Indiana Fiduciary Deed for Use by Executors, Trustees, Trustors, Administrators and Other Fiduciaries Form

What is the Indiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries

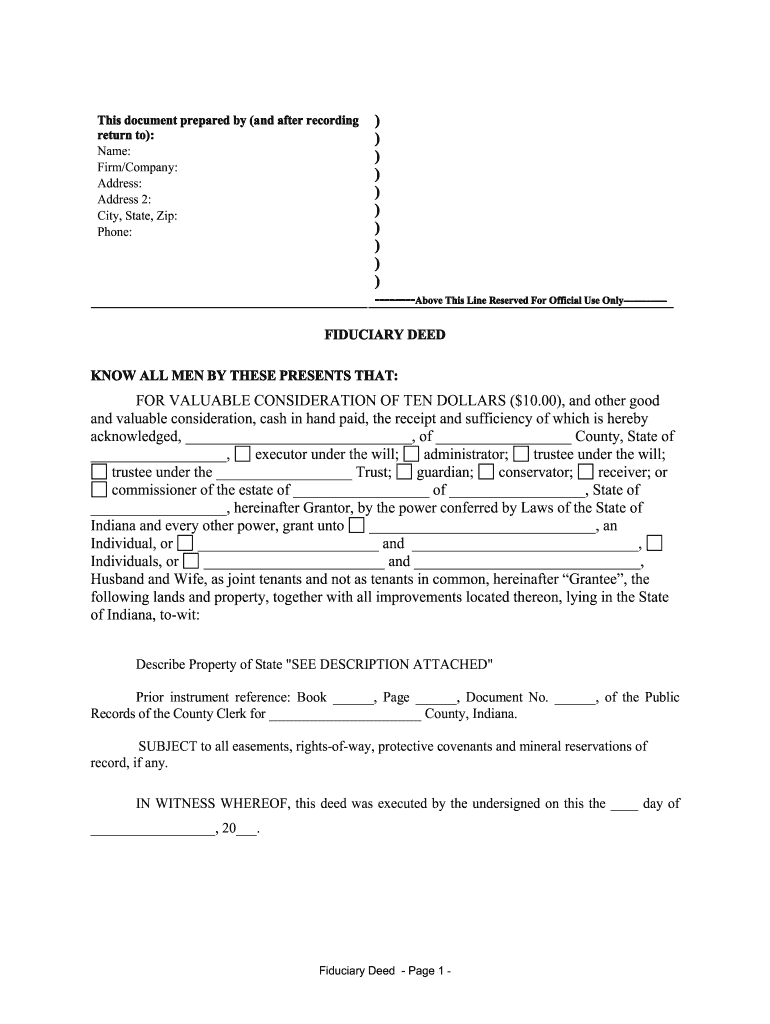

The Indiana Fiduciary Deed is a legal document utilized by executors, trustees, trustors, administrators, and other fiduciaries to transfer real estate property in the state of Indiana. This deed is essential for individuals acting in a fiduciary capacity, as it formally conveys property rights from the deceased or trustor to beneficiaries or the trust itself. The document ensures that the transfer is recognized legally, providing a clear chain of title and protecting the interests of all parties involved.

How to Use the Indiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries

Using the Indiana Fiduciary Deed involves several key steps to ensure its proper execution. First, the fiduciary must gather all necessary information regarding the property and the parties involved. This includes the legal description of the property, the names of the grantor and grantee, and any relevant details about the trust or estate. Once the information is compiled, the fiduciary can fill out the deed form accurately, ensuring that all required fields are completed. After signing the deed, it must be notarized and filed with the county recorder's office to be legally effective.

Steps to Complete the Indiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries

Completing the Indiana Fiduciary Deed involves the following steps:

- Gather necessary information, including property details and party names.

- Obtain the official Indiana Fiduciary Deed form.

- Fill out the form, ensuring accuracy in all entries.

- Sign the deed in the presence of a notary public.

- File the signed and notarized deed with the county recorder's office.

Each step is crucial for the deed to be valid and enforceable.

Key Elements of the Indiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries

Several key elements must be included in the Indiana Fiduciary Deed to ensure its validity:

- Grantor and Grantee Information: Full names and addresses of the parties involved.

- Legal Description of the Property: A detailed description that identifies the property being transferred.

- Statement of Authority: A declaration that the signer is acting as a fiduciary.

- Signatures: The signature of the fiduciary and a notary public.

- Date of Execution: The date when the deed is signed.

Legal Use of the Indiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries

The Indiana Fiduciary Deed is legally recognized when executed in compliance with state laws. It is important that the fiduciary adheres to the requirements set forth by Indiana law, including proper notarization and filing. The deed serves to protect the rights of beneficiaries and ensures that the property is transferred in accordance with the wishes of the deceased or the terms of the trust. Failure to follow legal procedures may result in disputes or challenges to the validity of the deed.

State-Specific Rules for the Indiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries

Indiana has specific rules governing the use of fiduciary deeds. These include:

- All fiduciary deeds must be notarized to be valid.

- Deeds must be filed with the county recorder's office within a specific timeframe after execution.

- The legal description of the property must be accurate and conform to local recording standards.

Understanding these state-specific rules is essential for ensuring the deed's legal standing and effectiveness.

Quick guide on how to complete indiana fiduciary deed for use by executors trustees trustors administrators and other fiduciaries

Effortlessly complete Indiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Indiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Indiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries without hassle

- Obtain Indiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Select relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign Indiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Indiana Fiduciary Deed for Use by Executors, Trustees, Trustors, Administrators, and Other Fiduciaries?

An Indiana Fiduciary Deed is a legal document that allows fiduciaries like executors, trustees, trustors, and administrators to convey property on behalf of an estate or trust. This deed ensures that all legal requirements are met, providing peace of mind for both the fiduciary and beneficiaries involved in the transaction.

-

How can I create an Indiana Fiduciary Deed efficiently?

You can create an Indiana Fiduciary Deed for Use by Executors, Trustees, Trustors, Administrators, and Other Fiduciaries effectively with airSlate SignNow. Our platform offers an easy-to-use interface that guides you through the process, allowing you to generate and customize your deed quickly and without hassle.

-

What are the costs associated with using airSlate SignNow for Indiana Fiduciary Deeds?

The pricing for using airSlate SignNow for creating Indiana Fiduciary Deeds varies based on the features and subscription plan you choose. We offer cost-effective solutions tailored to your needs, ensuring that you have access to essential tools without breaking the bank.

-

What features does airSlate SignNow provide for Indiana Fiduciary Deeds?

airSlate SignNow offers a variety of features for Indiana Fiduciary Deeds, including document templates, electronic signatures, and secure storage. These features make the process of preparing and managing your fiduciary deeds efficient and hassle-free, ensuring compliance with state regulations.

-

Can airSlate SignNow integrate with other tools for managing Indiana Fiduciary Deeds?

Yes, airSlate SignNow seamlessly integrates with various third-party applications such as CRM systems and cloud storage solutions. This enables fiduciaries to manage their Indiana Fiduciary Deeds alongside other essential tasks, streamlining workflows and enhancing productivity.

-

What are the benefits of using airSlate SignNow for Indiana Fiduciary Deeds?

Using airSlate SignNow for Indiana Fiduciary Deeds simplifies the process of document creation and signing. By enabling electronic signatures, ensuring compliance with legal requirements, and offering a user-friendly interface, airSlate SignNow helps fiduciaries save time and reduce stress associated with traditional document handling.

-

Is airSlate SignNow secure for handling Indiana Fiduciary Deeds?

Absolutely, airSlate SignNow prioritizes the security of your documents, including Indiana Fiduciary Deeds. With advanced encryption and compliance with legal standards, you can trust that your sensitive information remains safe and protected throughout the process.

Get more for Indiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries

Find out other Indiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word