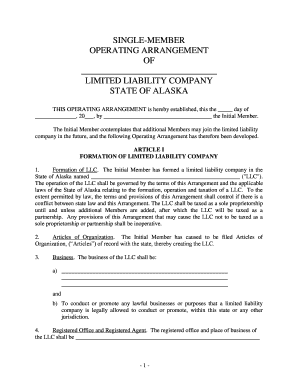

Ak Limited Liability Form

What is the Ak Limited Liability

The Ak Limited Liability, commonly referred to as an Ak LLC, is a business structure that provides personal liability protection to its owners, known as members. This means that the personal assets of the members are generally protected from the debts and liabilities of the business. An Ak LLC combines the flexibility of a partnership with the limited liability features of a corporation. This structure is particularly advantageous for small business owners in Alaska, allowing them to operate while minimizing personal risk.

How to Obtain the Ak Limited Liability

To obtain an Ak Limited Liability, you must follow a series of steps that involve filing specific documents with the state of Alaska. The primary requirement is to file Articles of Organization with the Alaska Division of Corporations, Business, and Professional Licensing. This document outlines essential details about your business, such as its name, address, and the names of its members. Additionally, you may need to create an operating agreement, which, while not mandatory, is highly recommended to define the management structure and operating procedures of your LLC.

Steps to Complete the Ak Limited Liability

Completing the process to establish an Ak Limited Liability involves several key steps:

- Choose a unique name for your LLC that complies with Alaska naming rules.

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- File the Articles of Organization with the Alaska Division of Corporations.

- Create an operating agreement to outline the management and operational procedures.

- Obtain any necessary business licenses and permits required for your specific industry.

- Apply for an Employer Identification Number (EIN) from the IRS if you plan to hire employees or if your LLC will have more than one member.

Legal Use of the Ak Limited Liability

The legal use of an Ak Limited Liability is governed by state laws that outline the rights and responsibilities of LLC members. An Ak LLC can engage in various business activities, provided they comply with local, state, and federal regulations. It is crucial for members to understand that while the LLC protects personal assets, they must still adhere to proper business practices, including maintaining accurate records and filing necessary tax returns. Failure to follow these legal requirements can result in the loss of liability protection.

Key Elements of the Ak Limited Liability

Several key elements define the structure and function of an Ak Limited Liability:

- Limited Liability Protection: Members are not personally liable for the debts of the LLC.

- Pass-Through Taxation: Profits and losses can be reported on members' personal tax returns, avoiding double taxation.

- Flexible Management Structure: Members can choose how to manage the LLC, either by themselves or by appointing managers.

- Operating Agreement: While not legally required, this document outlines the operational framework and can help prevent disputes.

Eligibility Criteria

To form an Ak Limited Liability, certain eligibility criteria must be met. The members must be at least eighteen years old and may include individuals, corporations, or other LLCs. Additionally, the chosen name for the LLC must be distinguishable from existing entities registered in Alaska. It is also essential that the LLC complies with any specific industry regulations, which may vary based on the nature of the business.

Quick guide on how to complete ak limited liability

Easily Prepare Ak Limited Liability on Any Device

Managing documents online has gained traction among both businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly and without hold-ups. Handle Ak Limited Liability on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to Modify and eSign Ak Limited Liability Effortlessly

- Locate Ak Limited Liability and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent parts of your documents or obscure sensitive details with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Verify all information and click on the Done button to save your alterations.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that require printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Ak Limited Liability and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow, and how does it benefit my ak company?

airSlate SignNow is an eSignature solution that empowers your ak company to send and sign documents electronically. This cost-effective service helps streamline your document workflows, saving time and reducing errors. With its user-friendly interface, airSlate SignNow can signNowly enhance your overall productivity.

-

Is airSlate SignNow pricing suitable for small ak companies?

Yes, airSlate SignNow offers competitive pricing tailored to meet the needs of small ak companies. By adopting our cost-effective solution, you can optimize your document management without straining your budget. We provide various pricing plans to ensure that you find the right fit for your company's requirements.

-

What features does airSlate SignNow offer for an ak company?

airSlate SignNow provides a range of features specifically designed for ak companies, including customizable templates, real-time tracking, and secure cloud storage. These features streamline document creation and help track the signing process, making it easier to manage your paperwork efficiently. Additionally, our platform ensures compliance with industry standards.

-

Can airSlate SignNow integrate with other tools my ak company uses?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various tools your ak company may already be using, such as CRM software, document management systems, and more. This integration capability enhances your existing workflows, allowing for a more cohesive and efficient operation, thus maximizing overall productivity.

-

How secure is airSlate SignNow for my ak company?

Security is a top priority for airSlate SignNow when it comes to your ak company. Our platform uses industry-standard encryption protocols to protect your documents and sensitive data during transmission and storage. We also comply with various regulatory standards to ensure that your information remains safe and secure at all times.

-

How quickly can I implement airSlate SignNow in my ak company?

Implementing airSlate SignNow in your ak company is a straightforward process that can be completed in just a few minutes. After signing up, you can quickly set up your account, create templates, and start sending documents for eSignature. Our user-friendly design means that you won't need extensive training to get started.

-

What customer support options are available for my ak company using airSlate SignNow?

airSlate SignNow offers comprehensive customer support options for your ak company, including live chat, email support, and a detailed knowledge base. Our team is dedicated to helping you resolve any issues swiftly and effectively, ensuring your experience with our service is smooth and satisfactory. We are here to assist you at any stage of your process.

Get more for Ak Limited Liability

- Colorado terminate form

- 38 22 109 form

- Colorado notice of intent not to renew at end of specified term from landlord to tenant for residential property form

- Colorado notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial form

- Co statement form

- Colorado notice of dishonored check civil keywords bad check bounced check form

- Colorado commercial sublease form

- Colorado assignment 481379275 form

Find out other Ak Limited Liability

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later