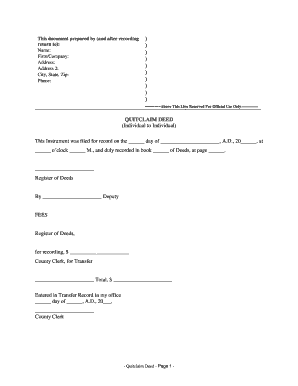

Kansas Deed Estate Form

What is the Kansas Deed Estate

The Kansas deed estate is a legal document used to transfer ownership of real property in the state of Kansas. This form serves as a formal declaration of the transfer of title from one party to another, ensuring that the transaction is recorded and recognized by relevant authorities. It is essential for establishing clear ownership and can be utilized in various scenarios, including sales, gifts, or inheritance of real estate. The quitclaim deed is a common variant of the Kansas deed estate, often used when the grantor is not guaranteeing clear title to the property.

How to Use the Kansas Deed Estate

Utilizing the Kansas deed estate involves several steps to ensure that the transfer of property is executed correctly. First, the parties involved must gather necessary information, including the legal description of the property, the names of the grantor and grantee, and any relevant terms of the transfer. After filling out the form, it must be signed by the grantor in the presence of a notary public to validate the transaction. Once completed, the deed should be filed with the appropriate county office to make the transfer official and maintain public records.

Steps to Complete the Kansas Deed Estate

Completing the Kansas deed estate form requires careful attention to detail. Here are the key steps:

- Obtain the correct form for the Kansas deed estate, ensuring it is the latest version.

- Fill in the grantor's and grantee's names and addresses accurately.

- Provide a complete legal description of the property being transferred.

- Include any specific terms of the transfer, if applicable.

- Sign the document in front of a notary public to ensure its legality.

- Submit the completed deed to the county clerk or recorder's office for filing.

Legal Use of the Kansas Deed Estate

The legal use of the Kansas deed estate is crucial for ensuring that property transfers are recognized by law. This form must comply with state regulations, including proper execution and notarization. The deed serves as evidence of ownership and can be used in legal proceedings to assert rights to the property. It is important for both grantors and grantees to understand their rights and obligations under Kansas law when using this document.

Key Elements of the Kansas Deed Estate

Several key elements must be present in the Kansas deed estate to ensure its validity:

- Grantor and Grantee Information: Full names and addresses of both parties.

- Legal Description: A precise description of the property being transferred.

- Consideration: The amount paid for the property or a statement indicating it is a gift.

- Signatures: The grantor must sign the deed, and it must be notarized.

- Filing Information: Details about where to file the deed after completion.

State-Specific Rules for the Kansas Deed Estate

Kansas has specific rules governing the use of the deed estate, which must be adhered to for the document to be legally binding. These include requirements for notarization, the necessity of a legal property description, and the need for filing with the appropriate county office. Understanding these regulations is essential for anyone involved in real estate transactions in Kansas, as failure to comply can result in disputes over property ownership.

Quick guide on how to complete kansas deed estate

Complete Kansas Deed Estate seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any delays. Manage Kansas Deed Estate on any platform with airSlate SignNow Android or iOS applications and streamline any document-based procedure today.

The easiest way to modify and eSign Kansas Deed Estate effortlessly

- Find Kansas Deed Estate and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that function.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form—via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Kansas Deed Estate and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Kansas deed estate?

A Kansas deed estate refers to a legal document that conveys ownership of real property in Kansas. This document is crucial for recording property transactions and establishing ownership rights. Understanding the specifics of a Kansas deed estate can help streamline the process of buying or selling property.

-

How does airSlate SignNow help with Kansas deed estate transactions?

airSlate SignNow simplifies the execution of Kansas deed estate transactions by providing an intuitive platform for electronically signing and sending documents. This ensures that all parties can engage in a secure and efficient signing process. Utilizing airSlate SignNow can signNowly reduce the time spent on paperwork for Kansas deed estate transactions.

-

What are the pricing options for using airSlate SignNow for Kansas deed estate documents?

airSlate SignNow offers a variety of pricing plans tailored to meet the needs of individuals and businesses managing Kansas deed estate documents. Whether you require basic features or more advanced capabilities, you can find a plan that suits your requirements. Competitive pricing ensures that managing Kansas deed estate transactions is affordable and efficient.

-

Can I customize my Kansas deed estate documents using airSlate SignNow?

Yes, airSlate SignNow allows users to easily customize Kansas deed estate documents to meet specific requirements. You can add fields, modify templates, and ensure all necessary information is included. This flexibility helps create accurate and legally compliant documents for Kansas deed estate transactions.

-

What benefits does airSlate SignNow provide for Kansas deed estate management?

Using airSlate SignNow for Kansas deed estate management offers numerous advantages, such as enhanced efficiency, minimized errors, and easy accessibility. The platform allows users to store and manage documents securely online, ensuring that you can access necessary files anytime, anywhere. This is particularly beneficial when handling Kansas deed estate documents.

-

Is airSlate SignNow compliant with Kansas deed estate regulations?

airSlate SignNow complies with legal standards and regulations pertaining to Kansas deed estate documents, ensuring that all electronic signatures are valid and enforceable. This compliance offers peace of mind when managing property transactions in Kansas. Utilizing a compliant platform like airSlate SignNow is vital for the legality of your Kansas deed estate documents.

-

Does airSlate SignNow integrate with other tools for managing Kansas deed estate processes?

Yes, airSlate SignNow integrates seamlessly with various tools and software, enhancing the efficiency of your Kansas deed estate processes. This integration allows users to synchronize data and streamline workflows, reducing the time and effort required for transactions. Using airSlate SignNow alongside your favorite applications can signNowly improve your Kansas deed estate document management.

Get more for Kansas Deed Estate

- Control number vt p093 pkg form

- Loan application langley federal credit union form

- Appointed and by these presents do make constitute and appoint form

- The federal lawyer august 2016 federal bar association form

- Vermont being of sound mind and memory do hereby make constitute and appoint form

- Vermont property form

- Applications must be typewritten or clearly printed all form

- Subsidy application mediation vermont judiciary form

Find out other Kansas Deed Estate

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document