Device

Digital document management has become increasingly favored among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Qualified Personal Residence on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

Efficiently Modify and eSign Qualified Personal Residence with Ease

- Obtain Qualified Personal Residence and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign Qualified Personal Residence while ensuring excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a qualified trust form and why do I need it?

A qualified trust form is a legal document used to establish a trust that meets IRS requirements for tax benefits. Having a qualified trust form can help you efficiently manage your assets and ensure proper distribution according to your wishes. Using airSlate SignNow, you can easily create, eSign, and manage your qualified trust forms securely.

-

How does airSlate SignNow help me create a qualified trust form?

With airSlate SignNow, you can utilize customizable templates to create a qualified trust form tailored to your specific needs. Our platform provides a user-friendly interface that guides you through the process, ensuring that all necessary information is included. You can also collaborate with legal advisors in real-time for additional assurance.

-

Is airSlate SignNow cost-effective for managing qualified trust forms?

Yes, airSlate SignNow is a cost-effective solution for managing qualified trust forms and other documents. Our flexible pricing plans cater to businesses of all sizes, enabling you to choose a plan that fits your budget. Save time and money while ensuring legal compliance with our streamlined eSignature process.

-

What security features does airSlate SignNow offer for qualified trust forms?

airSlate SignNow prioritizes the security of your qualified trust forms by implementing bank-level encryption and secure cloud storage. Our platform also features multi-factor authentication and customizable access controls, ensuring that only authorized individuals can access and sign your sensitive documents. Your data remains safe throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for managing qualified trust forms?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. This allows you to connect your qualified trust forms with the tools you already use, making document management even more efficient without additional manual steps.

-

What are the benefits of using airSlate SignNow for qualified trust forms?

Using airSlate SignNow for qualified trust forms streamlines the process of document creation, signing, and management. The platform enhances collaboration with features like shared access and comments, while also improving compliance with built-in audit trails. Experience greater efficiency and organization in handling your trust documents.

-

Do I need legal assistance to create a qualified trust form with airSlate SignNow?

While airSlate SignNow provides the tools to create a qualified trust form, seeking legal assistance is advisable to ensure compliance with state laws and regulations. Our platform allows you to collaborate easily with your legal team during the document creation process. This ensures that your qualified trust form meets all necessary legal standards.

Get more for Qualified Personal Residence

Find out other Qualified Personal Residence

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors