Illinois Quitclaim Deed from an Individual to a Trust Form

What is the Illinois Quitclaim Deed From An Individual To A Trust

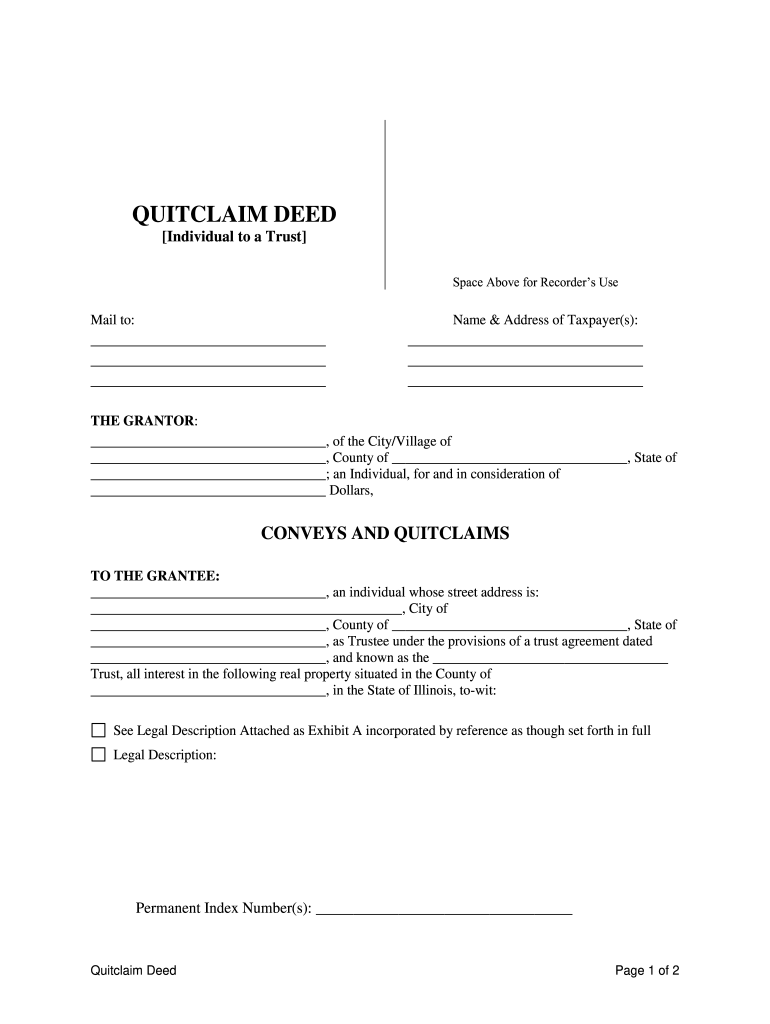

The Illinois Quitclaim Deed From An Individual To A Trust is a legal document that facilitates the transfer of property ownership from an individual to a trust. This type of deed is often used in estate planning, allowing individuals to place their property into a trust for various purposes, such as asset protection or streamlined inheritance. Unlike warranty deeds, quitclaim deeds do not guarantee that the property title is free of liens or encumbrances, making them a simpler, quicker option for transferring ownership.

Key elements of the Illinois Quitclaim Deed From An Individual To A Trust

Several essential elements must be included in the Illinois Quitclaim Deed to ensure its validity and effectiveness. These include:

- Grantor and Grantee Information: The full names and addresses of both the individual transferring the property (grantor) and the trust receiving it (grantee).

- Property Description: A detailed description of the property being transferred, including its legal description, address, and any relevant parcel numbers.

- Consideration: A statement indicating the consideration or value exchanged for the property, even if it is nominal.

- Signature: The grantor's signature is required, and it must be notarized to validate the deed.

- Date: The date on which the deed is executed.

Steps to complete the Illinois Quitclaim Deed From An Individual To A Trust

Completing the Illinois Quitclaim Deed involves several steps to ensure the document is filled out correctly and legally binding:

- Gather necessary information about the property, including its legal description and current ownership details.

- Obtain the names and addresses of the grantor and the trust.

- Fill out the quitclaim deed form accurately, ensuring all required elements are included.

- Sign the document in the presence of a notary public to validate the deed.

- File the completed deed with the appropriate county recorder's office to make the transfer official.

Legal use of the Illinois Quitclaim Deed From An Individual To A Trust

The legal use of the Illinois Quitclaim Deed is primarily for transferring property ownership without the guarantees typically associated with warranty deeds. This deed is particularly useful in situations where the grantor trusts the grantee, such as family transfers or estate planning scenarios. It is important to note that while the quitclaim deed simplifies the transfer process, it does not protect the grantee from potential claims against the property, such as liens or other encumbrances.

State-specific rules for the Illinois Quitclaim Deed From An Individual To A Trust

Illinois has specific rules governing the execution and recording of quitclaim deeds. These include:

- The deed must be notarized to be legally binding.

- It must be recorded with the county recorder's office in the county where the property is located.

- Illinois law requires that the property description be accurate and detailed to avoid future disputes.

- Any applicable transfer taxes must be paid at the time of recording.

How to use the Illinois Quitclaim Deed From An Individual To A Trust

Using the Illinois Quitclaim Deed involves a straightforward process. First, ensure that the deed is properly filled out with all necessary information. Next, have the document signed in front of a notary public. Once notarized, the deed must be filed with the local county recorder's office to complete the transfer of ownership. It is advisable to keep a copy of the filed deed for personal records, as it serves as proof of the property transfer.

Quick guide on how to complete illinois quitclaim deed from an individual to a trust

Finalize Illinois Quitclaim Deed From An Individual To A Trust effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the proper form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Illinois Quitclaim Deed From An Individual To A Trust on any device with airSlate SignNow’s Android or iOS applications and streamline your document-related tasks today.

The easiest method to modify and eSign Illinois Quitclaim Deed From An Individual To A Trust without any hassle

- Obtain Illinois Quitclaim Deed From An Individual To A Trust and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Illinois Quitclaim Deed From An Individual To A Trust and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois Quitclaim Deed From An Individual To A Trust?

An Illinois Quitclaim Deed From An Individual To A Trust is a legal document that transfers ownership of real estate from an individual to a trust. This type of deed does not guarantee that the title is free from claims but is often used for estate planning purposes. Using this deed can help streamline the process of transferring property to manage assets efficiently.

-

How much does it cost to create an Illinois Quitclaim Deed From An Individual To A Trust?

The cost of creating an Illinois Quitclaim Deed From An Individual To A Trust can vary based on the complexity of the deed and additional services required. Generally, fees include document preparation and filing costs, which can be managed easily using airSlate SignNow's affordable solutions. By choosing airSlate SignNow, you can benefit from a cost-effective way to handle your documentation needs.

-

What features does airSlate SignNow offer for creating Illinois Quitclaim Deeds?

airSlate SignNow provides various features for creating an Illinois Quitclaim Deed From An Individual To A Trust, including customizable templates, eSigning capabilities, and secure cloud storage. Our intuitive platform simplifies the process, allowing users to quickly generate and manage their deeds with ease. These features help ensure that your documents are legally compliant and efficiently handled.

-

Is the Illinois Quitclaim Deed From An Individual To A Trust applicable for all types of property?

Yes, an Illinois Quitclaim Deed From An Individual To A Trust can be used to transfer various types of real property, including residential and commercial properties. However, it's essential to check local regulations as different counties may have specific requirements. Using airSlate SignNow ensures that your deed meets legal standards for all property types.

-

What are the benefits of transferring property to a trust using a Quitclaim Deed?

Transferring property to a trust using an Illinois Quitclaim Deed From An Individual To A Trust can provide several benefits, such as avoiding probate, protecting assets from creditors, and facilitating seamless management of your estate. Trusts also offer privacy, as properties held in trust do not go through public probate proceedings. Utilizing airSlate SignNow can help you navigate this process with ease.

-

Can I integrate airSlate SignNow with other software to manage my documents?

Yes, airSlate SignNow offers various integrations with popular software platforms, allowing you to manage your documents efficiently. You can connect with applications such as Google Drive, Dropbox, and more for enhanced document handling. Integrating airSlate SignNow with your existing tools simplifies the process of creating and managing your Illinois Quitclaim Deed From An Individual To A Trust.

-

How do I ensure my Illinois Quitclaim Deed is legally binding?

To ensure your Illinois Quitclaim Deed From An Individual To A Trust is legally binding, all parties involved must sign the document in the presence of a notary. Proper filing with the local recorder’s office is also crucial to make the transfer officially recognized. Using airSlate SignNow helps facilitate the signing and filing process to ensure compliance with legal requirements.

Get more for Illinois Quitclaim Deed From An Individual To A Trust

- Owners or sellers affidavit of no liens arkansas form

- Affidavit of occupancy and financial status arkansas form

- Complex will with credit shelter marital trust for large estates arkansas form

- Special warranty deed form

- Marital legal separation and property settlement agreement where no children or no joint property or debts and divorce action 497296567 form

- Marital legal separation and property settlement agreement where minor children and no joint property or debts and divorce 497296568 form

- Marital legal separation and property settlement agreement where minor children and no joint property or debts that is 497296569 form

- Marital legal separation and property settlement agreement where minor children and parties may have joint property or debts 497296570 form

Find out other Illinois Quitclaim Deed From An Individual To A Trust

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now